|

Global Markets Are Shaping Rates

Published Date 7/19/2021

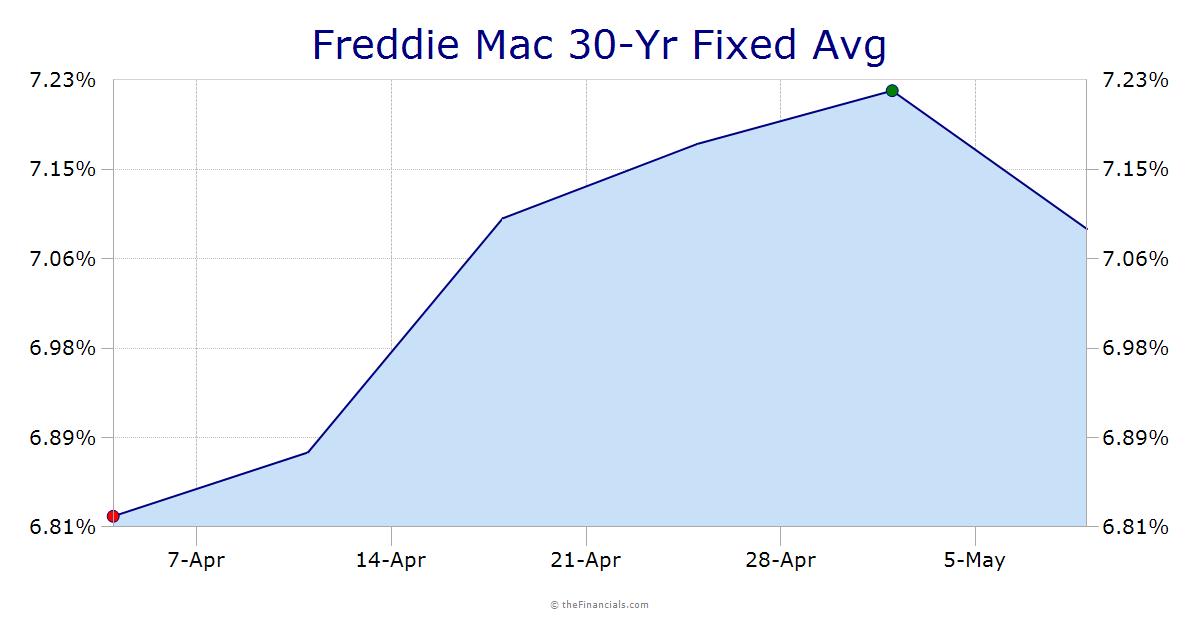

Last Friday the 10-year note closed right on its technical resistance at 1.30%. On Friday afternoon we commented "However it happens next week, the 10-yr. note (thus mortgage rates) are likely to see larger movements than we saw this week. Either the 10 breaks below 1.30%, or it doesn't; regardless the direction, the 10- yr. and mortgages are in for a volatile week coming up". The 10 broke the resistance at 8:00 pm ET yesterday and fell through the night and early morning, dropping the note to 1.22% at 8:30 am ET, 8 bps lower than Friday's close. MBS prices at 8:30 am ET +19 bps from Friday's close. The biggest moves in the interest rate markets just began overnight.

US stock indexes are getting slapped hard in pre-opening trade. The DJIA at 8:30 am ET was down -500. The news wires are pointing to the rising COVID delta virus as one key reason for the global equity markets slumping. While this is not happening as much here in the US, Asian countries and Europe are seeing a dramatic increase in new cases. There is more to it, however. This morning in the WSJ key economists from the large Wall Street firms are expecting the strong economic growth that has marked this year won't be sustained in Q3 and Q4. While they aren't looking for any recession and are still quite bullish for this year and in 2022, growth is not expected to be as powerful. "We've moved into the more moderate phase of expansion," said Ellen Zentner, chief U.S. economist at Morgan Stanley. "We're past the peak for growth, but that doesn't mean something more sinister is going on here and that we're poised to then drop off sharply."

It's not news that the economy has been on fire. It's also not news that financial markets have continued to push to new highs almost daily with demand for unproven IPOs, only now being seen in the light of excessive optimism. A correction is getting underway with increasing thoughts of a cooling down of the recent growth in outlooks when seen in the context of present growth outlooks that have softened over the last few weeks. The headlines in the media are that the decline in stocks and interest rates is mostly due to the increase in the spread of the delta variant. It may not be that simple, however.

At 9:30 am ET the DJIA opened down -458, the NASDAQ -171, S&P -51. 10 yr. 1.23% -7 bps. FNMA 2.5 30 yr. coupon +17 bps from Friday's close and +14 bps from 9:30 am ET Friday.

At 10:00 am ET the July NAHB housing market index expected at 82 from 81 in June, as released 80. Still strong but the index has leveled off the last three months.

It is a different world these days in movements of US treasuries and mortgage prices; in the so-called "old days" most of the changes in US interest rates occurred in the US session; these days the majority of the changes begin in the Asian time session. As is the case today the technical break below 1.30% started at 8:00 pm ET last night.

Source: TBWS