|

Published Date 7/20/2021

Today's Mortgage Rate Summary

How Rates Move:

Conventional and Government (FHA and VA) lenders set their rates based on the pricing of Mortgage-Backed Securities (MBS) which are traded in real time, all day in the bond market. This means rates or loan fees (mortgage pricing) moves throughout the day, being affected by a variety of economic or political events. When MBS pricing goes up, mortgage rates or pricing generally goes down. When they fall, mortgage pricing goes up.

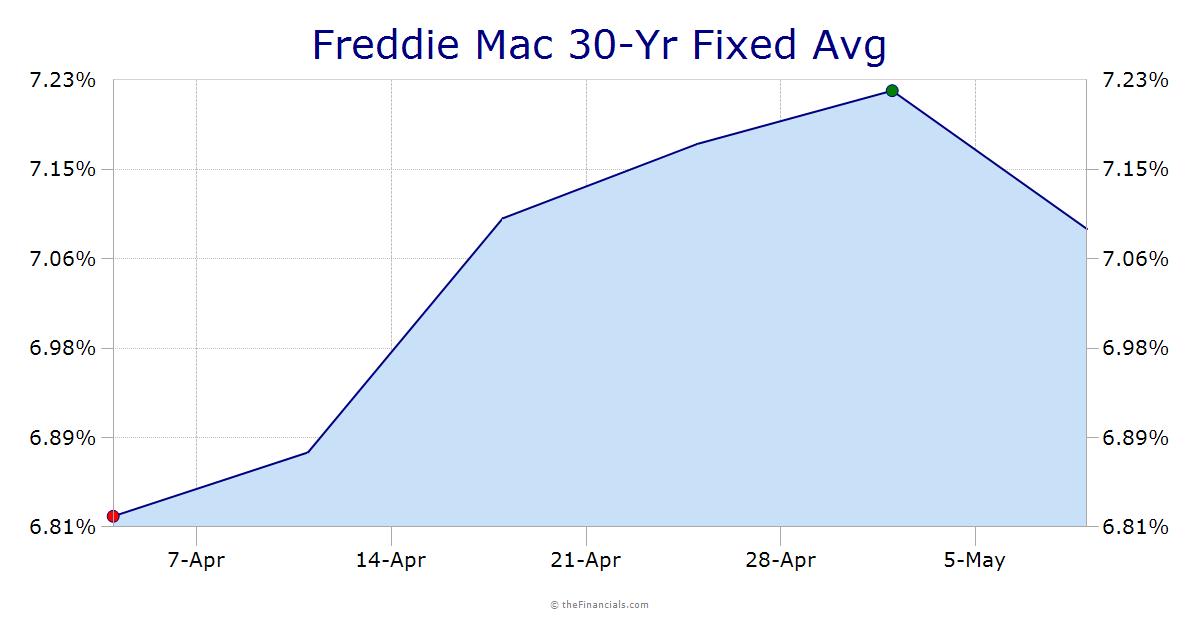

Rates Currently Trending: Neutral

Rates are moving sideways so far today. The MBS market improved by +8 bps yesterday. This caused rates or fees to mostly move sideways for the day. The rates experienced high volatility yesterday.

Today's Rate Forecast: Neutral

Housing: June Housing Starts were better than expected (1.643M vs. est. of 1.590M) but Building Permits were lighter than expected (1.598M vs. est. of 1.700M)

Central Banks: The People's Bank of China kept their key interest rate at 3.85%

Today's Potential Rate Volatility: High

This morning we're expecting some bounce back after yesterday but instead we have floated around the resistance level of the trading channel. Volatility remains high with Delta variant and inflation competing for market focus.

Bottom Line:

If you are looking for the risks and benefits of locking your interest rate in today or floating your loan rate, contact your mortgage professional to discuss it with them.

Source: TBWS