|

Published Date 7/21/2021

Stock indexes early this morning were mixed, the DJIA +141 at 8:30 am ET while NASADAQ -17. The 10 yr. note began up 2 bps to 1.23%, MBS prices -2 bps from yesterday. Starting the day with less volatility, no key data today; Treasury will auction $24B of 20 yr. bonds at 1:00 pm ET.

Traders turning to earnings season as would be normal but recent volatile movement put earnings on the back shelf for the last few sessions. Johnson & Johnson, Coca-Cola Co., Verizon Communications Inc., Kinder Morgan Inc., Baker Hughes Co. and Harley-Davidson Inc. among the many, many companies reporting.

Today is the day Congress was supposed to vote on the infrastructure bill, a $1T package that will fail as bipartisan negotiations drag on. Majority Leader Chuck Schumer has set a vote for today to begin consideration of infrastructure legislation, a step that Republicans have said they would oppose absent more details on its contents and how it would be paid for. Schumer is also pushing for all 50 members of the Democratic caucus to agree to a $3.5T outline for a broad antipoverty and climate package they are pursuing in parallel to the bipartisan infrastructure talks. Democrats on the Budget Committee and Mr. Schumer had announced a deal on the budget framework last week. The $3.5T bill tied to the infrastructure bill isn't likely to get enough votes.

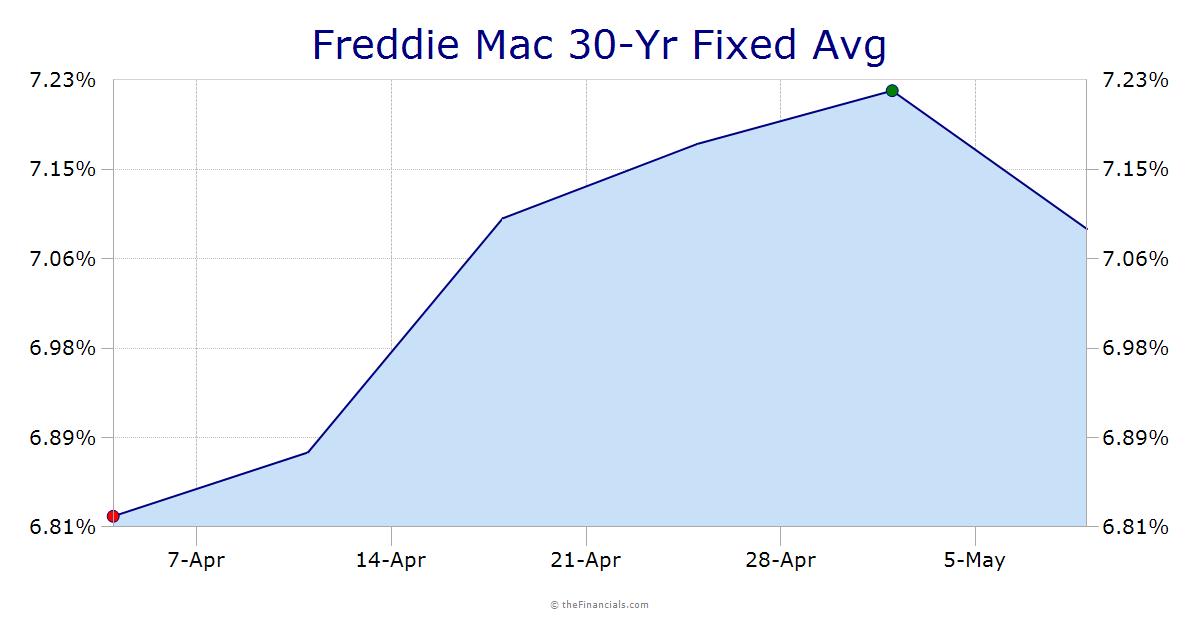

Mortgage applications last week declined; the composite index -4.0%, purchase apps -6.4% while re-finances were down 2.8%. It's a week old news, with this week's drop in mortgage rates we look for a dramatic increase in re-finances and purchases a week from now. Not news that purchases are slow with increasing home prices and a lack of inventories countrywide. Purchase applications the lowest since May 2020. The average contract interest rate for traditional 30-year mortgages increased to 3.11% from 3.09% the prior week; already this week 30 yr. mortgages at about 2.85%.

The Treasury debt limit is presently $28.5B, it can't exceed that level. It isn't the first time and won't be the last that that government spending will exceed the statutory limit. I has to be increased or the government will shut down, and that is not likely. Worst case, a day or two shutdown before the debt limit is increased; there have been three instances of a short shutdown over the last 10 years. On July 31, the Treasury Department technically bumps up against its statutory debt limit. Today the Congressional Budget Office is scheduled to release its latest estimate of when the government actually would be unable to pay its bills -- known as the "X Date."

At 9:30 am ET the DJIA opened +175, NASDAQ +11, S&P +9. 10 yr. note at 9:30 am ET 1.27% +6 bps. FNMA 2.0 30 yr. coupon at 9:30 am ET -16 bps from yesterday's close and -44 bps lower than at 9:30 am ET yesterday; the 2.5 coupon at 9:30 am ET -24 bps from 9:30 am ET yesterday.

The interest rate markets now still correcting from the excessive selling on Monday. The 10 yr. note technical support now at its prior resistance at 1.30%, likely to be tested. If 1.30% holds look for a new trading range for the 10 between 1.30% and 1.20%.

Source: TBWS