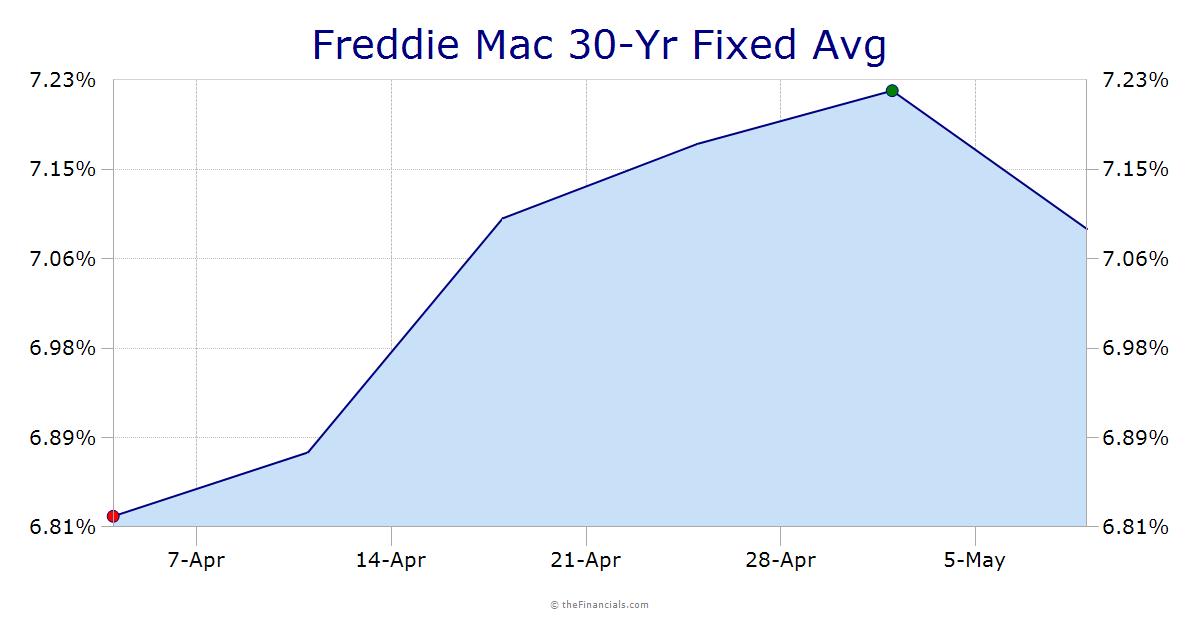

The economic data took a backseat to events in Europe again this week. Improved sentiment about the troubles in Europe influenced the willingness of investors to purchase riskier assets such as stocks, hurting bond markets. As a result, after dropping to the lowest levels of the year, mortgage rates ended the week a little higher.

A report on Wednesday that China was considering a move to reduce its holdings of European debt rattled global financial markets. There had been speculation in recent weeks that China, with the largest pool of foreign exchange reserves in the world, might cut its exposure to European debt. Thursday, however, Chinese officials made rare public comments that China was not planning to make any changes to its portfolio of European investments. Relieved global investors responded by embracing riskier assets such as stocks and partially reversing the effects from a flight to safer assets, such as bonds and mortgage-backed securities (MBS), seen over the last few weeks.

This week's news from the housing sector was mostly positive. April Existing Home Sales rose 8% to an annual rate of 5.77 million units, the highest level in five months. Inventories of unsold existing homes increased a little, but the median home price was 4% higher than one year ago. First-time buyers accounted for 49% of all existing home sales. April New Home Sales rose 15% to an annual rate of 504K units, above the consensus forecast of 425K, and the highest level since May 2008. The homebuyer tax credit helped boost sales before its April 30 deadline.

The biggest economic event next week will be the important Employment report on Friday. As usual, this data on the number of jobs, the Unemployment Rate, and wage inflation will be the most highly anticipated economic data of the month. Early estimates are for an increase of about 500K new jobs in May, of which 300K are the hiring of temporary census workers by the government. Before the employment data, the ISM manufacturing index will be released on Tuesday. Pending Home Sales, a leading indicator for the housing market, will come out on Wednesday. ISM Services will be released on Thursday. Productivity, Construction Spending and Factory Orders will round out the schedule. MBS markets will be closed on Monday for Memorial Day.

http://www.xinnix.com/viewemail/weekinreview.asp

Sunday, May 30, 2010

Wednesday, May 26, 2010

Banks tout new short-sale processes

by J. Craig Anderson The Arizona Republic May. 26, 2010 12:00 AM

Michael Schennum/The Arizona Republic A home is advertised as a short sale this month in Phoenix. While the short-sale process has been seen as a rocky and difficult experience for buyers and sellers alike, banks now hope speeding the transactions will help alleviate confusion and disappointment.

For a financially struggling homeowner, the decision to pursue a short sale does not come easily.

Homeowners who make that choice generally do so after months of searching and pleading for an alternative that would have kept them in the home.

Even when it goes smoothly, the short-sale process is painful for sellers. When it's bumpy and slow, the pain is far worse, said experts who met in Tempe this month for an educational conference on short sales.

Far too many short sales have been plagued by false starts, confusion, delays and disappointments, they said.

Phoenix-area short-sellers' many encounters with insult upon injury stem from a combination of problems, including sellers' lack of experience with the process and lenders' initial reluctance to adopt on a mass scale what they had long considered an obscure means of resolving bad mortgage debts.

Scottsdale resident Mary Purvis, 57, said Bank of America finally approved her short-sale application after 10 months of frustration and uncertainty.

But the pain didn't stop there.

"The sale finally went through last September, but now BofA reported my short sale as a foreclosure on my credit reports, which I have no idea how to fix," Purvis said.

Big mortgage lenders such as Bank of America and Wells Fargo are still smoothing out the wrinkles in their respective solutions to making short sales faster and more reliable. But they are now taking short sales

very seriously and have made many improvements, one bank representative said.

Just as the average Valley homeowner never imagined losing a home to financial hardship, the average mortgage lender never dreamed the bank would have to set up an assembly line to churn out short-sale approvals.

Purvis did not attend last week's conference to confront her lender directly, but Charlotte, N.C.-based Bank of America's Matt Vernon, the bank's top executive in charge of foreclosures and short sales, was there to face a roomful of like-minded consumers.

Vernon was quick to admit the bank's flawed handling of short sales, but he said Bank of America has since taken a 180-degree turn.

It has implemented an automated system - the first of its kind - for tracking the progress of short sales and has reduced the average number of days it takes for a short-sale to be approved, from 90 days to just over 50 days.

The bank approved 18,000 short-sale applications in April, Vernon said.

Unfortunately, it received more than 50,000 short-sale applications that month.

"Our system was never designed to handle this kind of volume," said Rick Sharga, senior vice president and chief economist at RealtyTrac, based in Irvine, Calif., which collects and analyzes nationwide data on short-sales and foreclosures. "Short sales were never intended to be a mass-market product."

That's exactly what they have become, said Sharga, who spoke Friday at a Tempe conference organized by the Distressed Property Institute, a San Diego-based business that has developed a certification and training program

for real-estate agents and other buyer and seller representatives in short-sale transactions.

Company founder and CEO Alex Chafen said the institute's twofold purpose is to teach real-estate professionals how to be more effective at negotiating short sales, while giving homeowners who need representation a way to separate the short-sale experts from the novices.

The company created a special designation, Certified Distressed Property Expert, which it hopes will become synonymous with short-sale expertise.

More on this topic

What is a short sale?

In a short sale, a homeowner seeks to sell the home for less than the amount still due on the mortgage. All lenders with a lien on the mortgaged home must agree to the short sale's terms, because they will not be compensated for the full amount of the mortgage when the home sells.

Tips for prospective short sellers

• Do not wait until foreclosure is imminent to initiate a short sale.

• The seller's agent bears the brunt of responsibility for making sure the sale is completed. When choosing an agent, ask for references from previous short-sale clients and other proof of expertise, such as Certified Distressed Property Expert certification.

• Be prepared to prove financial hardship. Lenders usually require the two most recent tax returns, bank statements, loan statements, pay stubs or other proof of income, along with a hardship letter explaining your circumstances, a detailed description of the home's current condition, closing documents from the home purchase and authorization for your representative to negotiate with the lender.

• Contact the primary mortgage lender for instructions on submitting a short-sale application. Be sure to include every document the lender requires.

• The seller or representative should call the lender every day until a short-sale negotiator is assigned, and then call the negotiator every day until he or she orders an appraisal or broker price opinion of the home's value.

• With an appraisal and comparable buyer's offer in hand, negotiate with the lender for approval.

Banks tout new short-sale processes

Michael Schennum/The Arizona Republic A home is advertised as a short sale this month in Phoenix. While the short-sale process has been seen as a rocky and difficult experience for buyers and sellers alike, banks now hope speeding the transactions will help alleviate confusion and disappointment.

For a financially struggling homeowner, the decision to pursue a short sale does not come easily.

Homeowners who make that choice generally do so after months of searching and pleading for an alternative that would have kept them in the home.

Even when it goes smoothly, the short-sale process is painful for sellers. When it's bumpy and slow, the pain is far worse, said experts who met in Tempe this month for an educational conference on short sales.

Far too many short sales have been plagued by false starts, confusion, delays and disappointments, they said.

Phoenix-area short-sellers' many encounters with insult upon injury stem from a combination of problems, including sellers' lack of experience with the process and lenders' initial reluctance to adopt on a mass scale what they had long considered an obscure means of resolving bad mortgage debts.

Scottsdale resident Mary Purvis, 57, said Bank of America finally approved her short-sale application after 10 months of frustration and uncertainty.

But the pain didn't stop there.

"The sale finally went through last September, but now BofA reported my short sale as a foreclosure on my credit reports, which I have no idea how to fix," Purvis said.

Big mortgage lenders such as Bank of America and Wells Fargo are still smoothing out the wrinkles in their respective solutions to making short sales faster and more reliable. But they are now taking short sales

very seriously and have made many improvements, one bank representative said.

Just as the average Valley homeowner never imagined losing a home to financial hardship, the average mortgage lender never dreamed the bank would have to set up an assembly line to churn out short-sale approvals.

Purvis did not attend last week's conference to confront her lender directly, but Charlotte, N.C.-based Bank of America's Matt Vernon, the bank's top executive in charge of foreclosures and short sales, was there to face a roomful of like-minded consumers.

Vernon was quick to admit the bank's flawed handling of short sales, but he said Bank of America has since taken a 180-degree turn.

It has implemented an automated system - the first of its kind - for tracking the progress of short sales and has reduced the average number of days it takes for a short-sale to be approved, from 90 days to just over 50 days.

The bank approved 18,000 short-sale applications in April, Vernon said.

Unfortunately, it received more than 50,000 short-sale applications that month.

"Our system was never designed to handle this kind of volume," said Rick Sharga, senior vice president and chief economist at RealtyTrac, based in Irvine, Calif., which collects and analyzes nationwide data on short-sales and foreclosures. "Short sales were never intended to be a mass-market product."

That's exactly what they have become, said Sharga, who spoke Friday at a Tempe conference organized by the Distressed Property Institute, a San Diego-based business that has developed a certification and training program

for real-estate agents and other buyer and seller representatives in short-sale transactions.

Company founder and CEO Alex Chafen said the institute's twofold purpose is to teach real-estate professionals how to be more effective at negotiating short sales, while giving homeowners who need representation a way to separate the short-sale experts from the novices.

The company created a special designation, Certified Distressed Property Expert, which it hopes will become synonymous with short-sale expertise.

What is a short sale?

In a short sale, a homeowner seeks to sell the home for less than the amount still due on the mortgage. All lenders with a lien on the mortgaged home must agree to the short sale's terms, because they will not be compensated for the full amount of the mortgage when the home sells.

Tips for prospective short sellers

• Do not wait until foreclosure is imminent to initiate a short sale.

• The seller's agent bears the brunt of responsibility for making sure the sale is completed. When choosing an agent, ask for references from previous short-sale clients and other proof of expertise, such as Certified Distressed Property Expert certification.

• Be prepared to prove financial hardship. Lenders usually require the two most recent tax returns, bank statements, loan statements, pay stubs or other proof of income, along with a hardship letter explaining your circumstances, a detailed description of the home's current condition, closing documents from the home purchase and authorization for your representative to negotiate with the lender.

• Contact the primary mortgage lender for instructions on submitting a short-sale application. Be sure to include every document the lender requires.

• The seller or representative should call the lender every day until a short-sale negotiator is assigned, and then call the negotiator every day until he or she orders an appraisal or broker price opinion of the home's value.

• With an appraisal and comparable buyer's offer in hand, negotiate with the lender for approval.

Banks tout new short-sale processes

Labels:

foreclosures,

short sales

Falling home prices stir fears of a new bottom

Associated Press May. 26, 2010 12:00 AM

NEW YORK - The housing slump isn't over.

Tax credits and historically low mortgage rates have failed to lift home prices so far this year. Prices nationally fell 0.5 percent in March from February, according to the Standard & Poor's/Case-Shiller 20-city index released Tuesday.

That marks six straight months of declines - a sign that the housing market is going in reverse.

"It looks a little like a double-dip already," economist Robert Shiller said in an interview. "There is a very real possibility of some more decline."

Home prices in Phoenix, one of the 20 indexed cities, mirrored the national trend with a 0.5 percent monthly decrease. In terms of ranking from most improved to biggest decline, Phoenix was in the middle at No. 10.

The co-creator of the Case-Shiller index, who predicted in 2005 that the housing bubble would burst, says he worries that home prices rose last year only because of the federal tax credits.

That fear is shared by other economists.

They note that weak job growth, tight credit and millions more foreclosures ahead will weigh on the home market.

All that is discouraging for homeowners who have seen the value of their largest asset

deteriorate sharply over the past three years. Falling home prices tend to curtail consumer spending. And they make it harder for struggling borrowers to refinance into an affordable home loan.

Prices in 13 of the 20 cities tracked by the index fell. Only six metro areas recorded price gains. One, Boston, came in flat.

In the first quarter of 2010, U.S. home prices fell 3.2 percent compared with the fourth quarter.

The numbers are especially disturbing because they show that improved sales due to the tax credits didn't translate into higher prices, said David M. Blitzer, chairman of the S&P index committee.

Falling home prices stir fears of a new bottom

NEW YORK - The housing slump isn't over.

Tax credits and historically low mortgage rates have failed to lift home prices so far this year. Prices nationally fell 0.5 percent in March from February, according to the Standard & Poor's/Case-Shiller 20-city index released Tuesday.

That marks six straight months of declines - a sign that the housing market is going in reverse.

"It looks a little like a double-dip already," economist Robert Shiller said in an interview. "There is a very real possibility of some more decline."

Home prices in Phoenix, one of the 20 indexed cities, mirrored the national trend with a 0.5 percent monthly decrease. In terms of ranking from most improved to biggest decline, Phoenix was in the middle at No. 10.

The co-creator of the Case-Shiller index, who predicted in 2005 that the housing bubble would burst, says he worries that home prices rose last year only because of the federal tax credits.

That fear is shared by other economists.

They note that weak job growth, tight credit and millions more foreclosures ahead will weigh on the home market.

All that is discouraging for homeowners who have seen the value of their largest asset

deteriorate sharply over the past three years. Falling home prices tend to curtail consumer spending. And they make it harder for struggling borrowers to refinance into an affordable home loan.

Prices in 13 of the 20 cities tracked by the index fell. Only six metro areas recorded price gains. One, Boston, came in flat.

In the first quarter of 2010, U.S. home prices fell 3.2 percent compared with the fourth quarter.

The numbers are especially disturbing because they show that improved sales due to the tax credits didn't translate into higher prices, said David M. Blitzer, chairman of the S&P index committee.

Falling home prices stir fears of a new bottom

Labels:

case-shiller report,

home prices

New index forecasts housing prices

by Catherine Reagor The Arizona Republic May. 26, 2010 12:00 AM

Phoenix-area home prices will climb slightly in June, take a small dip in July and then start to climb again in late August.

This prediction on home prices doesn't come from a crystal ball or an economic forecast. Metropolitan Phoenix has a new pending-sales index compiled by the Arizona Regional Multiple Listing Service. The index, a leading indicator for the housing market, can give homebuyers and sellers an accurate view of home prices a few months out.

ARMLS' Pending Price Index tracks home-purchase contracts signed but not yet finalized. But the purchase price is usually set when the contract is signed. ARMLS began testing the index in January, and since then, it has been 96 percent accurate on price fluctuations.

ARMLS is the only group that has access to all of the data from homebuying contracts signed but not yet recorded as public records. The group's tens of thousands of real-estate agent members enter contract purchase prices into the ARMLS system. The Price Index is updated with data from home sales after they close.

"Everyone wants to know where Phoenix home prices are headed," said Bob Beamis, chief executive of ARMLS. "We are in the unique position of having in our system information on home prices that no one else has, and now we are able to use that information to predict with great accuracy where home prices are heading 30, 60, 90 and 120 days out."

According to the Price Index, metro Phoenix's average home price will climb to $177,000 in June, fall to $167,000 in July and then start climbing again in late August. The upward/downward trend for median home prices is similar for the next two months.

ARMLS is unveiling its Price Index and other real-estate data, including home sales, foreclosures and listings, to its members this month through the "STAT" newsletter.

Homebuilding boost

The federal tax credit helped new-home sales increase enough in April to beat last year's pace. There were 823 new-home sales in metro Phoenix last month, according to the "Phoenix Housing Market Letter." That compares with 789 in April 2009. It's the first month this year that new-home sales have topped last year's closings.

Homebuilding in the region slowed last month as builders prepared for demand from the tax credit to wind down. There were 604 single-family permits issued in April, compared with 908 in March.

New index forecasts housing prices

Phoenix-area home prices will climb slightly in June, take a small dip in July and then start to climb again in late August.

This prediction on home prices doesn't come from a crystal ball or an economic forecast. Metropolitan Phoenix has a new pending-sales index compiled by the Arizona Regional Multiple Listing Service. The index, a leading indicator for the housing market, can give homebuyers and sellers an accurate view of home prices a few months out.

ARMLS' Pending Price Index tracks home-purchase contracts signed but not yet finalized. But the purchase price is usually set when the contract is signed. ARMLS began testing the index in January, and since then, it has been 96 percent accurate on price fluctuations.

ARMLS is the only group that has access to all of the data from homebuying contracts signed but not yet recorded as public records. The group's tens of thousands of real-estate agent members enter contract purchase prices into the ARMLS system. The Price Index is updated with data from home sales after they close.

"Everyone wants to know where Phoenix home prices are headed," said Bob Beamis, chief executive of ARMLS. "We are in the unique position of having in our system information on home prices that no one else has, and now we are able to use that information to predict with great accuracy where home prices are heading 30, 60, 90 and 120 days out."

According to the Price Index, metro Phoenix's average home price will climb to $177,000 in June, fall to $167,000 in July and then start climbing again in late August. The upward/downward trend for median home prices is similar for the next two months.

ARMLS is unveiling its Price Index and other real-estate data, including home sales, foreclosures and listings, to its members this month through the "STAT" newsletter.

Homebuilding boost

The federal tax credit helped new-home sales increase enough in April to beat last year's pace. There were 823 new-home sales in metro Phoenix last month, according to the "Phoenix Housing Market Letter." That compares with 789 in April 2009. It's the first month this year that new-home sales have topped last year's closings.

Homebuilding in the region slowed last month as builders prepared for demand from the tax credit to wind down. There were 604 single-family permits issued in April, compared with 908 in March.

New index forecasts housing prices

Labels:

armls

Toll Brothers posts smaller losses

Associated Press May. 27, 2010 12:00 AM

LOS ANGELES - Luxury homebuilder Toll Brothers Inc. posted a narrower loss in its latest quarter and saw a surge in orders for new homes, trends the company said were holding steady despite the end of two homebuyer tax credits.

New-home contracts jumped 41 percent in the February-April period and the value of the builder's backlog increased on an annual basis for the first time in four years, reflecting increased confidence among buyers, the company said.

"It appears our business has finally emerged from the tunnel and into a bit of daylight," said Robert Toll, chairman and CEO. He said sales held up in May even though two tax credits expired last month.

Toll said he believes customers are becoming more confident in their job security, their ability to sell previous homes and the outlook for home prices.

He did sound a cautious note, however, saying he expects a gradual recovery as the market faces headwinds from high unemployment and volatility in the financial markets.

"We don't expect housing to roar back right away," said Toll, who announced last week that he will step down from the CEO post on June 16 after more than four decades. He will stay on as chairman.

The company said it lost $40.4 million, or 24 cents per share, down from $83.2 million, or 52 cents per share. Analysts expected a loss of 23 cents per share.

Revenue dropped 22 percent, to $311.3 million from $398.3 million. Analysts expected $321.9 million.

Toll Brothers posts smaller losses

LOS ANGELES - Luxury homebuilder Toll Brothers Inc. posted a narrower loss in its latest quarter and saw a surge in orders for new homes, trends the company said were holding steady despite the end of two homebuyer tax credits.

New-home contracts jumped 41 percent in the February-April period and the value of the builder's backlog increased on an annual basis for the first time in four years, reflecting increased confidence among buyers, the company said.

"It appears our business has finally emerged from the tunnel and into a bit of daylight," said Robert Toll, chairman and CEO. He said sales held up in May even though two tax credits expired last month.

Toll said he believes customers are becoming more confident in their job security, their ability to sell previous homes and the outlook for home prices.

He did sound a cautious note, however, saying he expects a gradual recovery as the market faces headwinds from high unemployment and volatility in the financial markets.

"We don't expect housing to roar back right away," said Toll, who announced last week that he will step down from the CEO post on June 16 after more than four decades. He will stay on as chairman.

The company said it lost $40.4 million, or 24 cents per share, down from $83.2 million, or 52 cents per share. Analysts expected a loss of 23 cents per share.

Revenue dropped 22 percent, to $311.3 million from $398.3 million. Analysts expected $321.9 million.

Toll Brothers posts smaller losses

Labels:

new home sales,

toll brothers

State trust land sold at auction for $2 million

by Peter Corbett The Arizona Republic May. 26, 2010 12:00 AM

Amid some confusion, the head of a Seattle-based firm was the winning bidder Tuesday for 4.7 acres of state trust land in Scottsdale.

Perry Koon bought the parcel northeast of Loop 101 and Frank Lloyd Wright Boulevard for the minimum bid of $2.15 million or $451,681 per acre. His company is Koon-Boen Inc.

Koon could not be reached for comment on his plans for the commercial site he acquired from the Arizona State Land Department.

A second bidder, BYPG Holdings LLC, represented by broker George Haugen, thought it had signaled the only bid during the two-minute auction. But auctioneer Dana Brown recognized Koon's bid first with the No. 4 paddle.

Haugen and an associate, seated three rows ahead of Koon, apparently thought Brown had recognized their bid with the No. 1 paddle.

Brown called out three times that No. 4 had the bid at $2.15 million before banging the gavel to end the auction.

Just before the bidding closed, Scottsdale broker Jim Keeley asked for a clarification that the No. 4 bidder had the high bid.

Haugen's group did not realize they had missed their chance to bid until the auction closed and they got up to pay a $285,200 deposit for the land.

Haugen declined comment when asked about the bidding confusion.

BYPG Holdings includes the L.L. and P.A. Van Tuyl Revocable Trust.

State Land Commissioner Maria Baier, who witnessed the bidding, said the proper auction procedure was carried out with the bidders identified by number.

She also noted that developers are showing renewed interest in state trust lands.

Builders largely backed off buying or leasing state land the past two years because of the recession.

"I'm deadly serious when I say that in the last 30 days we've had a few large buyers in to see us," Baier said. "To me that says more about the potential economic recovery than all the economic forecasts."

It appears builders are ready to build up their land inventory again, she said.

State trust land sold at auction for $2 million

Amid some confusion, the head of a Seattle-based firm was the winning bidder Tuesday for 4.7 acres of state trust land in Scottsdale.

Perry Koon bought the parcel northeast of Loop 101 and Frank Lloyd Wright Boulevard for the minimum bid of $2.15 million or $451,681 per acre. His company is Koon-Boen Inc.

Koon could not be reached for comment on his plans for the commercial site he acquired from the Arizona State Land Department.

A second bidder, BYPG Holdings LLC, represented by broker George Haugen, thought it had signaled the only bid during the two-minute auction. But auctioneer Dana Brown recognized Koon's bid first with the No. 4 paddle.

Haugen and an associate, seated three rows ahead of Koon, apparently thought Brown had recognized their bid with the No. 1 paddle.

Brown called out three times that No. 4 had the bid at $2.15 million before banging the gavel to end the auction.

Just before the bidding closed, Scottsdale broker Jim Keeley asked for a clarification that the No. 4 bidder had the high bid.

Haugen's group did not realize they had missed their chance to bid until the auction closed and they got up to pay a $285,200 deposit for the land.

Haugen declined comment when asked about the bidding confusion.

BYPG Holdings includes the L.L. and P.A. Van Tuyl Revocable Trust.

State Land Commissioner Maria Baier, who witnessed the bidding, said the proper auction procedure was carried out with the bidders identified by number.

She also noted that developers are showing renewed interest in state trust lands.

Builders largely backed off buying or leasing state land the past two years because of the recession.

"I'm deadly serious when I say that in the last 30 days we've had a few large buyers in to see us," Baier said. "To me that says more about the potential economic recovery than all the economic forecasts."

It appears builders are ready to build up their land inventory again, she said.

State trust land sold at auction for $2 million

Phoenix puts property-tax hike on hold

by Jahna Berry The Arizona Republic May. 26, 2010 12:00 AM

Phoenix city leaders will wait two years before deciding whether to increase a property-tax rate that has stayed the same for 14 years.

Because of falling property values, the city is collecting less money from its secondary property tax, which is used to pay bond debt.

Those voter-approved bond projects include building police stations and parks and roadwork.

If the property-tax slide continues for several years, Phoenix could have trouble making debt payments.

Instead of voting to increase the tax rate, the City Council voted on Tuesday to keep the current fixed combined property-tax rate, which is $1.82 per $100 of assessed valuation.

If the property-values problem persists in two years, the council either will vote to change the city's secondary tax rate, change the primary tax rate or use the city's general fund to cover debt payments, said Councilman Bill Gates.

The city also voted to delay $200 million in bond projects, refinance some debt and closely monitor the situation.

At Tuesday's meeting, many residents were prepared to speak out against a proposal that would have raised the property-tax rate beginning in July 2013.

Residents are hard-hit and paying too much for taxes, several residents said, noting that the city started a 2 percent food tax and that voters recently approved a 1 percent increase in the state sales tax.

The council is scheduled to take a formal vote on the property-tax levy at its July 7 meeting.

Phoenix puts property-tax hike on hold

Phoenix city leaders will wait two years before deciding whether to increase a property-tax rate that has stayed the same for 14 years.

Because of falling property values, the city is collecting less money from its secondary property tax, which is used to pay bond debt.

Those voter-approved bond projects include building police stations and parks and roadwork.

If the property-tax slide continues for several years, Phoenix could have trouble making debt payments.

Instead of voting to increase the tax rate, the City Council voted on Tuesday to keep the current fixed combined property-tax rate, which is $1.82 per $100 of assessed valuation.

If the property-values problem persists in two years, the council either will vote to change the city's secondary tax rate, change the primary tax rate or use the city's general fund to cover debt payments, said Councilman Bill Gates.

The city also voted to delay $200 million in bond projects, refinance some debt and closely monitor the situation.

At Tuesday's meeting, many residents were prepared to speak out against a proposal that would have raised the property-tax rate beginning in July 2013.

Residents are hard-hit and paying too much for taxes, several residents said, noting that the city started a 2 percent food tax and that voters recently approved a 1 percent increase in the state sales tax.

The council is scheduled to take a formal vote on the property-tax levy at its July 7 meeting.

Phoenix puts property-tax hike on hold

Labels:

arizona,

property taxes

2 big solar projects mulled for W. Valley

by Rebekah L. Sanders The Arizona Republic May. 25, 2010 12:00 AM

Two solar arrays that could become among the country's largest are being planned in the West Valley.

Luke Air Force Base in Glendale is preparing to install solar panels this fall that would generate 60 percent of the base's electricity by 2011 and could eclipse solar projects at other U.S. military bases, according to Lt. Col. John Thomas, head of the base's civil-engineer squadron.

"We want to take care of the land we have and leave it better for tomorrow," he said.

Meanwhile, homebuilder DMB Associates is proposing a solar field nearly twice the size of Luke's on 200 acres at its Buckeye housing development Verrado, senior vice president of operations Tom Lucas said this week.

Verrado is near Interstate 10, west of 195th Avenue. Solon Corp., a photovoltaic solar-panel manufacturer based in Tucson, would supply the panels.

DMB's project is one of 50 renewable-energy proposals that Arizona Public Service is considering. APS had requested proposals for projects that would add to the utility company's alternative-energy portfolio.

APS would not say when a winning project would be chosen. Luke is not part of the APS proposals.

"We've cared about the environment ever since we started building master-planned communities," Lucas said. "We want to add solar energy to the portfolio of DMB."

The solar plans were touted as advances toward sustainability in the West Valley at a panel discussion May 18 sponsored by Valley Forward, a non-profit that promotes balancing economic development and environmental quality.

Glendale Mayor Elaine Scruggs, a panelist, noted the city's efforts to cut electricity use by replacing incandescent bulbs with more efficient lighting and partnering with a company that turns the city's landfill gas into power.

Scruggs advocated better statewide transportation planning to improve sustainability.

Funding for transit has plummeted with the economy and state budget cuts, forcing cities to reduce bus and transit services, she said.

2 big solar projects mulled for W. Valley

Two solar arrays that could become among the country's largest are being planned in the West Valley.

Luke Air Force Base in Glendale is preparing to install solar panels this fall that would generate 60 percent of the base's electricity by 2011 and could eclipse solar projects at other U.S. military bases, according to Lt. Col. John Thomas, head of the base's civil-engineer squadron.

"We want to take care of the land we have and leave it better for tomorrow," he said.

Meanwhile, homebuilder DMB Associates is proposing a solar field nearly twice the size of Luke's on 200 acres at its Buckeye housing development Verrado, senior vice president of operations Tom Lucas said this week.

Verrado is near Interstate 10, west of 195th Avenue. Solon Corp., a photovoltaic solar-panel manufacturer based in Tucson, would supply the panels.

DMB's project is one of 50 renewable-energy proposals that Arizona Public Service is considering. APS had requested proposals for projects that would add to the utility company's alternative-energy portfolio.

APS would not say when a winning project would be chosen. Luke is not part of the APS proposals.

"We've cared about the environment ever since we started building master-planned communities," Lucas said. "We want to add solar energy to the portfolio of DMB."

The solar plans were touted as advances toward sustainability in the West Valley at a panel discussion May 18 sponsored by Valley Forward, a non-profit that promotes balancing economic development and environmental quality.

Glendale Mayor Elaine Scruggs, a panelist, noted the city's efforts to cut electricity use by replacing incandescent bulbs with more efficient lighting and partnering with a company that turns the city's landfill gas into power.

Scruggs advocated better statewide transportation planning to improve sustainability.

Funding for transit has plummeted with the economy and state budget cuts, forcing cities to reduce bus and transit services, she said.

2 big solar projects mulled for W. Valley

Labels:

arizona,

dmb,

luke air force base,

solar

Sunday, May 23, 2010

Market Recap - Week Ending May 21, 2010

This week, uncertainty about the pace of the economic recovery caused investors to shift to relatively safer assets, including government insured mortgage-backed securities (MBS). Also positive for mortgage markets, the economic data released this week showed that inflation remains extremely low. As a result, mortgage rates declined during the week, reaching the lowest levels of the year.

Concern about the level of global economic growth drove financial markets this week. Troubled European countries will be forced to reduce government spending, and Chinese officials indicated that they will tighten monetary policy to reduce inflation. In the US, it's not clear to what degree the new financial regulation bill will cause banks to reduce lending, leading to slower economic growth. In response to periods of uncertainty such as this, investors seek to reduce risk by moving to safer assets such as bonds, and greater demand for MBS pushes mortgage rates lower.

This week's news from the housing sector was mixed. April Housing Starts increased above the consensus forecast to the highest level since October 2008. Building Permits, a leading indicator, declined moderately. The May NAHB Homebuilder confidence index rose to the highest level since August 2007. Even with the end of the homebuyer tax credit, the builders surveyed remained optimistic about the next six months.

Next week, a wide mix of economic data will shed some light on the level of economic growth. Existing Home Sales will be released on Monday, and New Home Sales will come out on Wednesday. Durable Orders, an important indicator of economic activity, will also be released on Wednesday. Thursday, a revised figure for first quarter Gross Domestic Product (GDP) will come out. The Chicago PMI manufacturing index and Personal Income are scheduled for Friday. Consumer Sentiment and Consumer Confidence will round out the Economic Calendar. In addition, there will be Treasury auctions on Tuesday, Wednesday, and Thursday.

Market Recap - Week Ending May 21, 2010

Concern about the level of global economic growth drove financial markets this week. Troubled European countries will be forced to reduce government spending, and Chinese officials indicated that they will tighten monetary policy to reduce inflation. In the US, it's not clear to what degree the new financial regulation bill will cause banks to reduce lending, leading to slower economic growth. In response to periods of uncertainty such as this, investors seek to reduce risk by moving to safer assets such as bonds, and greater demand for MBS pushes mortgage rates lower.

This week's news from the housing sector was mixed. April Housing Starts increased above the consensus forecast to the highest level since October 2008. Building Permits, a leading indicator, declined moderately. The May NAHB Homebuilder confidence index rose to the highest level since August 2007. Even with the end of the homebuyer tax credit, the builders surveyed remained optimistic about the next six months.

Next week, a wide mix of economic data will shed some light on the level of economic growth. Existing Home Sales will be released on Monday, and New Home Sales will come out on Wednesday. Durable Orders, an important indicator of economic activity, will also be released on Wednesday. Thursday, a revised figure for first quarter Gross Domestic Product (GDP) will come out. The Chicago PMI manufacturing index and Personal Income are scheduled for Friday. Consumer Sentiment and Consumer Confidence will round out the Economic Calendar. In addition, there will be Treasury auctions on Tuesday, Wednesday, and Thursday.

Market Recap - Week Ending May 21, 2010

American made ... Chinese owned - May. 7, 2010

By Sheridan Prasso Fortune May 7, 2010: 9:35 AM ET

(Fortune) -- About a mile past the Bountiful Blessings Church on the outskirts of Spartanburg, S.C., make a right turn. There, tucked into an industrial court behind a row of sapling cherry trees not much taller than I am, past a company that makes rubber stamps and another that stitches logos onto caps and bags, is a brand-new factory: the state-of-the-art American Yuncheng Gravure Cylinder plant. Due to open any day now, it will make cylinders used to print labels like the ones around plastic soda bottles. But unlike its neighbors in Spartanburg, Yuncheng is a Chinese company. It has come to South Carolina because by Chinese standards, America is darn cheap.

Yes, you read that right. The land Yuncheng purchased in Spartanburg, at $350,000 for 6.5 acres, cost one-fourth the price of land back in Shanghai or Dongguan, a gritty city near Hong Kong where the company already runs three plants. Electricity is cheaper too: Yungcheng pays up to 14¢ per kilowatt-hour in China at peak usage, and just 4¢ in South Carolina. And no brownouts either, a sporadic problem in China. It's true that American workers are much more expensive, of course, and the overall cost of making a widget in China remains lower, and perhaps always will.

But for hundreds of Chinese companies like Yuncheng, the U.S. has become a better, less expensive place to set up shop. It could be the biggest role reversal since, well ... when Nixon went to China. "The gap between manufacturing costs in the U.S. and China is shrinking," explains John Ling, a naturalized American from China who runs the South Carolina Department of Commerce's business recruitment office in Shanghai. Ling recruited Yuncheng to Spartanburg, and others too: Chinese companies have invested $280 million and created more than 1,200 jobs in South Carolina alone.

Today some 33 American states, ports, and municipalities have sent representatives like Ling to China to lure jobs once lost to China back to the U.S.: Besides affordable land and reliable power, states and cities are offering tax credits and other incentives to woo Chinese manufacturers. Beijing, meanwhile, which has mandated that Chinese companies globalize by expanding to key markets around the world, is chipping in by offering to finance up to 30% of the initial investment costs, according to Chinese business sources.

What would Henry Luce think?

The enticements are working. Chinese companies announced new direct investments in the U.S. of close to $5 billion in 2009 alone, according to New York City-based economic consultancy the Rhodium Group, which tallied the numbers for Fortune. That's well below Japanese investment in the U.S., which peaked at $148 billion in 1991, but a big jump from China's previous investments, which had been averaging around $500 million a year. Chinese firms last year acquired or announced they were starting more than 50 U.S. companies. And when China finally allows the value of its currency, the yuan, to appreciate -- and it's just a question of when -- Americans can expect to see Chinese projects, small today, really take off and have an impact on the U.S. economy. This could be a good thing for relations between the two countries. "It will take many years to balance out the flow of U.S. investment into China," says Dan Rosen, a principal at the Rhodium Group. But, he says, China's aggressive interest in U.S. investment suddenly gives Washington some leverage as it seeks to negotiate with Beijing on tariffs, trade issues, and economic policy.

None of that matters much in Spartanburg. Skilled workers at American Yuncheng will earn $25 to $30 an hour, line operators $10 to $12. That's a lot more than the $2 an hour that unskilled labor costs in China, but the company can qualify for a state payroll tax credit of $1,500 per worker (for any company creating more than 10 jobs). And by being closer to companies like Coca-Cola, Yuncheng can respond more quickly when they need new labels designed to show that a product has reduced its fat content or added more flavor. If business goes well, company president Li Wenchun expects to double the size of his operation, maybe in five to 10 years, and employ up to 120 Americans. "I'd like it to be next month, but it depends on how fast we develop the market here," he tells me through a Mandarin interpreter.

So far there's little sign of anti-Chinese sentiment among South Carolinians, who watched their state lose its cotton-based textile-manufacturing industry to low-cost countries like China. Fortune asked Sen. Jim DeMint, a Republican torchbearer for conservative causes, what he thinks of communists creating work in his home state. "South Carolina is one of the best places in the world to do business, and that's why so many international companies are moving jobs into our state" is his only reply.

Brenda Missouri, a 43-year-old leaks tester who works for appliance maker Haier, speaks about her employer in glowing terms. Haier was the first Chinese company to build a factory in the U.S. -- a refrigerator plant in Camden, S.C., in 2000. "They're good business folks; they get the job done," she says. As for communism? "Doesn't matter," she shrugs. "It's money that makes the difference."

Chinese companies, American workers

Last December the National Committee on U.S.-China Relations dispatched me to Corpus Christi to give a speech about the Chinese and their economy. Why? Because, they told me, the region is about to become home to the largest-ever Chinese-built factory in the U.S., a $1 billion plant by Tianjin Pipe Group to manufacture seamless pipe for oil drilling. If everything proceeds as planned -- the company received its air-quality permit on April 14 and hopes to break ground by fall -- Tianjin Pipe expects to employ 600 Texans by 2012 and to provide an estimated $2.7 billion to the local economy over the next decade. Corpus Christians, it turned out, wanted to know more about their new neighbors who are expected to relocate 40 to 50 families to Texas.

Upon arrival, I find it impossible not to notice the resemblance of Corpus Christi's long, curving coastline on the Gulf of Mexico to the one near Tianjin on the Bohai Sea between northern China and Korea. Some 75 U.S. locales competed for the factory, but when Chinese delegations from Tianjin Pipe visited Corpus Christi, the townspeople made them feel at home by welcoming the visitors to backyard barbecues. They even enlisted the Taiwan-born former owner of the local Chinese restaurant, Yalee Shih -- perhaps the only woman in town who could speak Mandarin -- to help them navigate cultural nuances. Shih, who also sits on the board of the Texas State Museum of Asian Cultures, delicately helped prevent a multimillion-dollar translation error over building costs that might have cost Corpus Christi the project, and also quashed what would have been an impolitic gift of clocks -- which to the Chinese symbolize death or the end of a relationship -- from a local retailer. She and others in the region's business community plan to help guide their new residents through life in America, like how to buy a car, how to rent a house, as well as where to go to buy fragrant rice instead of Uncle Ben's.

In the end, while feeling at home helps, it does come down to business, says J.J. Johnston, executive vice president and chief business development officer of the Corpus Christi Regional Economic Development Corp. "They like the strategic location of our region, the convenient access to materials coming in -- mostly scrap metal and pig iron -- and the ability to export to North and South America through the port of Corpus Christi," he says.

There are other incentives. On April 9 the U.S. Commerce Department imposed import duties of up to 99% on the type of seamless pipe that is to be manufactured by Tianjin Pipe -- a reprisal prompted by the United Steelworkers union. The Chinese company, the world's largest maker of steel pipe, had said it could not afford to export to the U.S. if tariffs were over 20%. Now its pipe will be made in America. "It's just another reason they have to have a U.S.-based production facility," says Johnston.

Even without tariffs, Tianjin had been looking to expand -- as are many Chinese companies once they reach about $100 million in annual sales. "Chinese companies, as they get bigger, have to start thinking about their global positioning," says Clarence Kwan, who runs the Chinese Services Group at Deloitte, which advises Chinese companies on doing business in the U.S. Officially the Chinese government has given approval to over 1,200 Chinese investments in the U.S., but that number is considered low because it doesn't count those made via Hong Kong -- where many Chinese companies earn equity capital from being publicly traded -- or tax havens like the Virgin Islands, where Chinese investment may stop first before flowing to the U.S. Plus, investments below $100 million don't need Beijing's nod and may be approved at the local level.

Chinese companies see America as more than a manufacturing center. So far this year they have announced plans to build a wind-energy turbine plant and wind farm in Nevada that will create 1,000 American jobs; purchased the 400-employee Los Angeles Marriott Downtown out of foreclosure; and acquired a shuttered shopping center in Milwaukee, with plans to turn it into a mega-mall for 200 Chinese retailers. In some cases Chinese companies are resuscitating American outfits that had been left for dead. About 70 miles west of Spartanburg, near the Georgia border, past signs reading "24-hour fried chicken," another Chinese company is hiring engineers -- metallurgical and mechanical, some from nearby Clemson University. In June 2009, Top-Eastern Group, a tool manufacturer based in China's coastal city of Dalian, acquired a factory here along with three other facilities from Kennametal, one of America's largest machine-tool makers, after the U.S. company, based in Latrobe, Pa., reported a $137 million loss (citing a slowdown in industrial activity) in the quarter before the sale.

This plant, in Seneca, S.C., makes drill bits. And in the months since his purchase of it for $29 million, Top-Eastern founder Jeff Chee has invested another $10 million to upgrade machinery, built a $3 million logistics center, brought back Kennametal's furloughed workers, hired 120 more, and now has his 260-employee plant working overtime filling orders for the Cleveland Twist Drills, Chicago Latrobe, Putnam, and Bassett brands he acquired. He brought back the company's old name, which was Greenfield Industries before Kennametal acquired it in 1997, and emblazoned it on a sign out front.

General Electric's former CEO , Jack Welch, he volunteers, is his inspiration. "I've read a lot of books, and I learned a lot from him," Chee says in broken English amid the sharp smell of grinding steel. "One person can change a lot." As one of China's self-made entrepreneurs, who started Top-Eastern in 1994 with just $500, Chee now has worldwide sales of more than $120 million, 4,000 employees, and factories in Germany and Brazil. He visits the South Carolina plant monthly to make sure all is proceeding as planned, and employs American managers to run it in his absence rather than bring over Chinese. "There's good, experienced people and good know-how already here," he says.

How can he make a drill bit factory profitable where Kennametal had struggled? By increasing productivity with new equipment and cutting costs, he says. Plus, Chee forges his own steel, and he owns the mines back in China for two of its more expensive components, tungsten and molybdenum. The fact that he can source from himself means he keeps the margins -- and now his tools are officially made in the U.S. The cost of making those products is much higher than in China, he says, "but the problem is customers just accept 'made in U.S.A.' products, so I have no choice. Lots of customers here have government contracts that have 'made in U.S.A.' requirements."

And how do the employees feel about having a Chinese entrepreneur come to their rescue? "Just because it's a Chinese owner, they don't really care," says Scott Henderson, a 47-year-old manufacturing manager who had been furloughed one week a month along with his workers before Chee bought the factory. "They're all happy to be working 40 hours a week." They also have the opportunity for overtime, and a third, graveyard shift has been added to serve a nearly 40% rise in orders. "I feel great about it," says Sam Marcengill, a 24-year-old technician at the plant. Last year he was laid off for six months before Chee's purchase gave him his job back. Now he's on overtime, 48 hours a week. "The work's a lot more steady. It's better. Personally I'm a lot better off. It's a great thing."

Never mind the hiccups Chinese companies experienced when they tried to enter the U.S. before. In 2005, Washington famously blocked China's National Offshore Oil Corp. (CNOO C) from buying Unocal, and Chinese appliance maker Haier failed to acquire Maytag. Now, like the Japanese in the 1980s -- when U.S. trade frictions combined with Japan's boom blossomed into Honda and Toyota manufacturing plants -- the Chinese are here to stay. Their presence initially made some folks uneasy. A few years ago a caller to The Rush Limbaugh Show complained that as he was driving past the Haier plant in Camden, the Chinese flag was flying higher than the American flag and the South Carolina state flag out front. It was an easy mistake to make by anyone looking at the three equal-height flagpoles from an angle.

Conservative media joined in and called for protests, and the public rang the factory to complain. The Chinese executives at Haier had no idea flags were such a big deal, and it became their bugaboo. The complaints continued until about a year and a half ago when Haier America factory president Joseph Sexton, who was new to the job, decided to fix it. He had two of the poles lowered so that the U.S. flag looks highest from all angles.

It took Haier some time to work through the issues of being a Chinese employer in a small, historic Southern town (pop. 6,682) lined with stately antebellum houses and home to two Revolutionary War battlefields. "Having a Chinese manager didn't work. That's why they took all the Chinese managers out of here," says Haier's human resources director, Gerald Reeves, who was one of the first hired by Haier and guided the Chinese through the realities of American-style personnel management -- including convincing them that they needed to offer health insurance. He once even asked John Ling, South Carolina's man in Shanghai, to fly home from China to talk to a manager who was arousing employee resentment by publicly embarrassing the workers, Chinese-style, for their mistakes.

Now the only way to know you're in a Chinese factory is by looking up at the large Chinese flag hanging from the rafters -- alongside an American one, of course -- and by the very Chinese motivational slogans on the walls: "Spirit of entrepreneurship -- strive for a clearly defined objective and make the impossible possible without an excuse" reads the banner over the refrigerator testing line. And if you come in February, Sexton organizes a Chinese New Year party with food and outdoor firecrackers.

What is perhaps most startling about the Haier factory is that it is actually shipping goods back to China. Best known for its mini-fridges for dorm rooms and studio apartments, Haier's U.S. plant also makes large units, good for supersized American McMansions but too large for a typical Chinese household. Now a growing number of wealthy people in China want to supersize too, so Haier has realized it can ship a small number, maybe 4,000 a year, of its highest-end refrigerators home and sell them for $2,600 apiece -- more than China's average annual income of around $2,000. (Haier also ships U.S.-made refrigerators to India, Australia, Mexico, and Canada.) There aren't enough wealthy customers yet to make it worthwhile retooling any of the 29 Haier factories in China, but the nearby deepwater port in Charleston, S.C., makes export easy enough. "There are folks in China who want high-end products," says Haier America factory president Joseph Sexton. "China is a much different place than people think."

Chinese newcomers would do well to learn from Haier's missteps as well as its great strides. "They're coming with little experience into a highly sophisticated market, and they are bound to make mistakes," says Karl Sauvant, executive director of the Vale Columbia Center on Sustainable International Investment at Columbia University and a law lecturer there, who in February published an edited volume titled Investing in the United States: Is the U.S. Ready for FDI From China?

"This is the thing the Japanese did fairly successfully: You have to be a good corporate citizen, source locally, contribute to causes and charities in the local community, and be familiar with how to navigate the corridors of Washington," says Sauvant. "And in key managerial positions you should have Americans." Legal questions, such as whether Chinese companies operating in America would be subject in U.S. courts to the Foreign Corrupt Practices Act for business practices in, say, India or elsewhere have yet to be tested, he says. And then there's the issue of the local sensitivities exhibited in the Haier flag-flying incident.

Unlike Japan, China is no U.S. military ally -- despite President Obama's naming China a "strategic partner," instead of the "strategic competitor" label it had under the Bush administration. Politically it remains a communist country, despite its capitalist economy. There's obviously more to overcome.

Chinese investors say they don't care too much about politics, but hope their entry into the U.S. can be a positive force. "This will definitely help U.S.-China relations," remarks Li, the manager of the print-cylinder factory Yuncheng, as he guides me on a tour. "Increasing communication makes the two sides closer." Even if it doesn't, business is business. "Good products are borderless," he notes. And there's always a Chinese proverb to cite: "It takes 10 years to make a sword," says Li. In other words, keep at it till you get it right, and the outcome will be strong and lasting. And perhaps transform into the plowshare that sows a mutually beneficial harvest for America and China both.

American made ... Chinese owned - May. 7, 2010

(Fortune) -- About a mile past the Bountiful Blessings Church on the outskirts of Spartanburg, S.C., make a right turn. There, tucked into an industrial court behind a row of sapling cherry trees not much taller than I am, past a company that makes rubber stamps and another that stitches logos onto caps and bags, is a brand-new factory: the state-of-the-art American Yuncheng Gravure Cylinder plant. Due to open any day now, it will make cylinders used to print labels like the ones around plastic soda bottles. But unlike its neighbors in Spartanburg, Yuncheng is a Chinese company. It has come to South Carolina because by Chinese standards, America is darn cheap.

Yes, you read that right. The land Yuncheng purchased in Spartanburg, at $350,000 for 6.5 acres, cost one-fourth the price of land back in Shanghai or Dongguan, a gritty city near Hong Kong where the company already runs three plants. Electricity is cheaper too: Yungcheng pays up to 14¢ per kilowatt-hour in China at peak usage, and just 4¢ in South Carolina. And no brownouts either, a sporadic problem in China. It's true that American workers are much more expensive, of course, and the overall cost of making a widget in China remains lower, and perhaps always will.

But for hundreds of Chinese companies like Yuncheng, the U.S. has become a better, less expensive place to set up shop. It could be the biggest role reversal since, well ... when Nixon went to China. "The gap between manufacturing costs in the U.S. and China is shrinking," explains John Ling, a naturalized American from China who runs the South Carolina Department of Commerce's business recruitment office in Shanghai. Ling recruited Yuncheng to Spartanburg, and others too: Chinese companies have invested $280 million and created more than 1,200 jobs in South Carolina alone.

Today some 33 American states, ports, and municipalities have sent representatives like Ling to China to lure jobs once lost to China back to the U.S.: Besides affordable land and reliable power, states and cities are offering tax credits and other incentives to woo Chinese manufacturers. Beijing, meanwhile, which has mandated that Chinese companies globalize by expanding to key markets around the world, is chipping in by offering to finance up to 30% of the initial investment costs, according to Chinese business sources.

What would Henry Luce think?

The enticements are working. Chinese companies announced new direct investments in the U.S. of close to $5 billion in 2009 alone, according to New York City-based economic consultancy the Rhodium Group, which tallied the numbers for Fortune. That's well below Japanese investment in the U.S., which peaked at $148 billion in 1991, but a big jump from China's previous investments, which had been averaging around $500 million a year. Chinese firms last year acquired or announced they were starting more than 50 U.S. companies. And when China finally allows the value of its currency, the yuan, to appreciate -- and it's just a question of when -- Americans can expect to see Chinese projects, small today, really take off and have an impact on the U.S. economy. This could be a good thing for relations between the two countries. "It will take many years to balance out the flow of U.S. investment into China," says Dan Rosen, a principal at the Rhodium Group. But, he says, China's aggressive interest in U.S. investment suddenly gives Washington some leverage as it seeks to negotiate with Beijing on tariffs, trade issues, and economic policy.

None of that matters much in Spartanburg. Skilled workers at American Yuncheng will earn $25 to $30 an hour, line operators $10 to $12. That's a lot more than the $2 an hour that unskilled labor costs in China, but the company can qualify for a state payroll tax credit of $1,500 per worker (for any company creating more than 10 jobs). And by being closer to companies like Coca-Cola, Yuncheng can respond more quickly when they need new labels designed to show that a product has reduced its fat content or added more flavor. If business goes well, company president Li Wenchun expects to double the size of his operation, maybe in five to 10 years, and employ up to 120 Americans. "I'd like it to be next month, but it depends on how fast we develop the market here," he tells me through a Mandarin interpreter.

So far there's little sign of anti-Chinese sentiment among South Carolinians, who watched their state lose its cotton-based textile-manufacturing industry to low-cost countries like China. Fortune asked Sen. Jim DeMint, a Republican torchbearer for conservative causes, what he thinks of communists creating work in his home state. "South Carolina is one of the best places in the world to do business, and that's why so many international companies are moving jobs into our state" is his only reply.

Brenda Missouri, a 43-year-old leaks tester who works for appliance maker Haier, speaks about her employer in glowing terms. Haier was the first Chinese company to build a factory in the U.S. -- a refrigerator plant in Camden, S.C., in 2000. "They're good business folks; they get the job done," she says. As for communism? "Doesn't matter," she shrugs. "It's money that makes the difference."

Chinese companies, American workers

Last December the National Committee on U.S.-China Relations dispatched me to Corpus Christi to give a speech about the Chinese and their economy. Why? Because, they told me, the region is about to become home to the largest-ever Chinese-built factory in the U.S., a $1 billion plant by Tianjin Pipe Group to manufacture seamless pipe for oil drilling. If everything proceeds as planned -- the company received its air-quality permit on April 14 and hopes to break ground by fall -- Tianjin Pipe expects to employ 600 Texans by 2012 and to provide an estimated $2.7 billion to the local economy over the next decade. Corpus Christians, it turned out, wanted to know more about their new neighbors who are expected to relocate 40 to 50 families to Texas.

Upon arrival, I find it impossible not to notice the resemblance of Corpus Christi's long, curving coastline on the Gulf of Mexico to the one near Tianjin on the Bohai Sea between northern China and Korea. Some 75 U.S. locales competed for the factory, but when Chinese delegations from Tianjin Pipe visited Corpus Christi, the townspeople made them feel at home by welcoming the visitors to backyard barbecues. They even enlisted the Taiwan-born former owner of the local Chinese restaurant, Yalee Shih -- perhaps the only woman in town who could speak Mandarin -- to help them navigate cultural nuances. Shih, who also sits on the board of the Texas State Museum of Asian Cultures, delicately helped prevent a multimillion-dollar translation error over building costs that might have cost Corpus Christi the project, and also quashed what would have been an impolitic gift of clocks -- which to the Chinese symbolize death or the end of a relationship -- from a local retailer. She and others in the region's business community plan to help guide their new residents through life in America, like how to buy a car, how to rent a house, as well as where to go to buy fragrant rice instead of Uncle Ben's.

In the end, while feeling at home helps, it does come down to business, says J.J. Johnston, executive vice president and chief business development officer of the Corpus Christi Regional Economic Development Corp. "They like the strategic location of our region, the convenient access to materials coming in -- mostly scrap metal and pig iron -- and the ability to export to North and South America through the port of Corpus Christi," he says.

There are other incentives. On April 9 the U.S. Commerce Department imposed import duties of up to 99% on the type of seamless pipe that is to be manufactured by Tianjin Pipe -- a reprisal prompted by the United Steelworkers union. The Chinese company, the world's largest maker of steel pipe, had said it could not afford to export to the U.S. if tariffs were over 20%. Now its pipe will be made in America. "It's just another reason they have to have a U.S.-based production facility," says Johnston.

Even without tariffs, Tianjin had been looking to expand -- as are many Chinese companies once they reach about $100 million in annual sales. "Chinese companies, as they get bigger, have to start thinking about their global positioning," says Clarence Kwan, who runs the Chinese Services Group at Deloitte, which advises Chinese companies on doing business in the U.S. Officially the Chinese government has given approval to over 1,200 Chinese investments in the U.S., but that number is considered low because it doesn't count those made via Hong Kong -- where many Chinese companies earn equity capital from being publicly traded -- or tax havens like the Virgin Islands, where Chinese investment may stop first before flowing to the U.S. Plus, investments below $100 million don't need Beijing's nod and may be approved at the local level.

Chinese companies see America as more than a manufacturing center. So far this year they have announced plans to build a wind-energy turbine plant and wind farm in Nevada that will create 1,000 American jobs; purchased the 400-employee Los Angeles Marriott Downtown out of foreclosure; and acquired a shuttered shopping center in Milwaukee, with plans to turn it into a mega-mall for 200 Chinese retailers. In some cases Chinese companies are resuscitating American outfits that had been left for dead. About 70 miles west of Spartanburg, near the Georgia border, past signs reading "24-hour fried chicken," another Chinese company is hiring engineers -- metallurgical and mechanical, some from nearby Clemson University. In June 2009, Top-Eastern Group, a tool manufacturer based in China's coastal city of Dalian, acquired a factory here along with three other facilities from Kennametal, one of America's largest machine-tool makers, after the U.S. company, based in Latrobe, Pa., reported a $137 million loss (citing a slowdown in industrial activity) in the quarter before the sale.

This plant, in Seneca, S.C., makes drill bits. And in the months since his purchase of it for $29 million, Top-Eastern founder Jeff Chee has invested another $10 million to upgrade machinery, built a $3 million logistics center, brought back Kennametal's furloughed workers, hired 120 more, and now has his 260-employee plant working overtime filling orders for the Cleveland Twist Drills, Chicago Latrobe, Putnam, and Bassett brands he acquired. He brought back the company's old name, which was Greenfield Industries before Kennametal acquired it in 1997, and emblazoned it on a sign out front.

General Electric's former CEO , Jack Welch, he volunteers, is his inspiration. "I've read a lot of books, and I learned a lot from him," Chee says in broken English amid the sharp smell of grinding steel. "One person can change a lot." As one of China's self-made entrepreneurs, who started Top-Eastern in 1994 with just $500, Chee now has worldwide sales of more than $120 million, 4,000 employees, and factories in Germany and Brazil. He visits the South Carolina plant monthly to make sure all is proceeding as planned, and employs American managers to run it in his absence rather than bring over Chinese. "There's good, experienced people and good know-how already here," he says.

How can he make a drill bit factory profitable where Kennametal had struggled? By increasing productivity with new equipment and cutting costs, he says. Plus, Chee forges his own steel, and he owns the mines back in China for two of its more expensive components, tungsten and molybdenum. The fact that he can source from himself means he keeps the margins -- and now his tools are officially made in the U.S. The cost of making those products is much higher than in China, he says, "but the problem is customers just accept 'made in U.S.A.' products, so I have no choice. Lots of customers here have government contracts that have 'made in U.S.A.' requirements."

And how do the employees feel about having a Chinese entrepreneur come to their rescue? "Just because it's a Chinese owner, they don't really care," says Scott Henderson, a 47-year-old manufacturing manager who had been furloughed one week a month along with his workers before Chee bought the factory. "They're all happy to be working 40 hours a week." They also have the opportunity for overtime, and a third, graveyard shift has been added to serve a nearly 40% rise in orders. "I feel great about it," says Sam Marcengill, a 24-year-old technician at the plant. Last year he was laid off for six months before Chee's purchase gave him his job back. Now he's on overtime, 48 hours a week. "The work's a lot more steady. It's better. Personally I'm a lot better off. It's a great thing."

Never mind the hiccups Chinese companies experienced when they tried to enter the U.S. before. In 2005, Washington famously blocked China's National Offshore Oil Corp. (CNOO C) from buying Unocal, and Chinese appliance maker Haier failed to acquire Maytag. Now, like the Japanese in the 1980s -- when U.S. trade frictions combined with Japan's boom blossomed into Honda and Toyota manufacturing plants -- the Chinese are here to stay. Their presence initially made some folks uneasy. A few years ago a caller to The Rush Limbaugh Show complained that as he was driving past the Haier plant in Camden, the Chinese flag was flying higher than the American flag and the South Carolina state flag out front. It was an easy mistake to make by anyone looking at the three equal-height flagpoles from an angle.

Conservative media joined in and called for protests, and the public rang the factory to complain. The Chinese executives at Haier had no idea flags were such a big deal, and it became their bugaboo. The complaints continued until about a year and a half ago when Haier America factory president Joseph Sexton, who was new to the job, decided to fix it. He had two of the poles lowered so that the U.S. flag looks highest from all angles.

It took Haier some time to work through the issues of being a Chinese employer in a small, historic Southern town (pop. 6,682) lined with stately antebellum houses and home to two Revolutionary War battlefields. "Having a Chinese manager didn't work. That's why they took all the Chinese managers out of here," says Haier's human resources director, Gerald Reeves, who was one of the first hired by Haier and guided the Chinese through the realities of American-style personnel management -- including convincing them that they needed to offer health insurance. He once even asked John Ling, South Carolina's man in Shanghai, to fly home from China to talk to a manager who was arousing employee resentment by publicly embarrassing the workers, Chinese-style, for their mistakes.

Now the only way to know you're in a Chinese factory is by looking up at the large Chinese flag hanging from the rafters -- alongside an American one, of course -- and by the very Chinese motivational slogans on the walls: "Spirit of entrepreneurship -- strive for a clearly defined objective and make the impossible possible without an excuse" reads the banner over the refrigerator testing line. And if you come in February, Sexton organizes a Chinese New Year party with food and outdoor firecrackers.

What is perhaps most startling about the Haier factory is that it is actually shipping goods back to China. Best known for its mini-fridges for dorm rooms and studio apartments, Haier's U.S. plant also makes large units, good for supersized American McMansions but too large for a typical Chinese household. Now a growing number of wealthy people in China want to supersize too, so Haier has realized it can ship a small number, maybe 4,000 a year, of its highest-end refrigerators home and sell them for $2,600 apiece -- more than China's average annual income of around $2,000. (Haier also ships U.S.-made refrigerators to India, Australia, Mexico, and Canada.) There aren't enough wealthy customers yet to make it worthwhile retooling any of the 29 Haier factories in China, but the nearby deepwater port in Charleston, S.C., makes export easy enough. "There are folks in China who want high-end products," says Haier America factory president Joseph Sexton. "China is a much different place than people think."

Chinese newcomers would do well to learn from Haier's missteps as well as its great strides. "They're coming with little experience into a highly sophisticated market, and they are bound to make mistakes," says Karl Sauvant, executive director of the Vale Columbia Center on Sustainable International Investment at Columbia University and a law lecturer there, who in February published an edited volume titled Investing in the United States: Is the U.S. Ready for FDI From China?

"This is the thing the Japanese did fairly successfully: You have to be a good corporate citizen, source locally, contribute to causes and charities in the local community, and be familiar with how to navigate the corridors of Washington," says Sauvant. "And in key managerial positions you should have Americans." Legal questions, such as whether Chinese companies operating in America would be subject in U.S. courts to the Foreign Corrupt Practices Act for business practices in, say, India or elsewhere have yet to be tested, he says. And then there's the issue of the local sensitivities exhibited in the Haier flag-flying incident.

Unlike Japan, China is no U.S. military ally -- despite President Obama's naming China a "strategic partner," instead of the "strategic competitor" label it had under the Bush administration. Politically it remains a communist country, despite its capitalist economy. There's obviously more to overcome.

Chinese investors say they don't care too much about politics, but hope their entry into the U.S. can be a positive force. "This will definitely help U.S.-China relations," remarks Li, the manager of the print-cylinder factory Yuncheng, as he guides me on a tour. "Increasing communication makes the two sides closer." Even if it doesn't, business is business. "Good products are borderless," he notes. And there's always a Chinese proverb to cite: "It takes 10 years to make a sword," says Li. In other words, keep at it till you get it right, and the outcome will be strong and lasting. And perhaps transform into the plowshare that sows a mutually beneficial harvest for America and China both.

American made ... Chinese owned - May. 7, 2010

6 simple steps to fix the financial system: full version - May. 5, 2010

By Allan Sloan Fortune May 5, 2010

(Fortune) -- The first thing you learn when you start looking at Wall Street, which I've been doing for 40 years, is to never trust the salesmen. What they promise you isn't necessarily what you get. You need to use common sense, watch out for your own interests, and at least make an attempt to understand the fine print.