Sunday, October 31, 2010

Historic first: Treasury sells debt with negative yield - Investment News

The securities drew a yield of negative 0.55 percent, the same as the average forecast in a Bloomberg News survey of 7 of the Federal Reserve's 18 primary dealers. The bid-to-cover ratio, which gauges demand by comparing total bids with the amount of securities offered, was 2.84. The average at the last 120 auctions was 2.38. The sale was a reopening of an $11 billion offering in April

“These negative yields are being driven by the Federal Reserve and their push to increase inflation expectations,” Michael Pond, co-head of U.S. rates strategy in New York at Barclays Plc, said before the sale. The firm is one of 18 primary dealers required to bid at Treasury auctions.

The U.S. can only sell debt at a negative yield on inflation-linked debt, according to McKayla Barden, a spokeswoman at the Bureau of the Public Debt. Conventional fixed-coupon Treasuries of a given maturity could be sold at price above face value with a zero percent coupon if yields in the market on that maturity were negative. The government began selling inflation-protected debt in 1997.

The sale was the first of four this week totaling $109 billion.

The last TIPS auction, on April 26, drew a yield of 0.550 percent, which was the lowest on record. The bid-to-cover ratio was 3.15.

Treasury 30-year bonds rose for a second day, leading a rally in Treasuries, amid speculation on how much debt the Federal Reserve may buy to spur the economy and before data that may show economic growth was below average.

Ten-year note yields fell for the first time in four days, shrinking the difference between 2- and 10-year yields before the Fed meets next week. Treasuries gained even as data showed sales of existing homes rose. The U.S. is scheduled to sell $10 billion of five-year inflation-linked securities today, the first of four note auctions this week totaling $109 billion.

“Whenever we see a bit of a selloff in the Treasury market it is getting met, and will continue to get met, by renewed buying until we get clarification with regards to the size and frequency of the Fed's asset purchases,” said Christian Cooper, senior rates trader in New York at primary dealer Jefferies & Co.

by Bloomberg News October 25, 2010

Historic first: Treasury sells debt with negative yield - Investment News

Waterfront's plan for 150-foot tower passes hurdle

Scottsdale Waterfront LLC, the owner, wants the city to modify its development standards for the vacant parcel immediately south of the Nordstrom parking garage to allow for a building that would rise nearly 150 feet. "We just want to have a single tower to the east," said Brett Sassenberg, Scottsdale Waterfront LLC spokesman. "It's an efficient structure, it's into the downtown because it makes sense for the downtown." The applicant hasn't yet submitted a specific site plan or use for Phase IV and V of the Waterfront development. John Berry, an attorney representing the applicant, said the recession has created an environment where financing isn't available until the development standards are in place and a user has been identified. "This allows nothing to be built, it doesn't block anyone's views," he said. "This allows (the applicant) to move forward and design the project." Commissioners based much of their unanimous vote on the applicant's record of development at the Waterfront. Commission Chairman Michael D'Andrea said the Waterfront has greatly benefited the downtown and he looks forward to seeing the next phase of the project. "This still does have to go through the (approval) process," Commission Vice Chairman Ed Grant said. "If this were a full-blown proposal, a continuance would be appropriate, but it's not. This is consistent with the downtown plan." The 3.35-acre site, called the Goldwater parcel, is on the east side of Goldwater Boulevard and the north side of the Arizona Canal. The maximum height now allowed on the parcel is 85 feet excluding rooftop mechanical needs. The request is to increase that maximum height to 149 feet including rooftop mechanical. That is roughly as tall as the AmTrust bank building at 68th Street and Camelback Road and the Scottsdale Waterfront condominium towers at Camelback and Scottsdale roads. The request also includes4 acres of open space across the entire Waterfront development. Michael Curley, an attorney representing the owners of nearly 200 Waterfront condominiums, argued that the developer should stick to the development standards agreed upon back in 2003. "We think the approval completely deviates from the city's normal standards," he said. "To give this additional height without any site plan is, in our view, the equivalent of signing a blank check." Berry said the original plan's heights would force a development with "squished- down" buildings and consequently less open space. The amended plan calls for a greater buffer along Goldwater and moving greater building heights away from areas outside of the downtown, he said. The previous plan called for two buildings of up to 36 feet in height, plus up to 24 feet of mechanical needs, to the west of the parcel. It also allows for one 85-foot-tall building plus up to 24 feet of mechanical to the east. "What they're requesting completely is an abandonment of commitments that were made in 2003 relative to the height on the parcel," Curley said. After the vote, Sassenberg said he looks forward to the council considering this request. "It's an infill-incentive district and all of it is amendable," he said, of the district created by the City Council this past summer that allows developers to seek revised standards on building heights. "We've gone through a major economic crisis, and things have to change. It's happening all around the Valley, it's happening all around the nation. It's inevitable and it will be positive once it's finished."

by Edward Gately The Arizona Republic Oct. 30, 2010 06:46 AM

Waterfront's plan for 150-foot tower passes hurdle

Scottsdale council postpones consideration of Blue Sky project

For a second time, Gray asked the Scottsdale City Council to delay considering its Blue Sky proposal, this time until Nov. 9. The developer was seeking more time to work with surrounding property owners who filed legal protests forcing a supermajority vote for council approval, but Gray almost got more than it asked for.

If the property owners - ST Residential and Triyar Properties - don't pull their protests, Gray will need six of seven council members to support the project.

Neither legal protest has been pulled.

The complex would occupy a 4.3-acre site originally planned for Phase 2 of the Safari Drive condominiums, on the east side of Scottsdale Road just north of Camelback Road.

Councilwoman Lisa Borowsky made a motion to delay consideration of Gray's proposal until Nov. 9, and Councilman Wayne Ecton seconded it.

Councilman Bob Littlefield then made an alternative motion to continue the proposal indefinitely, and his motion was seconded by Councilwoman Marg Nelssen. In a 4-3 vote, that motion failed, with Mayor Jim Lane, Vice Mayor Suzanne Klapp, Borowsky and Ecton voting with the majority.

The council then voted to delay consideration until its Feb. 9 meeting, with Littlefield and Nelssen dissenting.

Littlefield said Gray's proposal has "morphed" so much throughout the approval process and continues to change as the Phoenix-based developer negotiates with surrounding property owners.

"This project is massive. This is going to be the biggest change in downtown Scottsdale's history," Littlefield said. "This project isn't just about height. We need to take (more) time on this and, frankly, it needs to go back through the entire process."

Last month, the Planning Commission approved Gray's application and required rezoning as part of the downtown infill-incentive district. The commission recommended council approval.

Nelssen said Blue Sky still is too high and dense, and is not scaled correctly for the acreage and area. The legal protests are another concern.

"This, for me, is a clash of visions for this city, and I think that before we make a decision on this, that issue is going to have to be addressed, what this council's vision is for the city," Councilman Ron McCullagh said.

Neither Gray nor surrounding property owners addressed the council before the votes.

The Blue Sky project includes five buildings with a maximum height of 133 feet and 867 apartments.

In an effort to get Triyar Properties to pull its protest, Gray moved its rezoning application line an acre away from Triyar's property, said Brian Kearney, Gray's chief operating officer.

"The plan was the same essentially, we just pulled the line back and decided not to rezone a portion of it," he said.

As a result, one of the buildings would be slightly smaller.

Kearney hopes to tackle the protests before the project goes before the council again.

"The goal would be to have the protests a thing of the past and to have met the objectives of what the council is looking for," he said. "We're going to continue to work as hard as we can at it."

by Edward Gately The Arizona Republic Oct. 27, 2010 12:31 PM

Read more: http://www.azcentral.com/business/realestate/articles/2010/10/27/20101027scottsdale-council-postpones-consideration-blue-sky-project.html#ixzz13vhd5qo6

Scottsdale council postpones consideration of Blue Sky project

Fed is joining investigation of foreclosure procedures

Major banks are already under investigation by state officials with subpoena power, who could force them to detail how they handled hundreds of thousands of foreclosure cases.

Federal Reserve Chairman Ben Bernanke added weight to those efforts Monday by saying that the central bank would look "intensively" at policies and procedures that might have allowed banks to seize homes improperly.

"We take violation of proper procedures very seriously," Bernanke said in remarks to a housing-finance conference in Arlington, Va.

The Fed has the power to impose penalties on some of the nation's largest banks. Still, most legal experts expect an investigation by attorneys general in all 50 states to have a swifter impact.

Big mortgage lenders are looking into whether employees signed foreclosure documents without reading them. Some banks have halted tens of thousands of foreclosures since similar practices became public.

While the banks say there's little if any evidence that any foreclosures were improper, regulators around the country have suggested the banks were in a rush to foreclose and may have committed outright fraud.

Bank of America and Ally Financial Inc.'s GMAC Mortgage have started processing foreclosures again, after calling a temporary halt while they reviewed mortgage documents.

It's happening as the housing market struggles to recover. Sales of previously occupied homes rose 10 percent in September, but the foreclosure problem surfaced only at the end of the month. Industry experts say fears could keep buyers on the sidelines now.

Ohio Attorney General Richard Cordray said Bernanke's speech will force financial institutions to take the matter more seriously. In stepping up their inquiries, the Fed and other bank regulators are "not giving aid and comfort to institutions that want to sort of minimize this and almost sweep it under the rug," Cordray said.

The Fed is working with the Treasury Department's Office of the Comptroller of the Currency and the Federal Deposit Insurance Corp. They have a range of options, including ordering companies to stop certain practices, imposing fines and working with lenders to come up with a fix.

According to two officials familiar with the joint federal inquiry, the banking agencies are looking into whether companies had controls in place when foreclosure documents were signed and whether employees involved in the foreclosure process were adequately trained. Ultimately, though, the mess will probably be settled by the states.

"They can move more quickly than the Fed," said Mark Williams, a former bank examiner at the Fed and now a Boston University lecturer.

Like the Obama administration, Bernanke and other federal regulators have declined to call for a national moratorium on foreclosures. At least one regulator, Sheila Bair, chairman of the FDIC, is even discouraging homeowners from overloading the courts with lawsuits.

"The regrettable truth is that many of the properties currently in the foreclosure process are either vacant or occupied by borrowers who simply cannot make even a significantly reduced payment," Bair said Monday.

by Jeannine Aversa and Alan Zibel Associated Press Oct. 26, 2010 12:00 AM

Fed is joining investigation of foreclosure procedures

Depositors at closed bank lose $1.8 million

The Office of Thrift Supervision shut down the Scottsdale-based financial institution and appointed the Federal Deposit Insurance Corp. as receiver, citing a "critically undercapitalized" position.

The institution had nearly $199 million in total deposits, but the FDIC reiterated that $1.8 million of those exceeded the general insurance limit of $250,000 per account and were uninsured.

Banking regulators closed six other institutions last week, raising the year-to-date total to 139. First Arizona Savings marked the sixth case this year in which the FDIC wasn't able to find another bank to assume deposits for an acceptable price. In two cases, bank regulators started a new institution to take over.

The bank's branches won't re-open and all deposit accounts were closed. Still, officials said the transition went off without significant problems.

"I think it's been pretty smooth," said LaJuan Williams-Young, a spokeswoman for the FDIC in Washington, D.C. "There was a little anxiety initially, but it has calmed."

Adela Coronado, an FDIC ombudswoman who is helping to handle the First Arizona Savings case, said checks have been mailed out to insured depositors. Customers will receive an individual check for each account, along with a final statement, likely by the end of the week, she said.

The closure also affects customers with loans and transactional accounts. Checks drawn on First Arizona Savings that hadn't cleared as of Friday will be returned with a message indicating the bank has closed.

Direct deposits payable by the U.S. Treasury to First Arizona Savings customers will be redirected to Mutual of Omaha Bank. Customers will need to make other arrangements for other direct-deposit situations.

The contents of safe-deposit boxes at First Arizona Savings need to be removed by Nov. 22.

The FDIC now owns loans held by First Arizona Savings and directed customers to continue making payments as before. The agency also said it has temporarily suspended foreclosures started by First Arizona Savings. The FDIC didn't reveal how many foreclosures are in the pipeline.

The Office of Thrift Supervision in September ordered the bank to shore up its capital position and make other changes.

The company began operations in 1988 as First Arizona Savings and Loan Association. At last count, it had 90 employees and assets of roughly $272 million, with six branches in addition to its home office. The branches were in Scottsdale, Glendale, Bullhead City, Fort Mohave, Kingman and Lake Havasu City.

Customers are asked to contact the FDIC at 1-800-830-4698 or www.fdic.gov.

by Russ Wiles The Arizona Republic Oct. 26, 2010 12:00 AM

Depositors at closed bank lose $1.8 million

Unemployed workers caught in credit-report trap

After months without steady work, tens of thousands of unemployed Arizonans have battered credit records. Those credit blemishes are hurting their chances of getting jobs.

Employers scrutinize credit reports when evaluating candidates for all kinds of positions, from cashiers and police officers to warehouse workers and office staff. Employers don't see the actual credit scores, but credit reports do allow them to see the names of a job applicant's current and past creditors. They can see whether accounts have been paid on time or if a candidate has filed for bankruptcy or had a foreclosure.

Employer groups say that the reports help weed out workers who could commit fraud. In some fields, especially government work and finance, credit can be a deciding factor on whether a candidate is hired.

The issue puts the jobless in a tough situation. They often are saddled with bad credit because they or their spouses have been out of work for an extended time. About 150,000 Arizonans have been out of work six months or longer, according to Frank Curtis, an economist at the state Department of Commerce.

The debate has caught the attention of federal watchdogs.

Last week, the U.S. Equal Employment Opportunity Commission met to air concerns that credit checks were disproportionately affecting women and minority job seekers.

Job hunters, who sign many documents when they apply for work, may not realize that they've agreed to a credit check, said Andrea Baran, an EEOC trial attorney in Phoenix. And if employers use credit checks improperly, job applicants aren't likely to complain.

"People need jobs, and they are less likely to balk about something like that," she said.

For and against

According to a study conducted this year by the Society of Human Resources Management, 60 percent of employers conducted credit checks on job applicants compared with 19 percent in 1996.

Although 47 percent of employers consider credit history, they do so only for candidates for select jobs, the study said. Only 13 percent of organizations conduct credit checks on all job candidates, it said. The checks help employers verify job history and shed light on financial problems that could tempt an employee to steal or misuse customers' personal information.

The National Retail Security Survey found that the U.S. retail industry lost about $14.4 billion to employee theft in 2009.

Financial pressures often are a motivation for employee theft, according to the Association of Certified Fraud Examiners' 2010 review of more than 1,800 workplace-fraud cases worldwide. The study found that living beyond financial means accounted for 43 percent of the cases, and money difficulties accounted for 36 percent of the cases.

Those fraud statistics are disputed by consumer advocates, who argue that the fraud examiners' report suggested that men, older workers and divorced employees were prone to theft, but employers don't screen based on those characteristics.

Caught in the middle

Arizona's unemployment rate is at 9.7 percent, its highest level in 27 years. The housing crash and high unemployment have helped create an unprecedented tide of home foreclosures. State residents also are on track to file a record number of bankruptcies this year - roughly 40,000, which would be 17 percent higher than last year.

That statistic includes Dawn Layson, 40, of Glendale.

The mother of two says she was forced to file for Chapter 13 bankruptcy reorganization in July to save her home from foreclosure because she and her husband fell behind on mortgage payments amid their divorce. In August, she was laid off from her administrative job with a local city after 10 years.

She applied for a secretarial job this month and was told that she had the highest test score among the applicants. Because she knew there would be a credit check, Layson told the human-resources department about her bankruptcy. She wasn't chosen.

"I think that it's unfair to use it as an evaluation tool at this point," Layson said, adding that she thought employers would view her in a more positive light because, under Chapter 13, she would pay her debts.

"I was aware that it (the bankruptcy) would have an impact, but given the current economy, I didn't know exactly how much impact it would have," Layson said.

Enrique Francisco Figueroa, 40, didn't know that missing a payment on his Queen Creek house could make it tougher to get a job.

When he was laid off from his job as a commercial fire-alarm inspector in March 2009, he and his wife began to struggle with their house payments. They sought a loan modification and later a short sale. They also missed some mortgage payments, Figueroa said.

"Our house went upside down, and we tried getting it modified," Figueroa said. "In order to get it modified, you have to miss some payments." Those missed mortgage payments came back to haunt him when he applied for a job with the Transportation Security Administration.

Figueroa made it through several interviews but was rejected because he didn't pass the background check, which included his credit report, he said.

Figueroa and his family have moved to Tucson because his wife's job was transferred. Although he has experience working in engineering testing labs at Motorola in metro Phoenix, he is reluctant to apply for jobs with defense contractors. Many government contractors have strict credit-check policies, he said.

"Even now, I see myself applying for jobs I am way overqualified for," Figueroa said. "I am applying for warehouse worker (jobs) or bus driver, stuff like that."

'A huge problem'

Credit issues are increasingly troublesome, some recruiters say.

"It's a huge problem," said Charles Mitchell, CEO of staffing firm All About People Inc. The Phoenix company finds temporary and permanent hires for companies in 20 states, including Arizona.

Recruiters who work at his firm say that 60 to 70 percent of the job seekers they see self-report that they have some kind of credit problem, Mitchell said.

Black marks on credit records can affect a job candidate in different ways.

Often, it depends on the job and the industry.

Mitchell said such credit problems as a foreclosure, bankruptcy or unpaid bills could make a job candidate ineligible to work for many jobs in banking, finance and government or to work for government contractors.

Other employers may be OK with some credit blemishes, but not others, he added. For example, one employer may be more sympathetic if a job applicant has medical debt, but school officials may consider unpaid student loans a red flag.

Credit records also are scrutinized more heavily for jobs that involve handling cash, credit-card numbers or customers' personal information, Mitchell said.

Bad credit "absolutely narrows the pool of opportunity for them," he said.

Legal protections

Federal law does provide some protection. The Fair Credit Reporting Act restricts how employers can use credit checks to issues of "employment, promotion, reassignment, or retention."

If an employer plans to reject an applicant because of negative information in the report, the prospective hire must be notified and they can dispute the information.

In recent years, four states - Hawaii, Illinois, Oregon and Washington - have limited how employers can use credit information in employment matters. Proposed laws about the issue were considered in 20 states this year, but not in Arizona. A bill, HR 3149, has been introduced in Congress that would restrict how employers can use credit checks.

Dealing with the issue

If you're headed for financial problems, carefully consider how missed mortgage payments, overdue bills or a bankruptcy filing could affect your credit report and your future job prospects, several employment experts said. Seek out help and look for options that will protect your credit.

If you're headed for bankruptcy or foreclosure, consider consulting a lawyer who could help you weigh all possible outcomes, said Phoenix attorney Scott Drucker, who has advised law-enforcement and military clients facing foreclosure.

"If you do have credit problems, be upfront with prospective employers," he said.

by Jahna Berry The Arizona Republic Oct. 25, 2010 12:00 AM

Unemployed workers caught in credit-report trap

Steps can help simplify process of foreclosure

Recent lender announcements about the temporary suspension of foreclosures in the 23 states that process home repossessions through the courts have muddied the issue further in Arizona, which uses a completely different, non-judicial system.

Sensitive to the widespread confusion, housing analyst Tom Ruff, of Phoenix-based Information Market, recently distributed a handy flowchart to his clients and other contacts explaining the process in detail.

Here is a summary based on the information Ruff put together:

1 Notice of trustee's sale - In Arizona, a foreclosure is technically known as a trustee's deed sale, or simply a trustee's sale. State law requires the "trustee," hired to administer the foreclosure, to provide the delinquent borrower written notice of the scheduled sale date. The date can be no sooner than 91 days after the notice was recorded at the County Recorder's Office. For all homes purchased from the beginning of 2003 through the end of 2008, the lender must first "attempt to contact the borrower to explore options to avoid foreclosure," according to Arizona law.

2 Possible delays - A foreclosure can be delayed in Arizona through two primary ways. One of them, personal bankruptcy, is initiated by the borrower. The other, trustee's sale postponement, is initiated by the lender. Personal bankruptcy generally delays the foreclosure just one time, after which the lender may choose a new sale date. Lenders can postpone a sale as many times as they want, but each time they must select a new date that's within 90 days of the previously scheduled sale date. A foreclosure also can be canceled if the loan is repaid in full or the lender agrees to a short sale or loan modification.

3 The auction - On the home's scheduled sale date, it will be included on a list of homes up for auction at the trustee's sale, which occurs every business day on the Maricopa County Superior Court steps in Phoenix. The trustee is required to publish on the previous business day a best estimate of the minimum opening bid that the lender would be willing to accept. There is no requirement that says the lender must accept that amount at the following day's sale. Each eligible bidder must bring a cashier's check for $10,000 and must pay the trustee in full for any purchases no later than 5 p.m. the following day. The trustee then has seven business days to "execute and deliver" the trustee's deed to the new owner.

by J. Craig Anderson, The Arizona Republic - Oct. 24, 2010 12:00 AM

Steps can help simplify process of foreclosure

Lien Stripping, Cram-Down, and the Benefits of a Chapter 13 Bankruptcy | Arizona Bankruptcy

Lien Stripping

In meeting with people on a daily basis regarding financial problems, the number one issue facing most people is the fact that their house is upside down in value and the payments are way too high. Many people’s homes have dropped 50% in value over the last couple of years, leaving many to wonder if it is even worth staying in their homes.

A Chapter 13 bankruptcy can do two things for home owners in this current market: (1) get caught up on any missed payments. In fact you will be given 3-5 years to catch up on missed payments; (2) remove or “strip off” your second mortgage, Home Equity Line of Credit, or other junior lien on your home. For some, just having additional time to catch up on missed payments is all that is needed. The payments are spread out over the three to five year period and no interest accrues over the life of the Chapter 13 plan.

If your problem is that your house is upside down in value, then you may be able to remove and discharge your second mortgage or HELOC. In order to qualify, the value of your house must be less than what you owe on your first mortgage. For example, if you owe $200,000 on your first mortgage, and have a second mortgage of $50,000, but your house is only worth $150,000, then in a Chapter 13 we can remove the second mortgage completely, leaving only the first mortgage to pay. In determining the value of your home it may be necessary to get an appraisal. However, there are a couple of online websites that can give you an idea of what your home value is: www.zillow.com and www.cyberhomes.com .

Cram-Down

A second powerful tool in a Chapter 13 case is the “cram-down.” The typical situation where we see the cram-down used is on vehicles that are upside down. If you have a car that you owe more than it is worth, then in a Chapter 13 case you “cram-down” the amount owed to the fair market value of the vehicle. For example, if you have a truck that is worth $10,000, but you still owe $15,000, in a Chapter 13 case we can implement the cram-down and you would only be required to pay the value of the vehicle, or $10,000.

The only requirement under the bankruptcy code is that you must have purchased the vehicle at least 910 days (2 1/2 years) prior to filing your bankruptcy case. Further, not only can we reduce the principal amount owed, but we can lower the interest rate to a more reasonable rate. Currently we can usually get rates of 5.25%.

While a Chapter 13 case requires more of commitment than the Chapter 7, there are many tools that we simply don’t have in a Chapter 7 case. If you would like to learn more about the Chapter 13 bankruptcy process, lien stripping, a cram-down, or any other bankruptcy related question, Arizona Bankruptcy attorney John Skiba offers a free consultation.

by John Skiba Arizona Bankruptcy Attorney September 2, 2009

Lien Stripping, Cram-Down, and the Benefits of a Chapter 13 Bankruptcy | Arizona Bankruptcy

Land preserves add 3,139 acres

The back-to-back auctions generated more than $69 million for the Arizona State Land Department, which will use the funding for public schools.

The cities are also looking to acquire additional state trust land for their preserves next fall, but their plans hinge largely on land values and a Nov. 2 ballot measure that seeks to sweep conservation funds.

Proposition 301 asks for voter approval to take the remaining balance from the state's Land Conservation Fund and transfer it into the general fund. The measure is touted as a way to balance the state's budget.

Scottsdale and Phoenix tapped tens of millions of dollars in the Arizona Growing Smarter conservation funds to cover half the purchase price of their respective bids on Oct. 15. The cities hope to draw on more funding next year, depending on the outcome of Proposition 301.

Phoenix was the lone bidder on 1,139 acres a mile south of the Carefree Highway and 4 miles east of Interstate 17. Peters said a multiuse path will be built on the land, which runs between Seventh and 24th streets and Dove Valley and Lone Mountain roads, and will be part of the Phoenix Sonoran Preserve.

A Growing Smarter grant will cover half the purchase price of $25.8 million. The remainder will come from sales-tax proceeds from the Phoenix Parks and Preserve Initiative.

At Friday's auction, Scottsdale acquired 2,000 acres in the Granite Mountain area of northern Scottsdale, expanding its McDowell Sonoran Preserve by more than 12 percent.

A grant from Growing Smarter will cover half of the $44.1 million purchase price. The remainder will come from money from two city sales taxes.

by Beth Duckett The Arizona Republic Oct. 23, 2010 12:00 AM

Land preserves add 3,139 acres

G20 summit must reject competitive devaluations-EU leaders - Yahoo! Singapore News

Leaders of the world's 20 biggest developing and developed economies meet on Nov. 11-12 in Seoul to seek ways to rebalance world economic growth as diverging global trade and savings trends re-emerge after the economic downturn.

"The recovery of the world economy will be at stake and global economic imbalances and exchange rates will be at stake," European Council President Herman van Rompuy, who chaired the EU summit told a news conference.

"These issues affect the prospect for growth and employment in the European Union," he said.

The trade imbalances have triggered direct and indirect government interventions in foreign exchange markets to weaken their own currencies, or stop them from strengthening, in what Brazil has called "currency wars".

" stresses the need to avoid all forms of protectionism and to avoid engaging in exchange rate moves aimed at gaining short term competitive advantages," EU leaders said in written conclusions for the Seoul summit.

G20 finance ministers agreed last week to avoid competitive devaluations but stopped short of setting targets to reduce trade imbalances that are clouding global growth prospects.

The United States and the European Union believe that one of the key problems behind the huge trade and savings imbalances is the artificially weak Chinese yuan currency, which gives exports from China a competitive advantage.

In a bid to spur a faster revaluation of the yuan, the rate of which is managed by Beijing, Washington proposed to limit current account imbalances to 4 percent of GDP, as China had a current account surplus of 5.8 percent in 2009.

While there was no deal on the U.S. proposal, G20 ministers agreed that indicative targets should be rolled out at the G20 summit. South Korea's finance minister said on Thursday that G20 leaders would continue to discuss current account targets.

While the EU seems as keen as the United States to see the yuan strengthen, it is unlikely to back current account targets because its biggest economy Germany, which some EU diplomats call Europe's China because of its reliance on exports, had a 4.9 percent of GDP current account surplus last year.

The United States, by contrast, runs a substantial trade deficit, largely due to its deficit with China.

"If the debate on setting current accounts target will came back at the table, we should underline the benefits of our own mechanism based on a limited number of indicators," Van Rompuy and European Commission President Jose Manuel Barroso said in a joint letter on the Seoul summit endorsed by EU leaders.

An earlier version of the letter was even more explicit:

"We have presented a proposal to the G20 on how to address these issues in a cooperative way... without having to resort to controversial quantitative targets, as suggested by the U.S."

Van Rompuy and Barroso, who will represent the 27-nation EU in Seoul, will call for remedial action on exchange rates and capital flows to stop a widening of global imbalances, according to the first version of the letter.

Following a proposal from European Central Bank President Jean-Claude Trichet, the letter from the two EU leaders was changed to include more clear language on what the EU expects in terms of exchange rate policies.

"We cannot ignore the recent exchange rate issues and should promote our shared interest in a strong and stable international financial system," the final version of the letter said.

"The G20 should reaffirm its commitment to move towards more market oriented exchange rate systems that reflect underlying economic fundamentals and refrain from competitive devaluation of currencies," it said.

By Jan Strupczewski Yahoo News October 29, 2010

G20 summit must reject competitive devaluations-EU leaders - Yahoo! Singapore News

Phoenix-area condo projects to reopen next month

The projects are 44 Monroe in downtown Phoenix, 3rd Avenue Palms in Phoenix and Safari Drive Scottsdale, near Scottsdale Fashion Square mall.

The properties are undergoing renovations and awaiting Arizona Department of Real Estate approval to reopen their sales offices, according to the new owner, Chicago-based ST Residential.

Safari Drive will have 89 units available for sale beginning at $249,500. 44 Monroe will have 196 units available starting at $197,500, while 3rd Avenue Palms will have 74 units available starting at $80,000, a company news release said.

ST Residential is an investment and debt-resolution firm that is 60 percent owned by the Federal Deposit Insurance Corp.

Unlike the Resolution Trust Corp., which the federal government formed to dispose of failed lender-owned assets two decades ago following the savings-and-loan crisis, ST Residential also involves a group of private-equity firms, led by Starwood Capital Group.

All three properties had been owned by Corus Bankshares Inc., the holding company whose bank was taken over by regulators in September 2009.

Corus, based in Chicago, sought protection from creditors in June, filing for Chapter 11 reorganization in U.S. Bankruptcy Court.

At the same time, ST Residential was formed for the sole purpose of buying $4.5 billion worth of residential real-estate assets that Corus had repossessed, ST Residential CEO Wade Hundley said in an interview Thursday.

Hundley said about 30 percent of the assets are owned outright by ST Residential, and the rest are being financed with "favorable lending terms" by the FDIC.

The result is that ST Residential has cash and time, something Hundley said that most condo project owners lack.

"While most companies are trying to cut costs and save money, we're investing in these properties," he said.

Two of the projects, 44 Monroe and Safari Drive, began construction in 2006, Hundley said. Third Avenue Palms was a condo-conversion project initiated in 2005 on an apartment complex that was built in 1999.

In all three cases, the original developers slammed into a wall when the condo market plummeted in 2007. Only 3rd Avenue Palms had sold a significant amount, about half of the project's 155 units.

The other two projects had sold just over a dozen units each when their sales offices were shut down about a year ago, said Mike Messenger of Geoffrey H. Edmunds Realty, the Scottsdale company hired to handle sales and marketing for all three properties.

Edmunds also will set prices for the new units and help manage the homeowners associations.

"These are projects that we're bringing back to life, so to speak," Messenger said.

by J. Craig Anderson The Arizona Republic Oct. 22, 2010 12:00 AM

Phoenix-area condo projects to reopen next month

Rescue of Freddie and Fannie may hit $259 billion

That figure would be nearly twice the amount Fannie and Freddie have received so far. To date, the rescue of the two companies has cost taxpayers $135 billion. The companies have repaid $13 billion to the Treasury Department as dividends.

By contrast, the combined bailouts of financial companies and the auto industry have cost taxpayers roughly $50 billion, according to Treasury's latest projections. The bailouts of Wall Street banks alone, which sparked public fury, have so far brought taxpayers a $16 billion return.

Once the housing bubble burst and foreclosures soared, Fannie and Freddie were battered by losses on loans they had backed. The two companies buy home loans from lenders, package them into bonds with a guarantee against default and sell them to investors.

On Thursday, the government provided a broad estimate of the costs of bailing out Fannie and Freddie. The final cost will depend on the direction of home values over the next few years. If prices fall sharply, as some analysts forecast, Fannie and Freddie won't be able to recover as much money on foreclosures. They would require more taxpayer aid.

The Fannie-Freddie bailout could end up costing taxpayers $142 billion to $259 billion through 2013, the Federal Housing Finance Agency projected. The worst-case scenario assumes the economy would fall back into a recession and home prices would sink an additional 24 percent until early 2012.

The best-case scenario assumes home prices remain flat for the next two years.

"If the economy does unravel in the next couple of quarters, then the costs will mount very rapidly," said Mark Zandi, chief economist at Moody's Analytics.

The agency's figures take into account dividends that the agency estimates Fannie and Freddie will end up repaying. The terms of their rescue require them to pay a 10 percent annual dividend to the Treasury. That amount is expected to balloon in coming years. Regulators expect Fannie and Freddie to repay an additional $67 billion to $91 billion in dividends over the next three years.

The two mortgage-finance companies have been operating under federal control for more than two years. When the government stepped in to take them over in September 2008, their rescue was expected to cost a combined $200 billion.

Allegations that mortgage lenders nationwide cut corners on foreclosure documents as they moved to seize millions of homes have put Fannie and Freddie under scrutiny. The two companies have used so-called foreclosure-mill law firms that are accused of processing thousands of files in haste.

Several banks have been accused of similar conduct. If they can't resolve their foreclosure problems and are barred from seizing many homes, Fannie and Freddie could absorb huge losses on loans they own or guarantee. That's because they would no longer be able to recover anything on loans that have gone bad.

Delays in foreclosures would hurt Fannie and Freddie in areas of the country where home prices are falling. The longer they wait to sell homes, the less money they stand to recover.

But some analysts doubt the document mess will have much impact on Fannie, Freddie or the pace of foreclosures. It's likely to result in weeks of delays for foreclosures, not months, Zandi said.

Fannie and Freddie own or guarantee about half of all U.S. mortgages, or nearly 31 million home loans worth more than $5 trillion.

by Alan Zibel Associated Press Oct. 22, 2010 12:00 AM

Rescue of Freddie and Fannie may hit $259 billion

Saturday, October 30, 2010

Freeport third-quarter profit up 27%

Freeport increased production at its mines in Indonesia, South America and Africa in the past quarter, while production dropped at its North American mines.

The company is investing heavily into North America, including Arizona, but production for the region fell 12 percent for the quarter because of maintenance at a crusher at the Bagdad mine west of Prescott and lower ore grades at Safford, in Graham County, officials said.

Production at its Morenci mine in Greenlee County is being increased to 635,000 metric tons of ore per day from about 450,000 per day, although production for the quarter was down slightly from a year earlier.

The mill that was stopped at the Morenci mine in 2008 amid low copper prices also has been restarted.

"We are placing our highest priority in growth and expansion plans," President and CEO Richard Adkerson said.

Freeport also is spending $40 million and has resumed mining at its Miami mine east of Phoenix in Gila County, where activity was previously reduced.

Freeport is spending $150 million at the Safford property to build a sulfur burner, which will produce acid the company uses in some of its copper production.

"This will allow us to manage our sulfur purchases," Adkerson said. "Construction is going very well."

It also restarted its Chino mine in New Mexico that was mostly shuttered in 2008 except for limited copper production from piles of ore that had already been dug up. That project is costing $150 million.

"The economics for this are very attractive at today's copper prices," Adkerson said. "It's not until 2013 until you see the full impact of Chino (in Freeport's operating results). It takes time to ramp up. There is a significant amount of time from when you make a decision to make an investment, make the investment and see the results."

Third-quarter profits of $1.2 billion, or $2.49 per share, were a 27 percent improvement over the same quarter last year, when profit was $925 million, or $2.07 per share.

The company dug slightly more copper from its mines around the world during the quarter, but the real boost came from higher realized copper prices. Freeport sold its copper for an average of $3.50 per pound during the quarter, compared with $2.75 per pound in the same quarter last year.

That 75-cent difference is considerable, as the company produced 1.04 billion pounds of the metal during the quarter.

"The financial results speak for themselves," Adkerson said.

Gold production from its Indonesian mine declined but the company reported that was planned as part of the mine's sequencing.

Freeport's revenue rose 24 percent to $5.2 billion for the quarter.

Analysts, who usually focus on ongoing operations, expected the company to earn $2.12 per share on revenue of $4.6 billion.

Adkerson said prices are high because global copper demand is strong, including in the U.S., "even in the face of weak economic data and consumer confidence."

"There was a lot of expectation this year we would see a drop-off in imports of copper to China, and that has not happened," he said. "The country continues to invest in infrastructure. We are very encouraged by the Chinese story."

The company also announced its annual dividend would increase to $2 per share from $1.20 per share, with the first quarterly payment expected Feb. 1.

Analysts who follow Freeport's stock were pleased with the results, asking many questions during a conference call with executives as to whether the company would spend its cash on acquisitions, new projects or dividends.

"The (Barclays Capital) global metals and mining team continues to regard Freeport as the best way to gain exposure to what we believe is substantial upside risk to the copper price," Barclays analyst Peter Ward wrote in a Thursday memo.

Freeport shares closed Thursday up $1.08, or 1.13 percent, to $96.43.

Ward has a $130 price target on the stock. "We do not believe that Freeport's current share price appropriately discounts a high probability of sustainably stronger copper prices," he wrote.

by Ryan Randazzo The Arizona Republic Oct. 22, 2010 12:00 AM

Freeport third-quarter profit up 27%

H&R Block suit may end refund loans

With funding scarce and help underwriting the loans from the IRS discontinued, the high-interest advances on tax refunds are going to be harder to find when tax season begins in January. Where they are available, taxpayers will find that it's harder to get approved and they'll have to pay more.

Kansas City, Mo.-based H&R Block filed a lawsuit Friday that alleges HSBC has failed to honor its contract to back the loans, which expires next year. The suit says HSBC has not taken the necessary planning steps to ensure that H&R Block will be able to offer refund-anticipation loans and refund-anticipation checks during the 2011 tax season.

A refund-anticipation loan is a short-term loan backed by an expected federal income-tax refund. A refund anticipation "check" is actually an account where a refund is deposited. This enables taxpayers to have their tax-return preparation fees deducted from their refund, rather than paying up front. Both are typically used by low-income customers.

In the lawsuit, H&R Block said about 40 percent of its customers used one of these products during the 2010 tax season. Standard & Poor's equity analyst Erik Kolb estimated that translated into about $146 million in revenue from the loan products alone - not counting the tax-prep fees for the associated returns - or 3.8 percent of the company's annual revenue.

In terms of profit, eliminating the loans could mean a 10-cents-per-share reduction next year, estimated Vance Edelson, an analyst with Morgan Stanley. The drop could be higher if customers looking for these loans have their taxes prepared elsewhere. H&R Block was expecting to increase this segment of its business because it had full funding for loans, while some competitors did not.

The issue with HSBC stems from an August announcement by the Internal Revenue Service that it will no longer inform tax-prep companies if all of an individual's expected tax refund will be sent. Without such confirmation, called a "debt indicator," there's no way for tax-prep companies and the banks that fund their refund loan programs to know if the refund will be reduced by factors like back taxes due, a defaulted federal student loan or unpaid child support.

In essence, the IRS debt indicator acted as a form of credit check for a population that typically doesn't have access to traditional credit. The IRS said it would stop providing the information because it's now able to deliver refunds quickly.

"I think it's unfortunate that there's a lot of hardworking Americans that are in a financial situation where they have to pay a substantial fee to access their refunds a week or two before they can get it from the IRS," IRS Commissioner Doug Shulman told the Associated Press.

In the lawsuit, H&R Block said HSBC is trying to back out of funding its refund-anticipation products because without help from the IRS, the bank fears it will lose money.

by Eileen AJ Connelly Associated Press Oct. 21, 2010 12:00 AM

H&R Block suit may end refund loans

U.S. economic growth uneven, Fed survey says

A survey by the Federal Reserve released on Wednesday found seven of the Fed's 12 regions reported moderate improvements in business activity. Three regions - Philadelphia, Richmond and Cleveland - described economic activity as mixed or steady. Only two - Atlanta and Dallas - suggested economic growth was slow.

The survey indicated that the economy isn't weakening but is growing too sluggishly to drive down high unemployment, now at 9.6 percent. The jobless rate has been at or above 9.5 percent for more than a year.

"Hiring remains limited, with many firms reluctant to add to permanent payrolls given economic softness," the Fed survey concluded.

High unemployment is one of the Fed's biggest concerns. That's why Fed Chairman Ben Bernanke and his colleagues are widely expected to launch a new program at their Nov. 2-3 meeting to bolster the economy. The Fed is expected to buy Treasury bonds in a bid to drive down interest rates on mortgages, corporate loans and other debt. The hope is that cheaper credit will persuade Americans to increase spending, which would help the economy grow and lead companies to hire more workers.

The Fed's survey, known as the Beige Book, will figure into Fed policymakers' discussions at the November meeting about how the economy is faring.

The region-by-region survey is based on information collected from the Fed's 12 regional banks on or before Oct. 8. It provides a more intimate look at the overall economy than broad statistics.

"The overall read wasn't as depressing as it could have been," said Jennifer Lee, economist at BMO Capital Markets.

The economic picture hasn't changed much from early September, when the Fed's previous survey noted that seven regions saw modest improvement in business activity. What is different is which regions are growing, and which are struggling.

For instance, New York and Chicago reported a pickup in economic activity after having slower growth in the previous cycle. Conversely, the Dallas region was more subdued this time around after showing modest expansion the past report.

Either way, the economy has slowed from just a few months ago. In June, all 12 Fed regions reported their economies were growing. It was the first time that happened since the start of the recession in late 2007. That's a major reason the Fed is ready to launch a new round of stimulus next month.

by Jeannine Aversa Associated Press Oct. 21, 2010 12:00 AM

U.S. economic growth uneven, Fed survey says

Phoenix area sales rise for office, industrial buildings

The boost in sales since Jan. 1 has been particularly noticeable among smaller industrial properties and apartment buildings, they said, but even office buildings and some retail properties have begun to change hands.

As of Sept. 30, about 110 Phoenix-area industrial properties had been sold in 2010, said Craig Henig, senior managing director at CB Richard Ellis in Phoenix. The total price of those assets was more than $241 million.

Twenty-seven multitenant office properties were sold during the first three quarters, for a total price of about $107 million, and 17 retail properties were sold, totaling almost $42 million.

That's a major change from a year earlier, when virtually no sales were occurring, Henig said.

The uptick is being driven primarily by an increase in commercial foreclosures, as more lenders seek to clear non-performing loans off their books, he added.

"They (foreclosures) are slowly coming to the marketplace - they are not flooding the marketplace," Henig said.

Real-estate firm TransWestern, in Phoenix, hired veteran office-tower broker Phil Marino recently in anticipation of a future high-rise sell-off that most area brokers said is inevitable.

"You're going to see a lot more (commercial) foreclosures in Phoenix," said Marino, senior vice president of investments.

Marino is former president of Intercon West Realty Advisors, which specialized in office towers. The firm folded when high-rise properties stopped selling in 2007.

He said financial pressure on high-rise owners has been mounting that likely will lead to debt restructuring, short sales and possibly foreclosures.

A number of large office properties built during the real-estate boom have short-term loans coming due in 2011 and 2012, he said.

Bob Mulhern, managing director of Colliers International in Phoenix, said that the majority of individual property sales still are below the $5 million mark and that the primary buyers have been business owners who want to own their own buildings.

Asking prices are still higher than what most investors are willing to pay, he said, but they have fallen within a reasonable range for owner-occupants.

"Users of those buildings can come in there and buy for cash," Mulhern said, adding that more expensive buildings generally require financing, which many lenders still are reluctant to provide.

Both optimism and impatience have prompted a number of market watchers to make purchases in recent months, said Don Mudd, managing director of commercial-realty firm Jones Lang LaSalle in Phoenix.

"We're 3 1/2 years into this cycle, and people think we're starting to come out of it," Mudd said.

by J. Craig Anderson The Arizona Republic Oct. 20, 2010 12:00 AM

Phoenix area sales rise for office, industrial buildings

Crystal Cathedral megachurch files for bankruptcy - Yahoo! News

In addition to a $36 million mortgage, the Orange County-based church owes $7.5 million to several hundred vendors for services ranging from advertising to the use of live animals in Easter and Christmas services.

The church had been negotiating a repayment plan with vendors, but several filed lawsuits seeking quicker payment, which prompted a coalition formed by creditors to fall apart.

"Tough times never last, every storm comes to an end. Right now, people need to hear that message more than ever," Sheila Schuller Coleman, the Cathedral's senior pastor and daughter of the founder, told reporters outside the worship hall decked with a soaring glass spire.

"Everybody is hurting today. We are no exception," she said.

The church, founded in the mid-1950s by the Rev. Robert H. Schuller Sr., has already ordered major layoffs, cut the number of stations airing the "Hour of Power" and sold property to stay afloat.

In addition, the 10,000-member church canceled this year's "Glory of Easter" pageant, which attracts thousands of visitors and is a regional holiday staple.

The church was founded at a drive-in theater and attracted congregants with its sermons on the power of positive thinking. Its worship hall opened in 1970 and remains an architectural wonder and tourist destination.

The "Hour of Power" telecast, filmed in the cathedral's main sanctuary, at one point attracted 1.3 million viewers in 156 countries.

Church leaders said the Crystal Cathedral's Sunday services and weekly-telecast "Hour of Power" will continue while in bankruptcy.

Other megachurches have also suffered from the downturn and reduced charitable giving.

Crystal Cathedral saw revenue drop roughly 30 percent in 2009 and simply couldn't slash expenses quickly enough to avoid accruing the debt, said Jim Penner, a church pastor and executive producer of the "Hour of Power."

Vendors owed money by the church formed a committee in April and agreed to a moratorium to negotiate a repayment plan with the Crystal Cathedral. But after several filed lawsuits and obtained writs of attachment to try to collect their cash, it was difficult to keep the group together, Penner said.

Now, the church is avoiding credit entirely and spends only the roughly $2 million it receives each month in donations and revenue, Penner said. The church still hopes to pay all of the vendors back in full, he said.

"What we're doing now is we're trying to walk what we preach, we're paying cash for things as we go," he said.

by Amy Taxin Associated Press October 18, 2010

Crystal Cathedral megachurch files for bankruptcy - Yahoo! News

BofA Ends Foreclosure Freeze - WSB News on wsbradio.com

Bank of America said Monday that it plans to resume seizing more than 100,000 homes in 23 states next week. It said it has a legal right to foreclose despite accusations that documents used in the process were flawed.

Ally Financial Inc's GMAC Mortgage unit is also resuming foreclosures once documents are fixed. Gina Proia, a spokeswoman for Ally, said that ``as we review the affected files and take any remediation needed, the foreclosure process then resumes.''

Analysts expect other lenders to correct problems with the way they handled documents and proceed with a wave of foreclosures that have depressed the housing market. They are likely to follow because foreclosure practices were similar from bank to bank, said banking analyst Nancy Bush of NAB Research.

``We'll be back to square one by the end of the year,'' she said.

The bank's move could mean that the costs of the foreclosure-document mess will wind up being less than some investors had feared just days ago. Bank shares sank last week after JPMorgan Chase & Co. said it set aside $1.3 billion in the third quarter to cover legal expenses that include the foreclosure document problems.

Shares of Charlotte, N.C.-based Bank of America had been flat earlier Monday but jumped on the news. They rose 36 cents, or 3 percent, to close at $12.34.

Bank of America Corp. said it's confident of its foreclosure decisions. The bank is still delaying foreclosures in the 27 states that don't require a judge's approval. It said it's still reviewing its cases in those states.

The bank's move comes two weeks after it began halting foreclosures nationwide amid allegations that bank employees signed but didn't read documents that may have contained errors. These employees have earned the nickname ``robo-signers.''

The company said it plans to resubmit documents with new signatures in the 23 states that require judicial authorization to restart the foreclosure process. It will delay fewer than 30,000 foreclosures.

``The basis for our foreclosure decisions is accurate,'' Dan Frahm, a Bank of America spokesman, said in announcing the bank's new approach.

Bank of America had been the only lender to halt foreclosures in all 50 states. Other companies, including Ally Financial Inc.'s GMAC Mortgage unit, PNC Financial Services Inc. and JPMorgan, have halted tens of thousands of foreclosures after similar practices became public.

Analysts at FBR Capital Markets said in a note to clients that the bank's announcement demonstrates that the foreclosure document issue may be ``overblown.''

Still, more problems surfaced Monday that suggest the controversy may be far from over.

A deposition released by the Florida attorney general's office revealed that the office manager at a Florida law firm under investigation for fabricating foreclosure documents signed 1,000 files a day without reviewing them. The manager also would allow paralegals to sign her name for her when she got tired, the deposition said.

Cheryl Salmons, office manager at the Law Offices of David Stern, would sign 500 files in the morning and another 500 files in the afternoon without reviewing them and with no witnesses, former assistant Kelly Scott said in a deposition released by the Florida attorney general's office.

Jeffrey Tew, an attorney for Stern's firm, didn't immediately return a phone call.

Government-controlled mortgage buyers Fannie Mae and Freddie Mac have stopped referring foreclosures to Stern's firm while they review the firm's filings.

In some states, lenders can foreclose quickly on delinquent mortgage borrowers. By contrast, the 23 states in which Bank of America is restarting foreclosures use a lengthy court process. They require documents to verify information on the mortgage, including who owns it.

Those states are:

Connecticut, Delaware, Florida, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Nebraska, New Jersey, New Mexico, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, South Dakota, Vermont and Wisconsin.

(Copyright 2010 by The Associated Press. All Rights Reserved.)

by Jon Lewis Associated Press October 19, 2010

BofA Ends Foreclosure Freeze - WSB News on wsbradio.com

Banks probed in home seizures

The criminal investigation, still in its early days, is focused on whether companies misled federal housing agencies that now insure a large share of U.S. home loans or committed wire or mail fraud in filing false paperwork.

Although prosecutors across the country previously opened a patchwork of inquiries, a broader federal effort targeting companies that improperly evicted people from their homes is now taking shape. This comes at the same time that investors have begun to hold firms accountable for selling securities composed of mortgages that were improperly serviced.

As part of this reckoning, the Federal Reserve Bank of New York has joined with some of the country's largest investors in seeking to force Bank of America to buy back about $47 billion worth of troubled home loans packaged into bonds by Countrywide Financial, which is owned by the bank. The New York Fed, along with Pacific Investment Management Co., MetLife Inc. and BlackRock Inc., invested in some of these bonds during the rescue of the financial system. Now, the bondholders are raising the prospect that Bank of America and Bank of New York Mellon Corp., the trustee of the mortgage securities, could be sued to recoup losses on the mortgage bonds.

The investors are demanding the repurchase of loans that were originated "in violation of underwriting guidelines," according to a statement by Kathy Patrick of law firm Gibbs & Bruns, which is representing the group.

BofA Chief Financial Officer Chuck Noski defended the servicing of its mortgages and briefed analysts on the company's potential exposure to loan repurchases during a conference call Tuesday.

"While we continue to review and assess the letter and have a number of questions about its content, including whether these investors actually have standing to bring these claims, we continue to believe the servicer is in compliance with its servicing obligations," Noski said.

In recent weeks, senior congressional lawmakers have called for a probe into the use of flawed foreclosure documents and questionable practices during foreclosures.

Members of President Barack Obama's Financial Fraud Enforcement Task Force and other administration officials are scheduled to meet today to discuss the foreclosure controversy. That is to be followed by a White House news briefing led by Shaun Donovan, secretary of the federal Department of Housing and Urban Development.

"In more than 25 years dealing with major financial-crisis issues, I have never seen this many agencies focused on a single issue," said Andrew Sandler, a defense lawyer who works on government investigations. "We are beginning to see signs of extensive governmental investigation that may also have criminal-law implications."

Federal law-enforcement officials usually have little authority to prosecute cases involving foreclosure law because they are largely in the states' domain.

But according to sources familiar with the investigation, the government has both an interest and the grounds to prosecute the abuses because housing agencies under HUD play a major role in insuring home loans.

Reports surfaced in recent weeks that large banks filed court documents across the country that had not been properly prepared or reviewed. The court documents would not have been filed in Arizona cases because foreclosures in the state are not overseen by a judge.

Now, federal investigators want to determine whether similar paperwork was submitted to housing agencies to get insurance payouts, a source said.

In some cases, bank employees have acknowledged signing documents without reviewing them. If similar filings were made to housing agencies, this could violate federal law, which makes it a crime to lie about substantive matters to the federal government.

Investigators are also looking at whether the transfer of mortgage and foreclosure documents through the mail and computer networks would allow the federal government to make a legal case on charges of mail and wire fraud.

Separately, the Securities and Exchange Commission has opened an informal inquiry into possible wrongdoing related to foreclosures. Attorneys knowledgeable about securities law said the SEC would look to see whether banks had properly disclosed to shareholders the risks and processes associated with the foreclosures.

"Whenever there are suggestions that there may have been any kinds of issues with respect to disclosure, misrepresentations or omissions, we are always looking at that kind of conduct," SEC Chairman Mary Schapiro said.

by Zachary A. Goldfarb Washington Post Oct. 20, 2010 12:00 AM

Banks probed in home seizures

The Legitimacy of Securitization: Behind the Headlines

The Legitimacy of Securitization

Stories in major news outlets (including a front-page story in BusinessWeek subtitled "Who Owns Your House? A $1 Trillion Crisis of Faith" have suggested that unknown huge numbers of mortgage loans are floating around in cyberspace. Everything I've encountered suggests that these concerns are grossly exaggerated.

First, much speculation has resulted from the unfounded assumption that the deterioration in underwriting standards after 2004 also infected the process of creating the securitization trusts and transferring assets. Moreover, the reports ignore the 30-year history of the securitized mortgage market, along with the fact that the Uniform Commercial Code (UCC) has language governing the transfers of notes into securitization trusts adopted by all 50 states. The best analysis I've seen of the issue was written by the law firm SNR Denton, which concluded that "the recent allegations of possible wholesale failures to convey ownership of mortgage loans to private-label RMBS trusts are baseless and unfounded. All parties to these transactions...clearly intended that the transactions convey ownership of the loans to the trusts, and appropriate steps were taken to effect such conveyances in accordance with well-settled legal principals governing transfers of mortgage loans."

The Foreclosure Mess

There are many complex and interrelated issues associated with the foreclosure controversies, which were started by revelations that employees of servicers have improperly signed off on affidavits initiating foreclosures in judicial-foreclosure states (in which judges must approve foreclosures). Clearly, serious irregularities (such as allegations of forged paperwork) must be addressed. Nonetheless, the essential issue with so-called robo-signers is procedural in nature; in fact, the majority of states have non-judicial foreclosure procedures that don't require an affidavit to be presented prior to foreclosure.

It is easy to take servicers to task for their failings. However, it's increasingly clear that the servicing industry has the wrong economic structure to operate effectively in the current crisis. Servicing operations were designed and staffed to handle huge numbers of transactions in an efficient and cost-effective fashion. The system was never intended to handle large numbers of nonperforming loans, nor manage the decision processes necessitated by the various foreclosure-prevention and modification initiatives. The industry has never functioned efficiently under stressed conditions, and its problems can be only partially mitigated by additional staff and resources.

The unprecedented volume of nonperforming loans has exacerbated the industry's problems. Combined with the delays imposed by the various modification efforts, a huge backlog of seriously delinquent loans (that have yet to enter the foreclosure process) has developed. According to the MBA's most recent delinquency survey, 9.9% of all loans (out of the 44.5 million in their population) are delinquent, and 6.3% (or roughly 2.3 million loans) are delinquent for 60 days or more.

One of the most vexing issues facing the economy has been the question of when and how the industry will make progress in processing the pipeline of seriously delinquent loans. This has weighed on home prices through the huge hangover of "shadow inventories;" it has hurt servicers by requiring them to fund advances; and it has hurt investors by delaying principal recoveries and increasing loss severities. In this context, the calls for a nationwide moratorium on foreclosures are entirely misplaced. In addition to damaging the legitimate interests of bondholders and financial institutions, it would introduce new uncertainty to a housing market that continues to struggle with high unemployment and huge inventories.

It also seems clear that few unjustified foreclosures have taken place due to paperwork errors. The errors cited by the press, such as incorrect street addresses and misspelled names, are trivial under the circumstances. Borrowers that haven't made any payments in over a year (as Bank of America's chairman stated was the case in 80% of the bank's second-quarter foreclosures) cannot retain their properties through procedural loopholes. Rather than impeding an already stalled process, legitimate foreclosures must proceed, while initiatives designed to mitigate the pain (such as rent-back agreements pioneered by Fannie Mae' Deed for Lease program) should be explored.

Loan Buybacks and Putbacks

The notion that financial institutions will have huge liabilities resulting from violations of the representations and warranties embedded in private-label deals (contained in the deals' pooling and servicing agreements, or PSAs) has recently resurfaced. While a full examination of the issue will have to wait, the topic is highly complex. Major questions include the language in the PSAs that defines potential violations (which differs across originators), the ability of investors to gain access to a particular deal's underwriting files and the portion of losses that will be borne by the banks.

Most industry people I've questioned believe that the process will be long and arduous, the financial equivalent of urban warfare. Universal settlements are increasingly unlikely, and claims will be filed, negotiated and settled on a loan-by-loan basis. For example, it is not enough to simply identify a violation for a loan that has gone into default; it still must be demonstrated that the defect directly contributed to the default. In addition, the bank may be responsible for only part of any loss. An example might be a loan with an understated LTV attributable to a flawed appraisal. In that case, the loan might need to be bought back, but the bank may absorb only losses associated with the amount of the LTV discrepancy.

The markets were recently rocked by reports of legal action filed against Bank of America (the successor company to Countrywide) by a group of large and powerful investors constituting "investors with standing" (i.e., holders of more than 25% of each deal), which included the New York Fed. The group's lawyers sent a letter to BofA accusing it of failing in its duties as the master servicer of 115 separate Countrywide-issued deals backed by prime, subprime and alt-A loans. The "Notice of Non-Performance" sent to the bank (along with the Bank of New York, the trustee for the deals) raised a variety of issues, including the (dubious) claim that the bank kept "defaulted mortgages on its books rather than foreclose or liquidate them, in order to wrongfully maximize its Servicing Fee..." It also claimed that loans modified as part of a settlement with a group of state's attorneys general should be bought out of the trusts, since the settlement was based on evidence that the loans were predatory. (A similar suit was recently decided in BofA's favor, as a judge ruled that the investors did not have legal standing to sue.)

More important than the merits of the notice's claims is the nature of the remedy to an "Event of Default" by the servicer. In such an event, the PSAs require that servicing be transferred away from BofA to a third party (or to the trustee, if no other servicer can be found). Given the current unprofitable nature of the servicing business, it's unlikely that a new entity could be found to take on the role of master servicer for these deals. Moreover, a transfer of servicing would be highly disruptive to all investors in the transactions, including the investor group. Servicing transfers are problematic under the best of circumstances, and are typically plagued by glitches such as lost files and misplaced payments. In the current environment, the normal disruptions would be magnified by REO inventories, large numbers of loans in foreclosure and loans in various stages of modification. This suggests that if the requested action was actually carried out, it would damage the interests of the investors involved in the action.

This leads to questions regarding the motives of the investor group. One possibility is that they expect the servicing to be transferred to parties more agreeable to allowing access to the underwriting documents, which is necessary to directly pursue rep & warranty claims. The more likely explanation is that the letter was intended simply to pressure the bank to negotiate buyback settlements, in part by pushing its stock price down.

Also noteworthy was the involvement in the action by the New York Fed, as owners of non-agency MBS held in their Maiden Lane facilities. In my view, the involvement of the Fed is extremely troubling. If the transfer of servicing were actually to take place, all incomplete modifications would almost certainly be halted, a result contrary to the policies of the Obama administration. While unlikely, it is also conceivable that the notice could trigger unforeseen events that eventually destabilize the financial system, an outcome directly at odds with the Fed's responsibilities in ensuring financial stability.

Finally, the action highlights the major conflicts associated with the Fed simultaneously acting as investor, regulator and central banker. It's difficult to imagine how the Fed is supposed to effectively regulate a bank that it is separately targeting with legal action; could, for example, BofA refuse to turn over documents and data based on the NY Fed's adversarial role in any legal action? In my opinion, the multiple roles being played by the Fed risk its independence and credibility; in particular, the role of activist investor could damage the Fed at a moment when it is embarking on controversial and risky measures designed to boost the economy.

by Bill Berliner Mortgage News Daily October 29, 2010

The Legitimacy of Securitization: Behind the Headlines

Sunday, October 24, 2010

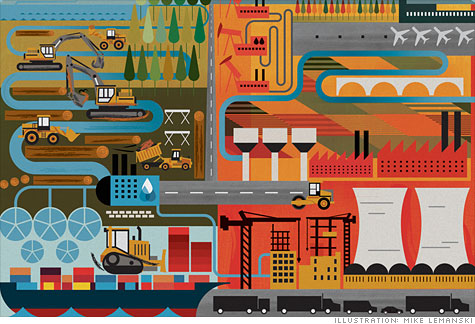

Invest in emerging markets infrastructure - Oct. 11, 2010

FORTUNE -- Emerging-markets economies seem to have it all these days. Their lands are stocked with natural resources. Their national finances are strong. And a rising middle class is spurring breakneck growth in their businesses.

Yet China, India, Brazil, and other developing countries share a glaring problem: inadequate infrastructure.

For example, 400 million people in India don't have electricity, according to the International Energy Agency. Brazil is one of the world's biggest commodities producers yet has one of the weakest port systems. Meanwhile millions are moving to cities in countries like China, increasing the need for power and transportation.

Emerging-markets governments are committing $6.3 trillion to address the infrastructure problem, according to a new report by Bank of America Merrill Lynch (BAML). The bulk of it is going to water systems, energy, and transportation. Kate Moore, one of the authors, says governments will increasingly direct the money to public-private partnerships. "They have plans to have private companies take a larger role," she says.

Ride the infrastructure wave

For investors the infrastructure boom offers a rich opportunity: Companies that build roads, transmit power, and operate utilities will get a shot in the arm from government spending, potentially boosting their earnings and shares. With that in mind, we consulted top infrastructure investors, who recommended a selection of stocks (all available in the U.S. as ADRs) poised to benefit from the theme. All emphasized the importance of finding companies that not only have a competitive edge and a reasonable valuation but also enjoy positive relationships with local governments. "The key is to think about where the profit lies in the chain," says Richard Titherington, head of J.P. Morgan Asset Management's emerging-market equities group.

Brazil