Sunday, March 31, 2013

US New Home Sales Drop as Prices Rise

Sales of new U.S. single-family homes fell more than expected in February after hefty gains the previous month, but steady gains in home prices suggested the housing market recovery remains intact.

The Commerce Department said on Tuesday sales dropped 4.6 percent to a seasonally adjusted annual rate of 411,000 units. Last month's decline followed a 13.1 percent jump in January.

Read more: US New Home Sales Drop as Prices Rise

Like your credit score? Look closer

PHOENIX -- You can gaze into a mirror to see what you look like to friends, family members, co-workers and acquaintances.

But what image do you project to banks, credit-card companies, insurers and even prospective employers? Your reflection on the piece of glass won't tell.

Read more: Like your credit score? Look closer

Title loans hurt poor, critics say

But the sunset of payday lending only fueled a surge in another form of quick cash for the financially vulnerable: auto-title lending. Like their payday-lending counterparts, auto-title lenders, which use borrowers’ vehicles as collateral, offer short-term loans at triple-digit interest rates, potentially reaching 204 percent.

Read more: Title loans hurt poor, critics say

Marley Park growth worries neighbors, schools

Neighbors on the western edge of Surprise’s Veramonte can look over their back walls to 153 open acres running all the way to Marley Park.

Within the next few years, Marley Park will run right back at them.

New homes in the Marley Park master-planned community will start to fill that open space next year. The closest Marley Park neighbors will have homes a few feet from the backyards of Veramonte, a 350-home subdivision northeast of Litchfield and Cactus roads.

Read more: Marley Park growth worries neighbors, schools

Investors buying homes in metro Phoenix at slower pace

Some of the early investors, who bought in 2009, have flipped the houses for a quick profit, but most of these buyers are holding on to the properties and turning them into long-term rentals.

David Bignoli, president of real estate data research firm Netvaluecentral Inc., recently complted a report on metro Phoenix’s biggest investors.

Read more: Investors buying homes in metro Phoenix at slower pace

Vacant offices in 1985 building could become loft apartments

A vacant Scottsdale office building would be converted to 56 loft apartments under a plan submitted last week to the city.

Joel Broder, Niche Residential chief executive, proposed an adaptive reuse of a 1985 red-brick building of 71,000 square feet southeast of 92nd Street and Shea Boulevard.

It will be a challenge to convert the three-story office building to loft apartments with 12-foot celings but it makes sense to reuse the structure for the Scottsdale 92 residential project, he said.

Read more: Vacant offices in 1985 building could become loft apartments

Sales price of metro Phoenix homes up 4 percent

The sales price of a metro Phoenix house climbed more than 4 percent in February, bringing the region’s median home-sales price nearly back to what it was in 2004.

Last month, the median sales price of a house hit $170,000, according to the W. P. Carey School of Business at Arizona State University. That’s up 36.5 percent from the Phoenix area’s median sales price of $124,500 in February 2012.

Read more: Sales price of metro Phoenix homes up 4 percent

Scottsdale Councilman Phillips wields ax on apartment rezoning

A south Scottsdale neighborhood is on a mission to stop an apartment complex from being built on the site of a former McDowell Road auto dealership.

Read more: Scottsdale Councilman Phillips wields ax on apartment rezoning

5 favorite golf courses in Arizona

With hundreds of golf courses around Arizona, how is a duffer to choose? We asked John Davis, a freelance writer and The Republic’s former golf reporter, about his favorites in the Valley and around the state. Here are five locations he particularly likes. Look for five more in next Saturday’s Explore Arizona section.

Read more: 5 favorite golf courses in Arizona

Chandler program clears city of dilapidated buildings

A vacant, dilapidated building is more than an eyesore to residents of the surrounding neighborhood.

That empty building can pose hazards, including fire, safety, crime and illegal dumping. With that in mind, Chandler’s Code Enforcement Unit and other city departments have been attempting to rid the city’s neighborhoods of such structures.

Among the city’s most-effective tools is the Voluntary Demolition Program.

Read more: Chandler program clears city of dilapidated buildings

Scottsdale's proposed budget hints at better times for city

New development projects and an uptick in building permits are contributing to a brighter outlook in Scottsdale’s newly released budget.

Read more: Scottsdale's proposed budget hints at better times for city

Apartment, condo complexes, Fry’s revamp get Scottsdale council OK

An apartment complex that will replace Rural/Metro’s Corp’s billing and call center was approved by the Scottsdale City Council on Tuesday.

The council also gave the go-ahead for an eight-story condominium complex in downtown’s entertainment district and a face lift for an aging Fry’s shopping center.

Wood Partners, a developer of multifamily residences, plans to build a four-story, 218-unit apartment complex at the northeastern corner of Indian School and Granite Reef roads. The site has been home to the Rural/Metro center, which is closing.

The $35 million apartment complex will be named Alta Scottsdale.

Read more: Apartment, condo complexes, Fry’s revamp get Scottsdale council OK

JPMorgan Chase Is Reining In Payday Lenders - NYTimes.com

JPMorgan Chase will make changes to protect consumers who have borrowed money from a rising power on the Internet — payday lenders offering short-term loans with interest rates that can exceed 500 percent.

JPMorgan, the nation’s largest bank by assets, will give customers whose bank accounts are tapped by the online payday lenders more power to halt withdrawals and close their accounts.

Under changes to be unveiled on Wednesday, JPMorgan will also limit the fees it charges customers when the withdrawals set off penalties for returned payments or insufficient funds.

Read more: JPMorgan Chase Is Reining In Payday Lenders - NYTimes.com

Freddie Mac sues 15 banks over LIBOR | The Columbus Dispatch

WASHINGTON — Freddie Mac has sued 15 big international banks, including JPMorgan Chase, Bank of America and Citigroup, accusing them of rigging a key interest rate and causing huge losses for the government-controlled mortgage giant.

Read more: Freddie Mac sues 15 banks over LIBOR | The Columbus Dispatch

DMB resumes projects in the Northwest Valley

DMB Associates Inc. is preparing to roll out a new neighborhood in Surprise’s Marley Park, signaling another turning point in the housing recovery.

The new Marley Park neighborhood, combined with the resumption of work in Verrado, another DMB master-planned community in Buckeye, represents a return to work in the West Valley for the developer, which put a number of projects on hold in the wake of the housing crash more than five years ago.

Read more: DMB resumes projects in the Northwest Valley

A Look Behind The Curtain: How To Choose A Mortgage Lender - Forbes

Last week I saw a restaurant review on a local blog that touted “The New York Times says . . .” and I thought, wait a minute, the Times didn’t “say” anything, somebody that works for the Times did! One person, one opinion, not the entire staff and their collective opinion, but one individual. Invoking the mighty Times just because the reviewer works for the NY Times, transfers the credibility and credentials of the institution to the individual and turns an individual opinion into a powerful endorsement.

When someone refers to this writing, chances are they will say; “forbes.com said ” and not “Mark Greene said on forbes.com . . .” See what I mean? “Who’s Mark Greene” is replaced with the towering credibility of the forbes.com brand. Unknown uncertainty instantly transformed into concrete factual evidence.

Read more: A Look Behind The Curtain: How To Choose A Mortgage Lender - Forbes

Friday, March 29, 2013

Delinquent Loans Rolling into Foreclosure Inventory after Settlement

Tuesday, March 26, 2013

Changes to California’s Principal Reduction Program Attract More Mortgage Servicers

Veros Releases Price Forecast, Predicts Appreciation in 75% of Markets

Monday, March 25, 2013

Metro Phoenix real estate now a seller's market

It’s a seller’s market in metro Phoenix real estate, with so few moderately priced houses on the market that typical buyers have to scramble to make a deal.

Last week, about 13,000 houses and condominiums across the region were listed for sale. In 2008, there were four times as many houses for sale in the Phoenix area, according to the Arizona Regional Multiple Listing Service.

Houses, particularly those priced below $200,000, are selling faster than they have since mid-2006, at the peak of the housing boom. The typical house now sells within 72 days, almost half the time it took five years ago.

Sunday, March 24, 2013

Valley Home Values 2013 : Median home prices for 2011-12 by city in Maricopa County

The following is a sampling of median home prices for Maricopa County municipalities with at least 50 sales of single-family detached houses during the past two years. (Some municipalities overlap into Pinal County.) See how your community's median home price for 2012 compared to last year's price and which municipality had the biggest overall increase:

Read more: Valley Home Values 2013 : Median home prices for 2011-12 by city in Maricopa County

Rising home values in metro Phoenix spur refinance boom

Climbing home values are sparking a surge in refinancing across metro Phoenix. With the overall median sale price up nearly 40 percent since January 2012, most homeowners trading in loans for lower rates don’t need help from a federal program to get it done.

Tens of thousands of homeowners, underwater on their loans a year ago or less, now have enough equity to refinance with interest rates below 4 percent. The new mortgage loans can save hundreds of dollars a month, freeing money for other expenses or to pay down debt.

Read more: Rising home values in metro Phoenix spur refinance boom

Wednesday, March 20, 2013

Foreclosures Back Up

By most measures the U.S. housing market is still in a state of recovery, but reports that new foreclosure numbers are rising may add a darkening cloud to its long-term prospects. New foreclosures may be up 2.26% in February from the previous month, but analysts at the research firm also note that actual repossessions have dropped by 25%. Even so, government officials warn of foreclosure flare-ups and point to many states that have seen rapid ballooning in the number of new foreclosures, with some spiking as much as 300% over the last month. For more on this continue reading the following article from TheStreet.

Read more: Foreclosures Back Up

Tuesday, March 19, 2013

Industry Experts Predict Price Growth into 2017

More than One-Third of Listed Homes Sold Within 2 Weeks: Redfin

Monday, March 18, 2013

Meredith Whitney: This Is the Most Bullish I've Been In My Career - MarketBeat - WSJ

Calculated Risk: Builder Confidence declines in March to 44

The National Association of Home Builders (NAHB) reported the housing market index (HMI) decreased 2 points in March to 44. Any number under 50 indicates that more builders view sales conditions as poor than good. Read more... http://www.calculatedriskblog.com/2013/03/builder-confidence-declines-in-march-to.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed:+CalculatedRisk+(Calculated+Risk)&m=1

Borrowers control risks associated with reverse mortgages [feedly]

Q: "It seems to me that you are writing a lot about reverse mortgages recently ... is the subject really worth the time you are spending on it?"

A: I think so. I view the home equity conversion mortgage (HECM) program as an important, if partial, solution to a critical problem: an increasing concern among people looking ahead that their living standards won't be maintained after they stop working. Read more... http://feedproxy.google.com/~r/inmannews/~3/QBYWWurF2nU/borrowers-control-risks-associated-with-reverse-mortgages

Gilbert council OKs $2M deal to lure furniture chain

The Gilbert Town Council on Thursday approved a $2 million economic-incentive package for a Colorado-based furniture chain that plans to build a showroom and warehouse in the town’s Power Road Corridor.

American Furniture Warehouse is looking to open near Power Road and the Santan Freeway within the year, potentially bringing 300 jobs and $150million in annual sales to the area.

Read more: Gilbert council OKs $2M deal to lure furniture chain

Sierra Reserve is Lyle Anderson’s smallest project, but the developer still finds he’s in

The developer who invented the concept of upscale living around world-class golf courses in Scottsdale three decades ago is now building on one of the last residential parcels in the northeast Valley city.

Lyle Anderson plans to build 250 custom homes and a resort on 223 acres next to the Golf Club Scottsdale. Plans for the community, called Sierra Reserve, began to take shape at the height of the housing boom and have evolved in the years since. The community at Dynamite Road and 118th Street is Anderson’s smallest development so far, and his first since 2008.

Read more: Sierra Reserve is Lyle Anderson’s smallest project, but the developer still finds he’s in

Rental-homes spurt impacts monthly rents

The growing number of metro Phoenix rental homes is putting pressure on monthly rents in some areas. But the rising price of buying a home is making it a financial toss-up for many people trying to decide whether to rent or to own.

There were a record 2,645 leases signed for houses in the Phoenix-area during February, according to the Fletcher Report. The average monthly rental rate was $1,100 last month, exactly the same as in February 2012.

However, the own-to-rent ratio climbed from 10.4 percent a year ago to 13.6 percent now.

Read more: Rental-homes spurt impacts monthly rents

Metro Phoenix bankruptcy filings fall at fast clip

Plenty of Arizonans continue to struggle financially, but their stress isn’t showing up in bankruptcy filings: The number of Valley residents seeking protection in February fell at the fastest pace in nearly 6 1/2 years.

Throughout metro Phoenix, 1,059 individuals and businesses started bankruptcies last month, down nearly 35 percent from February 2012, according to the U.S. Bankruptcy Court in Phoenix.

Filings have dropped for the past 25 months when compared with the same month in the previous year. The cyclical peak of 3,063 bankruptcies was reached in March 2010. The most recent results showed the best rate of improvement since October 2006 — one year after the numbers were distorted by a change in the law making it less advantageous to file.

Read more: Metro Phoenix bankruptcy filings fall at fast clip

Speedy home sale reflects recovery in housing market

Imagine putting your house up for sale and selling it a day later.

A few years ago that would have been unlikely but it is exactly what happened to a Scottsdale couple last month.

Vivien and Helmut Stampf listed their four-bedroom home southwest of 94th Street and Thunderbird Road for sale Feb. 1 for $385,000. They had 28 viewings in two days and four offers by the end of the second day. Three of those offers were above the asking price, Vivien Stampf said.

Read more: Speedy home sale reflects recovery in housing market

Arizona Appeals Court OKs mortgage-fund use

State officials acted legally when they took $50 million from a national mortgage-settlement fund and used it to help balance the state budget, the state Court of Appeals ruled Tuesday.

State officials acted legally when they took $50 million from a national mortgage-settlement fund and used it to help balance the state budget, the state Court of Appeals ruled Tuesday.

The opinion frees the state to put the money in the general fund once a stay on the money expires April 1.

However, attorney Tim Hogan of the Arizona Center for Law in the Public Interest, who brought the suit on behalf of housing advocates, said he is considering an appeal to the state Supreme Court.

Read more: Arizona Appeals Court OKs mortgage-fund use

New plan would drop Mountain Shadows resort, golf course

A recent filing of a Paradise Valley resort’s reorganization plan in U.S. Bankruptcy Court could signal big changes for its future development.

MTS Land LLC and MTS Golf LLC, both affiliates of Crown Realty and Development, have submitted a new plan that could allow them to develop the shuttered Mountain Shadows resort property without a golf course or resort.

The reorganization plan in Bankruptcy Court includes a deadline for the Paradise Valley Town Council to approve the resort’s current redevelopment plan, which would retain the current proposal for the resort and golf course.

Read more: New plan would drop Mountain Shadows resort, golf course

Sunday, March 17, 2013

New Chandler complex set to have more than 250 homes

Pollack Real Estate Investments recently finalized the sale of 9.61 acres on the northeastern corner of Alma School and Pecos roads to Aerie Land Development LLC of Tucson.

Construction of multifamily homes is expected to begin on the corner in March, according to Pollack.

Read more: New Chandler complex set to have more than 250 homes

Wealthy investors keep buying metro Phoenix homes to rent

Billion-dollar investors backed by Wall Street continue to buy metro Phoenix houses with plans to turn them into rentals.

Billion-dollar investors backed by Wall Street continue to buy metro Phoenix houses with plans to turn them into rentals.

New York-based Blackstone Real Estate, buying through a Tempe partnership called Treehouse, has spent several million dollars on houses in the region over just the past few weeks. At the end of 2012, almost 25 percent of all the region’s homes were owned by investors, according to an Arizona Republic analysis.

Read more: Wealthy investors keep buying metro Phoenix homes to rent

2 apartment developers ask for more time to build projects

Two apartment developers are asking Scottsdale for more time to build their residential projects northeast of Scottsdale and Camelback roads.

Two apartment developers are asking Scottsdale for more time to build their residential projects northeast of Scottsdale and Camelback roads.

That includes Gray Development Group’s Blue Sky complex with more than 700 units units just off Scottsdale Road near the Safari Drive residences.

The other is Modus Development’s eight-unit “green” apartments southeast of Minnezona Avenue and 73rd Street, east of Scottsdale Road and the Arizona Canal.

Read more: 2 apartment developers ask for more time to build projects

Scottsdale land that includes famous Greasewood saloon may one day host discovery center

Sixty years ago, George “Doc” Cavalliere purchased more than 40 acres of raw desert east of Pinnacle Peak, in an area that is now part of north Scottsdale.

He and his wife ran the famous Reata Pass Steakhouse on the property until 1975, when they leased it to another operator.

Read more: Scottsdale land that includes famous Greasewood saloon may one day host discovery center

Scottsdale aims to add to Sonoran Preserve

Scottsdale is setting its sights on acquiring nearly 4,000 acres of state trust land in the far northern area of the city.

The Scottsdale McDowell Sonoran Preserve Commission is working to prioritize a list of state land parcels that have long been sought for conservation.

The commission, at its meeting last week, considered four parcels northeast of Happy Valley and Scottsdale roads and stretching farther northeast of Pima Road and Dynamite Boulevard.

Read more: Scottsdale aims to add to Sonoran Preserve

Florence votes to take land in copper-mine dispute

The Florence Town Council is preparing to take more than 1,100 acres from Curis Resources, a company it is locked in a bitter dispute with over a proposed copper mine.

The Florence Town Council is preparing to take more than 1,100 acres from Curis Resources, a company it is locked in a bitter dispute with over a proposed copper mine.

The council voted 7-0 Monday evening to “exercise its power of eminent domain” — the latest salvo in a battle between Florence and Curis over the controversial project.

Read more: Florence votes to take land in copper-mine dispute

Friday, March 15, 2013

Short Sales: How Investors, House Hunters Find Real Estate Deals - Investors.com

Census: Phoenix-area population tops 4.3 million, moves up metro rankings - Phoenix Business Journal

China’s Non-Existent Property Bubble

Thursday, March 14, 2013

No Signs of a Slowdown for Prices; Market Poised for Supply Increase

NAR Survey Reveals Homebuyer Preferences

10 Banks Foreclosing on the Most Homes | AOL Real Estate

Tuesday, March 12, 2013

Homebuilders target active markets | HousingWire

ACC fines Radical Bunny, Horizon Partners nearly $195M

http://www.bizjournals.com/phoenix/news/2013/03/12/acc-fines-radical-bunny-horzon.html

Global luxury real estate market showing 'strong momentum' | Inman News

Understanding HECM loan's dual interest rates | Inman News

Sunday, March 10, 2013

Hovnanian: Housing Market is About to Get Moving

Hovnanian: Housing Market is About to Get Moving

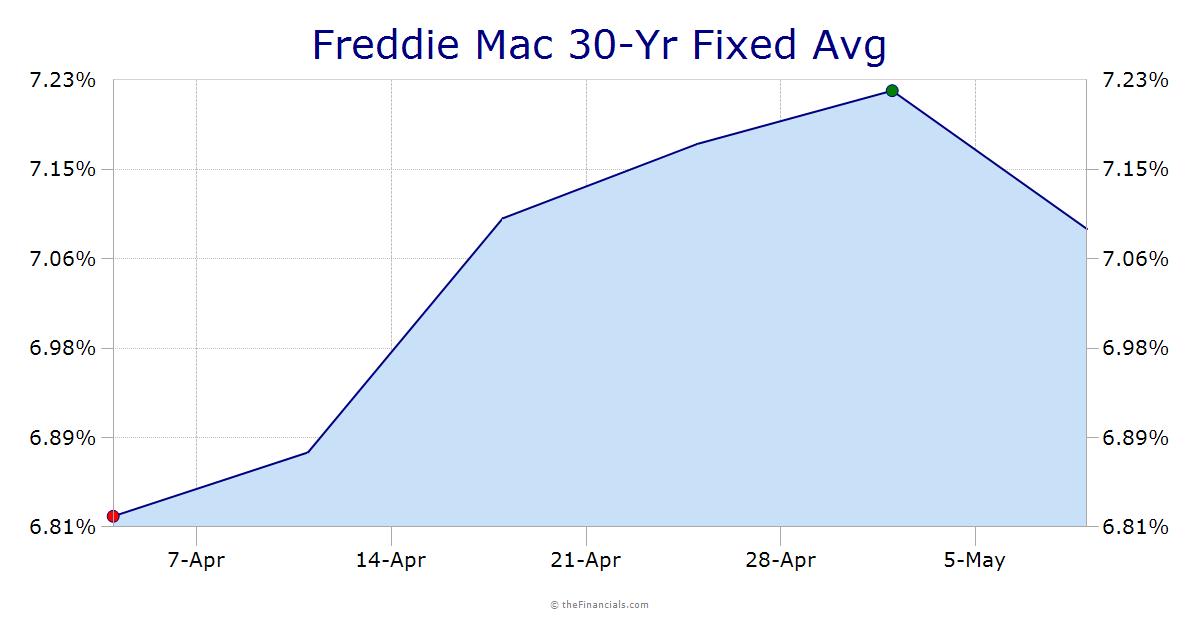

Mortgage Rates Highest In Nearly 10 Months After Employment Data

Mortgage rates vaulted higher today at their fastest pace since late January, after the Employment Situation showed an unexpectedly high number of jobs created in February. The Employment Situation is the most important piece of domestic economic data each month and always has the potential to greatly impact markets. This was indeed the case today, and it brings 30yr Fixed Best-Execution up to 3.75% for the first time since May 2012. Lenders are still offering lower rates, but at greatly increased costs. For every $100k in loan amount, you'd pay an extra $700 of closing costs to keep yesterday's rates at an average lender. On average, the costs associated with 3.625% yesterday are the same costs associated with 3.75% today.

Mortgage rates vaulted higher today at their fastest pace since late January, after the Employment Situation showed an unexpectedly high number of jobs created in February. The Employment Situation is the most important piece of domestic economic data each month and always has the potential to greatly impact markets. This was indeed the case today, and it brings 30yr Fixed Best-Execution up to 3.75% for the first time since May 2012. Lenders are still offering lower rates, but at greatly increased costs. For every $100k in loan amount, you'd pay an extra $700 of closing costs to keep yesterday's rates at an average lender. On average, the costs associated with 3.625% yesterday are the same costs associated with 3.75% today.

Read more: Mortgage Rates Highest In Nearly 10 Months After Employment Data

Real Estate News

Reuters: Business News

- 👉 A major cyber attack under way. A sophisticated state-based actor is targeting all levels of Australian government and a range of... via Hvper.com - 6/19/2020 -

- 👉 Police officers shoot and kill Los Angeles security guard: 'He ran because he was scared' via Hvper.com - 6/19/2020 -

- 👉 People Are Filming Creepshots of Women at BLM Protests via Hvper.com - 6/19/2020 -

- 👉 "I want you to look me in my eye and say that you're sorry": Man who lost his eye protesting says he demands a response from the mayor via Hvper.com - 6/19/2020 -

- 👉 Facebook Removes Trump Political Ads With Nazi Symbol. Campaign Calls It An 'Emoji' via Hvper.com - 6/19/2020 -

National Commercial Real Estate News From CoStar Group

- Westwood Financial taps Phillips Edison executive to serve as CEO - 7/15/2025 - Brannon Boswell

- Pack it up: Tupperware's former office campus hits market after bankruptcy filing - 7/15/2025 - Katie Burke

- Shorenstein banks on 'pockets of strength' in Dallas - 7/15/2025 - Candace Carlisle

- New York City Council rejects Bally’s $4 billion Bronx casino bid - 7/15/2025 - Andria Cheng

- Pack it away: Tupperware's former office campus hits market in aftermath of bankruptcy filing - 7/15/2025 - Katie Burke

Latest stock market news from Wall Street - CNNMoney.com

- Barnes & Noble stock soars 20% as it explores a sale - 10/3/2018 -

- Toys 'R' Us brand may be brought back to life - 10/3/2018 -

- Honda teams up with GM on self-driving cars - 10/3/2018 -

- Aston Martin falls 5% in London IPO - 10/3/2018 -

- JCPenney names Jill Soltau as its new CEO - 10/2/2018 -

Archive

-

▼

2013

(395)

-

▼

March

(67)

- US New Home Sales Drop as Prices Rise

- Like your credit score? Look closer

- Title loans hurt poor, critics say

- Marley Park growth worries neighbors, schools

- Investors buying homes in metro Phoenix at slower ...

- Vacant offices in 1985 building could become loft ...

- Sales price of metro Phoenix homes up 4 percent

- Scottsdale Councilman Phillips wields ax on apartm...

- 5 favorite golf courses in Arizona

- Chandler program clears city of dilapidated buildings

- Scottsdale's proposed budget hints at better times...

- Apartment, condo complexes, Fry’s revamp get Scott...

- JPMorgan Chase Is Reining In Payday Lenders - NYTi...

- Freddie Mac sues 15 banks over LIBOR | The Columbu...

- DMB resumes projects in the Northwest Valley

- A Look Behind The Curtain: How To Choose A Mortgag...

- Delinquent Loans Rolling into Foreclosure Inventor...

- Changes to California’s Principal Reduction Progra...

- Veros Releases Price Forecast, Predicts Appreciati...

- Metro Phoenix real estate now a seller's market

- Valley Home Values 2013 : Median home prices for 2...

- Rising home values in metro Phoenix spur refinance...

- Foreclosures Back Up

- Industry Experts Predict Price Growth into 2017

- More than One-Third of Listed Homes Sold Within 2 ...

- Meredith Whitney: This Is the Most Bullish I've Be...

- Calculated Risk: Builder Confidence declines in Ma...

- Borrowers control risks associated with reverse mo...

- Gilbert council OKs $2M deal to lure furniture chain

- Sierra Reserve is Lyle Anderson’s smallest project...

- Rental-homes spurt impacts monthly rents

- Metro Phoenix bankruptcy filings fall at fast clip

- Speedy home sale reflects recovery in housing market

- Arizona Appeals Court OKs mortgage-fund use

- New plan would drop Mountain Shadows resort, golf ...

- New Chandler complex set to have more than 250 homes

- Wealthy investors keep buying metro Phoenix homes ...

- 2 apartment developers ask for more time to build ...

- Scottsdale land that includes famous Greasewood sa...

- Scottsdale aims to add to Sonoran Preserve

- Florence votes to take land in copper-mine dispute

- Short Sales: How Investors, House Hunters Find Rea...

- Census: Phoenix-area population tops 4.3 million, ...

- China’s Non-Existent Property Bubble

- No Signs of a Slowdown for Prices; Market Poised f...

- NAR Survey Reveals Homebuyer Preferences

- 10 Banks Foreclosing on the Most Homes | AOL Real ...

- Homebuilders target active markets | HousingWire

- ACC fines Radical Bunny, Horizon Partners nearly $...

- Global luxury real estate market showing 'strong m...

- Understanding HECM loan's dual interest rates | In...

- Hovnanian: Housing Market is About to Get Moving

- Mortgage Rates Highest In Nearly 10 Months After E...

- Crowdfund your real estate costs | Inman News

- ASU: Phoenix-area home prices surge 35% - Phoenix ...

- CoreLogic: Prices Up 9.7%; Market Poised for Stron...

- Multifamily, Commercial Loans Fared Better During ...

- Merger of Fannie, Freddie's bond units proposed - ...

- Report: Why High-Priced Homes Are Leaders in the R...

- FHA Reform: MBA, NAR Outline Importance of FHA

- Apartments acquisition OK’d as grant-obligation st...

- Where are mortgage rates heading in 2013? | Charlo...

- NY firm drives major mixed-use project in Gilbert

- Money Velocity Free-Fall and Federal Deficit Spending

- Short Sales Surge Before Foreclosure, But Take Lon...

- Housing’s ‘Wealth Effect’ Isn't What It Used To Be...

- Calculated Risk: Freddie Mac: $4.5 Billion Net Inc...

-

▼

March

(67)

Recent Comments

- Влагостойкая фанера ФСФ - область применения http:... - 12/8/2022 - Anonymous

- Особенностью ламинированной пленки есть не только ... - 12/3/2022 - Anonymous

- Значительная часть возможностей портала Лиопал пре... - 11/11/2022 - Anonymous

- Опытный штат работников компании Liopal сможет соз... - 11/10/2022 - Anonymous

- можно ли пробить номер телефона - 11/2/2022 - Anonymous