Rate Update Thursday – January 31, 2019

The partial government shutdown ended last Friday so the delay of sales of newly built homes for November was reported today with a big number. November New Homes Sales jumped 17% from October to an annual rate of 657,000 units, well above the 555,000 expected. However, sales were down 7.7% from November 2017. Across the country, sales jumped 100% in the Northeast, up 30.5% in the Midwest, up 20.6% in the South with a 5.9% decline in the West. There was a six-month supply of homes for sale on the market which is seen as normal. A solid report, though somewhat backward looking due to the delay in reporting the numbers.

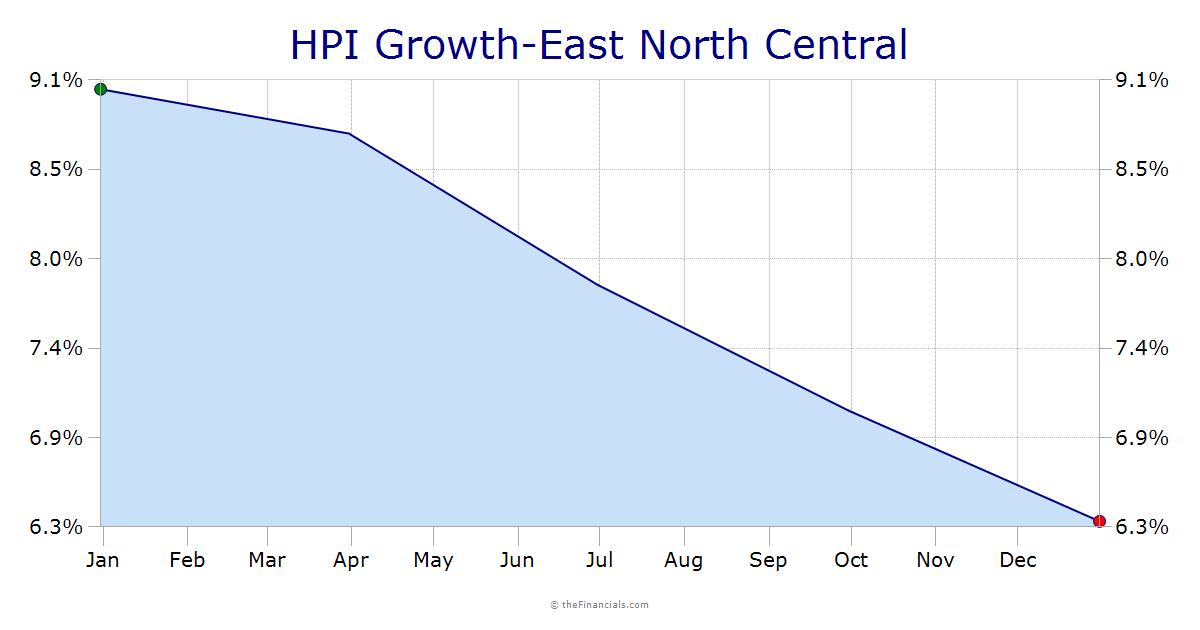

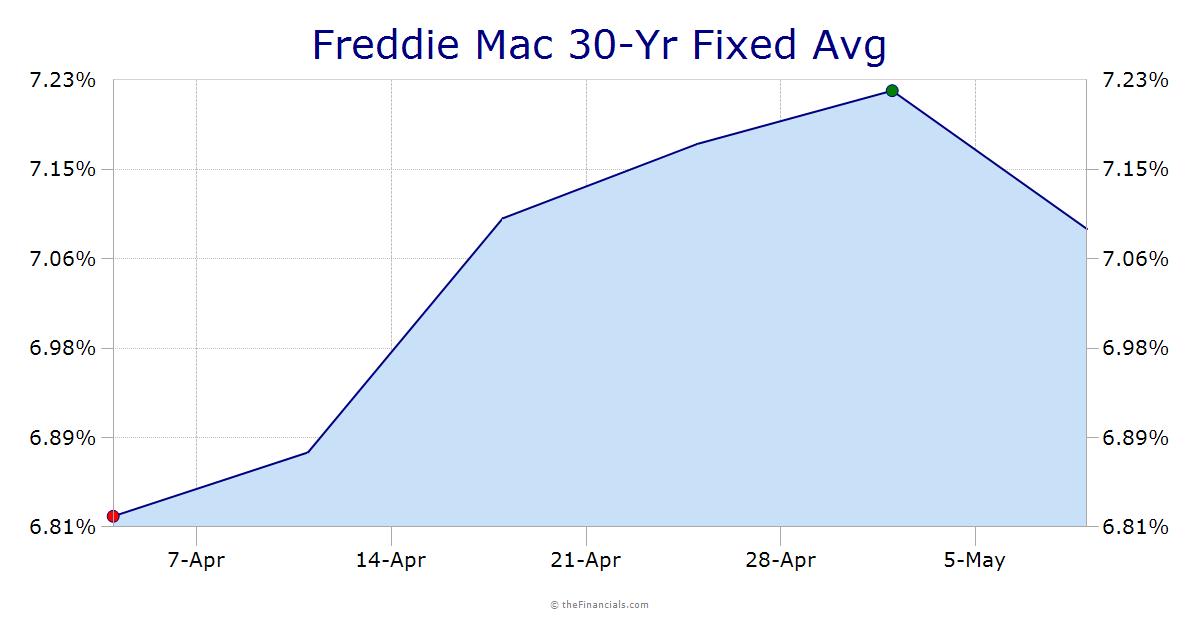

Mortgage rates were essentially unchanged in the latest week after the rise seen from January 2018 through November. Freddie Mac reports that the 30-year fixed-rate mortgage average 4.46% this week with an average 0.50 in points and fees. A year ago this time, the rate was 4.22%. Sam Khater, Freddie Mac’s chief economist, says, “Purchase applications were down this week after soaring early in the year. However, softening house price appreciation along with increasing inventory of homes on the market – and historically low mortgage rates – should give a boost to the spring homebuying season.”

Americans filing for first-time unemployment benefits rose to a near two and a half year high in the latest week. The partial government shutdown could be attributed to the jump in claims. Weekly Initial Jobless Claims rose 53,000 in the week ended January 26, above the 220,000 expected. The four-week moving average of initial claims, which irons out seasonal abnormalities, rose 5,000 to 220,250.

Courtesy of Mortgage Market Guide