Saturday, February 25, 2012

Building-permit complaints in Phoenix increased in 2011

According to the Phoenix Planning and Development Department, the number of complaints rose to 1,446 from 1,135 between 2010 and 2011. The number of court cases dropped from 54 to six.

About half the increase in complaints can be attributed to a home appraiser who noted differences between homes he inspected and public records, said Mo Glancy, the department's deputy director.

Many of the rest are the result of "house flippers," investors who buy and remodel foreclosed homes without the necessary permits, he said.

About two-thirds of the violations were resolved in both years, simply by notifying the project owner who followed through with the required permits, Glancy said. Most of the others could not be verified, did not involve an active project or were the result of neighbor or family disputes, he said.

Glancy said responsibility for permit enforcement switched from the Neighborhood Services Department to the Planning and Development Department in August 2010, accounting for the drop in court cases.

"It is hard to get a resolution through the court," Glancy said. "We have tried to make resolution easy" by working with homeowners and contractors.

Phoenix issued about 20,000 building permits last year, about two-thirds of them for residential projects.

Most violations are the result of confusion about the requirements, which are in place to protect public health and safety, Glancy said. The city does not have enough personnel to check all projects but will follow up on complaints.

The cases that go to court are the most serious violations, Glancy said. In one case, a wedding facility went into operation without the needed permits, even though the owner had been alerted. That case is still in the works.

by Michael Clancy - Feb. 23, 2012 10:00 PM The Republic | azcentral.com

Building-permit complaints in Phoenix increased in 2011

Report: Upbeat findings for Arizona housing market

Metro Phoenix home prices are up. Fewer inexpensive homes are for sale, and the number of pending foreclosures is down.

The positive housing-market update comes from Arizona State University's newest real-estate report.

It's the first monthly housing analysis from Mike Orr, who was recently named director of the Center for Real Estate Theory and Practice for ASU's W.P. Carey School of Business.

"Single-family home prices overall in the Phoenix area have been moving up since they reached a low point in September," Orr said in his debut monthly housing report.

"Also, looking forward, I expect a declining trend in foreclosures."

Orr also publishes a daily online analysis of Phoenix-area housing indicators called the "Cromford Report."

The median price of all home sales, including new homes, reached $120,500 in January of this year, Orr reports. That compares with $113,166 a year earlier.

The average price per square foot of Valley houses has climbed 3 percent since last year.

There were approximately 8,000 new and used homes sold in January, up from 7,500 in January 2011.

Orr said investors have snatched up the oversupply of homes for sale under $300,000.

"Many people think there's a glut of homes the banks are hiding somewhere, and that may be the case in other markets, but not here in the Phoenix area," he said.

"We've gone through so many foreclosures that the system has been working itself out for about five years."

In January, there were 2,450 single-family foreclosures in both Maricopa and Pinal counties, compared with 4,200 during January 2011, according to the ASU report.

The supply of homes listed for sale in metro Phoenix is down 42 percent from a year earlier.

by Catherine Reagor - Feb. 23, 2012 06:35 PM The Arizona Republic | azcentral.com

Report: Upbeat findings for Arizona housing market

Friday, February 24, 2012

Arizona bills target home-affidavit law

But what he and many others feared turned out to be a dud.

The issue wasn't home values -- always a touchy subject -- but a requirement for an affidavit declaring the property is the owner's primary residence. Failure to return the affidavit could result in property taxes going up as much as $600 a year.

Swanson, a Realtor, said he was aware of the pending change and planned to notify his clients of it in his February newsletter. He, like others in the real-estate industry, worried homeowners would not scrutinize the annual statements and either toss them in a file or throw them away, risking a hit on their property taxes.

But when Swanson got his own valuation notice, there was no affidavit.

That's because the county assessors, who send out the valuation notices, didn't follow through on the affidavit, a provision of the Legislature's "jobs bill" that passed last year.

"The cost of doing it would have been considerable," Maricopa County Assessor Keith Russell said.

Besides, lawmakers had already signaled they intended to repeal the requirement because it was burdensome, Russell said, so it made little sense to whipsaw homeowners with a new requirement, only to walk it back. The result has been confusion in the real-estate ranks, said Tom Farley, CEO of the Arizona Association of Realtors. Those with long memories remember the debate at the Capitol in early 2011, when Farley warned that the affidavit could be easily overlooked and lead to unintended tax hikes.

That's because homeowners who actually live in their homes, as opposed to renting them out, automatically qualify for a rebate of up to $600 a year. Under last year's legislation, if a property owner didn't return the affidavit, he or she would lose the rebate.

"Our advice to homeowners right now is to sit tight," Farley said. "We're hoping this provision from last year's law will be repealed and a more targeted notice will be put in its place."

Lawmakers are speeding through two bills to do just that. One, Senate Bill 1217, has already passed the Senate and is awaiting a vote of the full House. The House version, House Bill 2486, which essentially does the same thing, is now in the Senate for action.

Rep. Debbie Lesko, R-Glendale, proposed the affidavit as a way to ferret out people who claim multiple properties as their primary residence and wrongly get a tax break.

It was rolled into the jobs bill to offset the money the state would lose from property-tax cuts for business and agriculture. Lawmakers figured the state would save $39 million a year by not granting the rebate to rental properties.

by Mary Jo Pitzl - Feb. 22, 2012 10:21 PM The Republic | azcentral.com

Arizona bills target home-affidavit law

Investors have eye on McDowell Corridor - USATODAY.com

It was standing-room only at a recent meeting of the Scottsdale City Council Subcommittee on Economic Development, where project representatives gave updates on their plans to kick-start revitalization on McDowell.

Residents learned that there already is new investment in the area and that more is on the way. In all, the corridor has attracted about $138million in private investment money in the past two years, said Jim Mullin, the city's economic-vitality director.

Those investments include apartment projects by Mark-Taylor and Chason Development, Chapman Ford's continued expansion, Fry's upcoming renovation, Comerica Bank, Chase Bank's expansion, Certified Benz & Beemer, and Paul's Ace Hardware renovation.

"There are two properties in escrow that, when announced, will bring the total to $150million, all since the city's Economic Development Department reorganization in November 2010," Mullin said.

That total doesn't include two major projects planned at SkySong, the Arizona State University Scottsdale Innovation Center.

And rising above it all could be an elevated trail in the center of McDowell that would go from the Indian Bend Wash just east of Miller Road to 64th Street at Papago Park and could include a 3,000- to 4,000-seat amphitheater at Papago Park. The proposal could be considered by voters in a bond proposal next year.

Current and future investments are aimed at bringing the McDowell Corridor "back to where it wants to be," Mullin said.

Mayor Jim Lane said there are no subsidies from the city in any of the projects involving that $138million investment.

New dealership

In 2008, Penske Automotive Group Inc. closed its Scottsdale Jaguar and Scottsdale Land Rover dealership at 6725 E. McDowell. Last November, Certified Benz & Beemer purchased the property from Penske and moved its pre-owned luxury-auto business from Mesa to McDowell.

"We started out in Mesa back in 2006, and we had 30 cars and 10 employees," manager Normand Neal said.

"Today, we have about 200 cars and over 40 employees, and we're estimating our annual sales this year to be about $45million."

A Scottsdale address better suits the business because of its focus on luxury autos, he said.

New residential

Chason Development, an upstate New York apartment developer, has purchased from Pitre Properties Ltd. a 5-acre site at the northwestern corner of McDowell and 68th Street. What was once an auto dealership will be transformed into a high-end apartment complex.

Zoning attorney John Berry said Chason plans to invest $25million in the project, which will include 220 units in one-, two- and three-story buildings, and reuse the existing parking garage.

The units along McDowell will feature stoops, or porches, with steps to bring the "activity out front."

"This is something we haven't seen in Scottsdale yet," Berry said.

The project would provide access to the nearby canal and could include landscaping the canal, he said.

In the meantime, Mark-Taylor expects to begin demolition next month to make way for its 536-unit luxury-apartment complex on 27 acres at the southeastern corner of 74th Street and McDowell.

The project represents a $75 million investment, and rents will average about $1,200 a month, said Scott Taylor, Mark-Taylor's president.

The project already has spurred commercial redevelopment in the area.

Fry's spokeswoman JoEllen Lynn said the Fry's store on McDowell west of Hayden Road will be remodeled and expanded in anticipation of the increased population in the area.

Work should begin in June with completion slated for January.

SkySong

Employment at SkySong has reached more than 1,000, and it has generated more than $397million in economic impact for the city since its inception, according to a new report from the Greater Phoenix Economic Council.

The complex, at the southeastern corner of Scottsdale Road and McDowell, now includes more than 70 companies and has reached 97 percent occupancy.

The foundation expects to have a third office building and a 325-unit apartment complex under construction at SkySong in the coming months.

Construction permits should be obtained within 90 days for the apartments, said Don Couvillion, vice president of real estate for the ASU Foundation.

Pre-leasing has begun for the third office building, SkySong III, he said.

By Edward Gately, The Republic|azcentral.com Feb 23, 2012

Investors have eye on McDowell Corridor - USATODAY.com

Rising sales point to a stronger year for housing

Sales of previously occupied homes are at their highest level since May 2010. More first-time buyers are making purchases. And the supply of homes fell last month to its lowest point in nearly seven years, which could push home prices higher.

Sales have now risen nearly 13 percent over the past six months. While they are still well below the 6 million that economists equate with a healthy market, the gains have coincided with other changes in the market that suggest more sales are coming.

"The trend is clearly upward," said Ian Shepherdson, chief U.S. economist at High Frequency Economics.

The National Association of Realtors said Wednesday that re-sales increased 4.3 percent last month to a seasonally adjusted annual rate of 4.57 million.

Single-family home sales rose 3.8 percent. And the number of first-time buyers, who are critical to a housing recovery, increased slightly to make up 33 percent of all sales. That's still below 40 percent, which tends to signal a healthy market.

One concern is that the market is still saturated with homes at risk of foreclosure, which lower broader home prices. Those increased to make up 35 percent of sales.

But the supply of homes on the market has plunged to 2.3 million, the lowest since March 2005. At last month's sales pace, it would take more than six months to clear those homes, consistent with a healthy housing market. Fewer homes on the market could help boost prices over time.

Most economists said the January report was encouraging, especially when viewed with other recent positive housing data.

Mortgage rates have never been lower. Homebuilders are slightly more hopeful because more people are saying they might be open to buying this year -- and they responded in January to that interest by requesting more permits to construct single-family homes.

"The rise in existing-home sales in recent months adds to the indication from housing starts, building permits and homebuilder sentiment that the sector has improved modestly since the middle of 2011," said John Ryding, an economist at RDQ economics.

Much of the optimism has come because hiring has picked up. More jobs are critical to a housing rebound. In January, employers added 243,000 net jobs -- the most in nine months -- and the unemployment rate fell to 8.3 percent, the lowest level in nearly three years.

Analysts caution that the damage from the housing bust is deep and the industry is years away from fully recovering. Since the bubble burst, sales have slumped under the weight of foreclosures, tighter credit and falling prices.

Many deals are also collapsing before they close. One-third of Realtors say they've seen at least one contract scuttled over the past four months. That's up from 18 percent in September.

Realtors say deals are collapsing for several reasons: Banks have declined mortgage applications. Home inspectors have found problems. Appraisals have come in lower than the bid. Or a buyer suffered a financial setback before the closing.

Sales rose across the country in January. They rose on a seasonal basis by nearly 9 percent in the West, 3.5 percent in the South, 3.4 percent in the Northeast and 1 percent in the Midwest.

by Derek Kravitz - Feb. 22, 2012 06:15 PM Associated Press

Rising sales point to a stronger year for housing

Expert: Building jobs on rebound

In 2011, Arizona construction jobs increased by 1.6 percent, the 11th-highest increase among the 50 states and the District of Columbia, according to Anirban Basu, chief economist for Arlington, Va.-based trade group Associated Builders and Contractors Inc.

The top-ranked state in 2011 for construction-job growth was North Dakota, where employment increased by 5.7 percent, due primarily to energy-related projects, Basu said.

Basu was among a group of economists, journalists and industry leaders who spoke at the 2012 BizCon convention, held Tuesday and Wednesday at the Arizona Biltmore hotel in Phoenix.

"The construction industry is now beginning to recover," he said.

Basu pointed to three key indicators of the construction industry's health, all of which have turned positive in recent months.

Construction employment had been on the rise in early 2011 but began to decrease in the summer, an aftershock from what Basu described as a "soft patch" in the nation's economic recovery, caused by high gas and food prices and a bitter fight in Congress over raising the debt ceiling.

The downward trend ended in November, and construction employment has since increased nationwide, he said.

"Construction is adding jobs in the country again," Basu said.

Another key indicator known as the Construction Backlog Index showed considerable recovery in 2011, he said, although it ended the year down slightly from its annual peak.

The index, which Associated Builders and Contractors releases quarterly, is an average of the backlog of work all U.S. construction companies have accrued, measured in months. An increase in the backlog is a sign of improvement.

In the fourth quarter, the reported index was 7.8 months, Basu said, down slightly from 8.1 months in both the second and third quarters but up 10.9 percent compared with the fourth quarter of 2010.

The third key indicator, known as the Architecture Billings Index, measures changes in the average amount of money architectural firms bill clients in a given month.

The American Institute of Architects, a Washington, D.C.-based trade group, reported slight architecture-billings increases in November and December following several months of decline.

Architecture billings are significant because they are a reliable leading indicator of future construction work, Basu said. He described the boost in economic indicators as a positive, early sign of recovery but said the industry still has a long way to go.

"We are on the mend," Basu said.

by J. Craig Anderson - Feb. 22, 2012 05:27 PM The Republic | azcentral.com

Expert: Building jobs on rebound

Paradise Valley residents get first glimpse of resort plan

Specifics are still minimal, but officials with JDM Partners LLC expect more information to be available when their special-use permit is submitted in the next week.

Stephen Earl, zoning counsel for the developer, said the firm's permit application is nearly complete. The Town Council met Friday to go over plans for the resort, at 56th Street and Lincoln Drive, on the northeastern side of Camelback Mountain. The resort closed in September 2004, but residences on the property are still in use.

JDM agreed to buy the 68-acre property late last year.

"We've been working intensely on this for the last month and a half, but we're not quite ready to file the (special-use permit)," Earl said. "We have a draft and hope to file very soon, but we don't know yet."

JDM, co-owned by sports businessman Jerry Colangelo, has projects that include Chase Field, US Airways Center and Comerica Theatre.

The company's purchase of the Wigwam resort in Litchfield Park about two years ago marked its first foray into the hospitality industry. The parties involved with the resort in Paradise Valley are looking to JDM's experience in the renovation of the 82-year-old Wigwam as a touchstone for Mountain Shadows.

Architect Erik Peterson, principal with PHX Architecture, said the team that worked on the Wigwam is working on the Mountain Shadows project.

Litchfield Park officials have said that sustainable changes were made to the Wigwam's pool areas, restaurants and bars, and that events like golf tournaments are beginning to draw more visitors to the Southwest Valley city.

"The Wigwam was rundown, broken and in disrepair," Peterson said.

The Mountain Shadows resort plan for renovation includes residential and retail components.

Peterson said the site will be reminiscent of California resort destinations like those in Santa Barbara.

Paradise Valley Town Councilman Michael Collins said past plans formally submitted for the Mountain Shadows site never truly captured the opportunity for the historic resort to be a legacy project -- something that transcends rudimentary development calculations, with the owners making a long-lasting contribution to the fabric and quality of life of the community.

Collins served on the Planning Commission for three years before being elected to the council in 2010.

He said the current concept embraces the proposed 2012 General Plan update, with a low-density resort town center that provides amenities to Mountain Shadows residents and includes a limited amount of community-oriented commercial services.

The General Plan update goes before voters on March 13.

"None of the plans before spoke to the true heritage of the site as a community gathering place," he said.

by Philip Haldiman - Feb. 23, 2012 10:30 AM The Republic | azcentral.com

Paradise Valley residents get first glimpse of resort plan

Wednesday, February 15, 2012

Builder Sentiment Up Again « Eye on Housing

Monday, February 13, 2012

California Mortgage Applicants Tops in the Nation With Highest Credit Scores | Mortgage News | Daily National and State Headlines

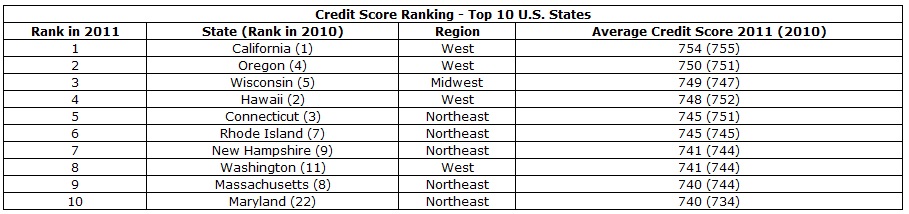

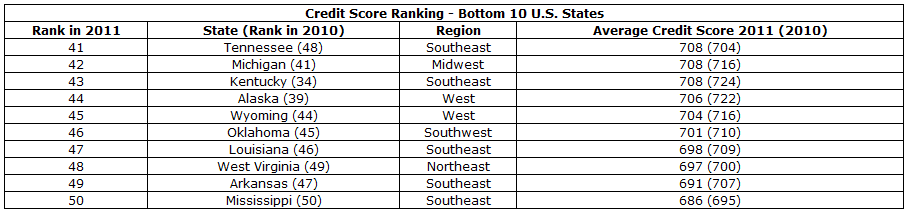

A study conducted by Mortgage Marvel has concluded that California mortgage applicants, for the second year in a row, have the highest average credit scores in the nation at 754—a full 24 points above the national average of 730. Mississippi mortgage applicants, again for the second year in a row, had the lowest average credit score of 686, 44 points below the national average. The information was compiled by analyzing more than 330,000 mortgage applications received in 2011 by clients of Mortgagebot, a D+H company. Mortgagebot is the owner of Mortgage Marvel and the provider of the PowerSite suite of integrated point-of-sale solutions.

Of the states with the highest average credit scores, four are in the West and five are in the Northeast. There was only one state in the top 10, Wisconsin, from another region (Midwest).

The Southeast occupied five of the 10 lowest credit score positions. Mississippi, for the second year in a row, had the nation's lowest average credit score.

Arizona gets $1.6 billion in mortgage fraud settlement

Arizona's portion of a nationwide, $26 billion settlement with the country's five biggest lenders will be $1.6 billion, the third-largest share after hard-hit California and Florida.

Most of the money in that deal, announced Thursday after negotiations by attorneys general across the country, will be paid out by lenders in the form of principal reductions -- cutting the amount of money that certain borrowers are responsible for repaying on their home loans. Lenders will also dedicate part of the funds to reducing other borrowers' interest payments and will issue $2,000 payments to people who lost homes in improperly managed foreclosures.

A second, smaller settlement with Bank of America ends a state lawsuit over the bank's lending practices and will fund consumer protection and future investigation of mortgage lending.

The national settlement will not deliver assistance to every struggling homeowner. It applies only to mortgages held by the five large lenders and does not extend to borrowers with loans backed by federal mortgage giants Fannie Mae and Freddie Mac, who make up more than half of all mortgage-holders.

Still, federal officials estimate that 60,000 Arizona borrowers could see assistance with their principal or interest rates. And the settlement marks the first time lenders have agreed, on any large scale, to forgive money owed by underwater borrowers.

"These settlements will help Arizona homeowners and the state's economy that is so tied to housing," Arizona Attorney General Tom Horne said. "I think we are holding banks accountable."

Who benefits

Only borrowers with loans owned by BofA, Citigroup, the former GMAC (now known as Ally Financial), JPMorgan Chase and Wells Fargo are eligible for aid from the national settlement. The five lenders are responsible for contacting eligible homeowners in the coming month to offer assistance.

The deal requires the banks to reduce loans for about 1 million households that are at risk of foreclosure. The lenders will also send $2,000 each to about 750,000 Americans who were improperly foreclosed upon from 2008 through 2011. The banks will have three years to fulfill terms of the deal.

Borrowers who had loans originally issued by the five participating lenders but then had their mortgages sold to another bank aren't eligible.

About $1.3 billion of Arizona's $1.6 billion will go toward principal reductions. Federal officials estimate the national average for principal reductions will be $20,000 per loan. In Arizona, where home prices have fallen 60 percent, many homeowners are likely to be underwater by far more than $20,000.

Horne said homeowners whose mortgage balances are 175 percent or more of their current home values and who are current on their payments will probably be the first to receive principal reductions.

Nationally, at least $17 billion of the settlement is to go directly to reducing principal. Details on how much lenders will reduce the amount borrowers owe aren't available yet.

About $86 million of Arizona's share of the deal will go toward offers to modify borrowers' loans by lowering interest rates. An additional $110.4 million has been set aside to compensate Arizona borrowers who lost their homes to foreclosure from 2008 to 2011 and believe they suffered unfair treatment by lender servicers. Each borrower is eligible for $2,000.

Horne said that any former homeowner who thinks he or she qualifies for the $2,000 should contact the lender and that little documentation will be required to receive this compensation.

Shaun Donovan, secretary of the U.S. Department of Housing and Urban Development, said 55,000 former Arizona homeowners will qualify for the $2,000 payments. During the housing crash, more than 175,000 borrowers have had Arizona homes taken back by lenders, though that figure includes loans held by Fannie and Freddie.

Arizona will receive $102.5 million to be used for mortgage-fraud investigations and consumer counseling.

Arizona State University's real-estate analyst Mike Orr said reducing mortgage principal for underwater homeowners will "significantly bolster the housing market" if it entices more people to stay in their homes and keep making payments.

Almost 50 percent of the state's homeowners are underwater, meaning homeowners owe more than their homes are now worth because values have plunged by more than half since the market's peak in 2006.

Patricia Garcia Duarte, president of the Phoenix-based housing non-profit Neighborhood Housing Services, said the settlement looks like a lot of money to help both former and current homeowners. However, she said the damage done to Arizona families and communities has been extreme.

"The funds will definitely help," Garcia Duarte said. "But how the funds are spent in Arizona will determine the success in our housing recovery."

BofA lawsuit

Arizona is also receiving $10 million through the settlement of a lawsuit with BofA over allegations of mortgage fraud and deceiving borrowers trying to obtain loan modifications.

The money will go toward funding criminal loan investigation and consumer education. Horne said it's not clear yet whether the BofA borrowers who served as plaintiffs will be compensated from the $10 million or the state's $1.6 billion from the national settlement.

The suit, filed in December 2010 by the state's attorney general, had to be reconciled for Arizona to participate in the national settlement.

"If we had continued to litigate the BofA lawsuit, we might have recovered more money," Horne said. "But the lawsuit could have taken another five to six years. By settling now and joining the national settlement, more homeowners will receive help sooner."

Enforcement

The deal establishes a regulatory group of local and federal government agencies. It calls for North Carolina's banking regulator Joseph Smith to monitor lenders for compliance.

Horne said lenders will be subject to hefty fines if they don't follow through with the actions to help homeowners laid out in the settlement.

Federal officials said states could receive more funding if more mortgage firms sign onto the agreement. One estimate is for the national settlement to grow to $40 billion if the next nine large lenders join in. The only state not part of the national settlement is Oklahoma. Arizona, California, Florida, New York and Nevada were the last states to join. Arizona's negotiations with BofA over the mortgage-fraud lawsuit went on until almost 11 p.m. Wednesday night.

President Barack Obama said in a speech Thursday that the $26 billion settlement will allow the nation's biggest banks, "banks rescued by taxpayer dollars," to right wrongs committed in making loans and foreclosing on homeowners during the past several years.

"These banks will put billions of dollars towards relief for families across the nation. They'll provide refinancing for borrowers that are stuck in high interest-rate mortgages," Obama said. "They'll reduce loans for families who owe more on their homes than they're worth. And they will deliver some measure of justice for families that have already been victims of abusive practices."

12 News reporter Melissa Blasius contributed to this article.

by Catherine Reagor - Feb. 9, 2012 09:28 AM The Republic | azcentral.com

Arizona gets $1.6 billion in mortgage fraud settlement

Wednesday, February 8, 2012

PennyMac posts $19.6 million in earnings, plans to expand correspondent lending | HousingWire

Moorpark, Calif.-based PennyMac posted net income for the fourth-quarter of $19.6 million, or 70 cents a share, beating analysts estimates. That compared to net income of $7.3 million, or 43 cents a share, a year ago.

On average, analysts expected the company to earn 65 cents a share, according to Thomson Reuters I/B/E/S.

For the 2011 fiscal year, PennyMac earned $64.4 million, or $2.41 a share, on total net investment income for the year of $128.6 million.

PennyMac said it expects 2012 mortgage originations in the United States to hit the $1 trillion mark, with $300 million through coorespondent lending. However, new regulatory and capital requirements are causing the big banks to retreat from the mortgage industry, PennyMac said. The result is more opportunity in the mortgage servicing space, the real estate investment trust said, especially with the industry in a period of reform.

"PennyMac will continue to pursue distressed whole loan investments, while also seeking new opportunities, such as mortgage servicing rights," the earnings report states. "Correspondent volume should steadily increase as this becomes a greater component of PennyMac's earnings over the year."

In the most recent fourth quarter, PennyMac's fundings in the correspondent lending side of the business hit $991 million with rate locks of $1.3 billion. Conventional loans made up $566 million of total correspondent funding, followed by Federal Housing Administration loans, which made up $410 million, and jumbo loans, which hit $15 million.

The pre-tax gain of $7.4 million tied to the correspondent lending segment is attributed to conventional and jumbo loans.

During the quarter, PMT agreed to purchase a pool of mortgage loans and REOs with an unpaid principal balance of $49 million. By year end, the company's portfolio of residential mortgage loans, REOs and mortgage-backed securities were valued at $826 million.

Total investment income for 4Q hit $38.7 million.

by Kerri Panchuk Housingwire Feb 8, 2012

PennyMac posts $19.6 million in earnings, plans to expand correspondent lending | HousingWire

Tuesday, February 7, 2012

Arizona housing experts guarded but hopeful

The annual Arizona conference, where real-estate industry leaders convene and predict the market's movements, has been the most important summit on Valley real estate since the beginning of the housing boom nearly a decade ago. But this year, the conversations and atmosphere were different.

The many experts who spoke were more low-key and pragmatic than they'd been during the last five years. Few offered any guesses at when home prices might rebound to boom levels.

That may have been because so many past predictions have been wrong.

At the conference in 2007, the forecast was for metro Phoenix home prices to recover to boom levels by 2010. Instead, prices continued to drop until late last year.

Year after year, as the housing crash and economic downturn worsened, analysts and investors tried to forecast when the market would rebound. By 2011, the mistaken predictions had become a subject of some wry humor.

This year's panel discussions with local and national real-estate investors and developers, held last week in downtown Phoenix, revolved more around hope that the housing market had finally bottomed out. That's because, just as housing helped pull down the rest of the real-estate market, economists and experts believe its recovery will help lead other sectors out of the crash. This idea was echoed again and again during the event.

"Many people believe we are three-fourths through the foreclosures," said Greg Vogel, CEO of Land Advisors, during a discussion on homebuilding. "There's anticipation this spring will be better for housing."

Housing

Metro Phoenix home prices ticked up at the end of last year but are still below 2000's level.

No one at the ULI conference ventured a guess at how long it would take the region's median existing home price to rebound to $267,000, the record it reached in late 2006. The last home-price prediction from the event was last year, when housing analysts called for metro Phoenix home prices to return to pre-boom levels by 2015.

Phoenix's current median existing-home price is $120,000, where it was in 1999. The last pre-boom median is considered to be the 2003 figure -- $155,000.

"Phoenix is in the middle of the pack for a housing recovery," said Steve Hilton, chairman of Scottsdale-based Meritage Homes, comparing the region with other parts of the country.

Homebuilding

For the past few years, the consensus at the ULI conference was that foreclosures would have to slow for home prices to climb and for homebuilding -- a major Valley industry and a source of many jobs -- to begin recovering to pre-boom levels.

Fewer than 7,000 homes were built across the Valley last year, according to the Phoenix Housing Market Letter. That compares with a record 64,000 in 2006. A pre-boom building pace for new homes in the region is closer to 35,000.

Homebuilders at the conference agreed building will pick up this year but said it will be a while before buyers go back out to the fringes of metro Phoenix, no matter how inexpensive the home is or how low gas prices go.

"There are fringe parts of Phoenix where we couldn't make a profit on a new home even if the land was free," said Hilton.

Builders and investors continue to buy land in metro Phoenix in anticipation of the homebuilding market's recovery.

Vogel said $95 million was spent on Phoenix-area home lots ready for construction in 2011.

Apartments

Investors are also buying metro Phoenix apartments again. Developers are building multifamily housing projects, but only in prime central locations. These are positive signs, but none of the apartment experts went as far to say the market was on the rebound.

New complexes, with smaller units and pricier-than-average rents, are going up in central Scottsdale and Phoenix's Biltmore area.

Alliance Residential is building apartments at 25th Street and Camelback Road, where Donald Trump once planned a condominium tower.

Jay Hiemenz of Alliance said when his company committed to the site last year "it was a leap of faith" because Phoenix's apartment market was still struggling.

But Jerry Brand of apartment developer Greystar said Phoenix has great rent-growth potential during the next few years due to the region's increase in renters who either lost homes to foreclosure or don't want to buy no matter how low prices and interest rates fall.

Commercial real estate

Metro Phoenix's retail market started to struggle as soon as residential foreclosures jumped, and it became evident too many speculative homes had been built. Empty shopping centers still dot the Valley in neighborhoods with too many empty homes.

Dan Gardiner, a retail expert with Phoenix Commercial Advisors, said new retail centers went up on the region's fringes right behind the construction of new homes. But when no one moved into the houses, the retailers left or decided not to move in.

He said those neighborhoods will have to fill up before retailers return to those suburbs.

The markets for office and industrial space are more closely tied to Phoenix's job market than its housing market. As the region lost jobs during the recession, offices and warehouses emptied out. The vacancy rate for Valley office space is hovering around 20 percent, according to Phoenix real-estate brokerages.

These two sectors of the real-estate industry are expected to be the last to recover, and the timing depends on metro Phoenix's job growth.

"It's all about putting butts in seats for the office market," said Pete Bolton, managing director of Grubb & Ellis Phoenix. "Phoenix continues to be a cheaper alternative than California for companies transporting and warehousing products."

Christopher Toci of Cushman & Wakefield joked that his market predictions for office and industrial from a few years ago would be correct if you turned them upside down now -- his forecasts for increases were about as big as the market's actual decreases in leasing and sales.

The final takeaway from the conference was that growth would continue in metro Phoenix, but it would be slower than expected and different from past cycles.

"The balance between new housing near new jobs is more important than ever," said Steve Betts, chairman of ULI Arizona.

Unlike last year or 2009, the experts gave up on predicting the timing of a recovery and focused on the first real positive market signs they have seen in years.

"The new homes we sold in 2005, we re-bought in 2007," said Drew Brown, chairman of Scottsdale-based DMB Associates, developer of Verrado in Buckeye and DC Ranch in Scottsdale. "Now, we are finally selling those homes again."

by Catherine Reagor - Feb. 3, 2012 11:21 PM The Republic | azcentral.com

Arizona housing experts guarded but hopeful

Apartments are planned

The proposed Bauhaus Flats & Studios would be built on 4.4 acres northeast of Scottsdale and Thomas roads and on an adjacent ¾-acre parcel on 73rd Street. It would include about 10,000 square feet of commercial space.

The shopping plaza, built in 1960, includes a florist, locksmith, rental-car agency, restaurant, hobby shop and Plato's Closet clothing store. More than half of the 40,251-square-foot plaza is vacant.

Architect Kristjan Sigurdsson of K&I Homes LLC said there is high demand for apartments in the area because virtually no units have been built downtown in the last decade.

"This would be a nice addition to that whole housing market," he said, adding that the Bauhaus apartments would be within walking distance of neighborhood commercial services.

The area has a diverse mix that includes a supermarket, hardware store, coffee shop, bowling alley, adult bookstore, car wash, bail bondsman and pawnshops.

The Sphinx Ranch Gourmet Gift Market, which has operated in the Valley for 61 years, is two doors to the north. Jason Heetland, Sphinx Ranch owner, said it's time for something to be done to update the area.

"I would hope that the current tenants would have a first right of refusal to lease space" in the Bauhaus' shops, Heetland said.

Area business owners have struggled for nearly a year with Scottsdale Road streetscape improvements, he said. The developers are seeking a rezoning for the Plaza 777 site from commercial to planned-unit development.

The development team includes architect Sigurdsson, Tom Frankel and Keith Nygren. KT777 LLC bought the plaza for $2.58 million.

No date has been set for the rezoning hearings.

by Peter Corbett - Feb. 3, 2012 02:33 PM The Republic | azcentral.com

Apartments are planned

Foreclosures hit 4-year low in metro area

Last month, there were 2,263 foreclosures, or trustee sales, in the region, according to real-estate research firm Information Market. Pre-foreclosures, also known as notice of trustee sales, fell to 2,932, the lowest level since the summer of 2007.

A year ago, both foreclosures and pre-foreclosures were double what they are now. The number of pending foreclosures is one-third of what it was a year ago. Only 15,000 active foreclosures are making their way through the process now.

Some housing analysts continue to talk about shadow inventory, characterized as essentially unexpected foreclosures that will hit the market just as it begins to recover. But that phenomenon can't be tracked now.

Tom Ruff, analyst with Information Market, tracks notice of trustee sales, trustee sales and homes sold at the foreclosure auction daily. He said he sees no sign of a shadow-inventory problem in metro Phoenix.

The region's mortgage-delinquency rate has also fallen during the past year, meaning fewer homeowners are falling behind on their payments. Some market watchers say banks just aren't moving on many foreclosures and are not reporting all the loans borrowers are missing payments on, but lenders deny this.

So going by the numbers and word of lenders, it looks like the worst of metro Phoenix's foreclosure crisis is behind it.

Economic barometer

The southeastern corner of 25th Street and Camelback became a Christmas-tree lot in the mid-1980s during an office-construction boom in metro Phoenix, and the first Esplanade tower went up west of it. Then came the real-estate crash of 1990. The lot at 25th Street remained empty except around the holidays.

As the Phoenix office market rebounded in the mid-1990s, the lot was developed into a shopping center with an athletics store and two popular eateries, the Hard Rock Cafe and Marco Polo Supper Club.

But then came the slight downturn from the dot.com bubble, and by 2003, the center's stores and both restaurants had closed. Developer Donald Trump proposed a high-rise resort for the corner during the boom in 2005 but walked away from the project in 2006.

Last year, Alliance Residential bought the lot out of foreclosure.

The firm is building a 270-unit upscale-apartment complex there.

by Catherine Reagor - Feb. 3, 2012 02:39 PM The Arizona Republic

Foreclosures hit 4-year low in metro area

Economist sees hope for Ariz. recovery

“When this state gets cooking, it’s cooking, and I think the winds are beginning to change,” he said Friday at the annual economic-forecast meeting of Westmarc, a West Valley coalition of business owners, government leaders and educators, at ASU’s West campus.

A year ago, Hoffman told Westmarc members that he was seeing the first “signs of life” in the state’s economy but did not expect much improvement until at least 2013.

Hoffman, director of ASU’s L. William Seidman Research Institute, sounded more upbeat this year, especially with a report showing that the national unemployment rate had dropped to 8.3 percent.

“The nation, at least temporarily, appears to be raining jobs,” he said. “We’ve created a lot of jobs in the last month.”

Consumer spending is expected to remain in the modest range, and some analysts predict that housing starts will stay in the “trough” for a prolonged period, but Hoffman again is picking up on winds of change.

“There is a buzz in the air,” he said, speaking of real-estate trends. “It may be a low buzz right now — it may be beginning to accelerate — but it’s a different attitude, in my experience, from 2009 to 2010 or even 2011.”

He put chances at a double-dip recession below 15 percent, although risks from the European financial crisis, the potential for worldwide political shocks and other unexpected events could affect that outlook.

Hoffman noted that an understanding of the Great Recession and its place in history is crucial to any forecasts for the economy.

“It absolutely sets the stage for Arizona and provides some understanding of where we’re likely to go from here,” he said.

A chart showing recessions in the post-World War II era underscored his point. In prior recessions, the economy tended to roar back, at points even exploding with growth, after about two years. Four years after the start of this recession, the nation is struggling to get back to prior levels of consumption.

“When I look at (this chart), it says very clearly to me that this recession, both in depth and duration, is simply unlike any recession that we’ve experienced in the postwar period,” Hoffman said.

The huge drop in household wealth — estimates put the loss in home-equity wealth at $7.38 trillion — is a major cause of the slow recovery.

“Never has household wealth evaporated the way it did this time,” Hoffman said. “Consumption is determined by how we view our wealth portfolio. So we have a vicious cycle — no spending, no jobs.”

Employment also plummeted, and people stopped moving to Arizona, an outcome that was a shock to one of the fastest-growing states in the country.

But the labor market is improving, and Arizona ranks seventh in the nation among states that are adding jobs.

“Clearly, it’s getting better,” Hoffman said.

by Lesley Wright - Feb. 3, 2012 03:42 PM The Republic | azcentral.com

Economist sees hope for Ariz. recovery

Thursday, February 2, 2012

Obama unveils plan on housing

One immediate goal of the so-called Homeowner Bill of Rights is to enable more borrowers to refinance, reduce their monthly payments or pay off their loans sooner, rebuilding equity lost in the housing crash.

The legislation announced Wednesday also would create a standardized system for mortgage applications and would expand bulk sales of government-owned foreclosure homes to investors, with the goal of decreasing the number of empty homes.

The bill would expand on a refinancing plan announced in October. That plan directed federal mortgage giants Fannie Mae and Freddie Mac to allow refinancing for mortgage-holders even if their homes are underwater by any amount. But the plan could not be offered to homeowners with mortgages privately held by banks. The new legislation would allow those homeowners to refinance as well, with the associated costs covered by a fee on major lenders.

Nearly 3.5 million U.S. homeowners with private mortgages, who owe more than their houses are now worth, could be eligible if the legislation passes.

However, the proposal is expected to meet strong opposition from Republicans. The program would cost between $5 billion and $10 billion.

"Millions of families who did the right and responsible thing, folks who shopped for a home that they could afford, secured a mortgage, made their payments each month -- they were hurt badly by the irresponsible actions of other people who weren't playing by the same rules," Obama said Wednesday.

"It is wrong for anybody to suggest that the only option for struggling, responsible homeowners is to sit and wait for the housing market to hit bottom," he said.

Political analysts see the new Obama plan as a direct response to Republican presidential candidate Mitt Romney's recent comments in Las Vegas.

Romney said the government shouldn't try to help homeowners by stopping foreclosures, instead suggesting letting the market hit bottom so investors buy the houses and rent them out until the housing turns around.

"This plan is a win-win for the president. He is clearly responding to the Romney statement that the best way to handle the housing crisis is ride it out," said Bruce Merrill, political-science analyst and pollster with the Phoenix-based Morrison Institute. "The battleground for the presidential race is the middle class, and there is clearly nothing more important to that group than homeownership."

Merrill said the housing issues shouldn't be a political one because helping homeowners is clearly what is good for the country.

House Speaker Republican John Boehner was critical of the plan Wednesday, saying none of the president's previous proposals to help the housing market has worked.

Many metro Phoenix homeowners have already started to apply for the refinancing program available for loans backed by Fannie and Freddie. Those refinanced loans are expected to be available in March. The program allows homeowners, no matter how underwater they are, to refinance to current low interest rates, as long as they haven't missed more than one payment in the past six months.

In the Phoenix area, where home values have plummeted 60 percent since the boom of 2006, almost half of all homeowners owe more than their homes are worth.

Details of Obama's proposed legislation include:

Allowing eligible, underwater homeowners with private mortgages to refinance.

Banks would potentially pay to finance part of the program.

Standardizing the loan application and borrowing process.

This is a move to cut down on mortgage fraud and protect borrowers from being overcharged or placed in risky loans they don't understand. The federal government's new consumer-protection group would oversee this process.

Allowing Fannie and Freddie to sell foreclosure homes in bulk.

The sales would run through a new auction process instead of happening one at a time. This would draw more big investors to buy the houses and turn them into rentals. The goal is for fewer foreclosure homes to sit vacant for long periods of time. However, such bulk purchases could drive down an area's home prices.

Separately, Obama said Wednesday that the Home Affordable Modification Program he announced in Mesa three years ago hasn't been nearly as successful as he hoped. That program encouraged lenders to modify loans, decreasing interest rates or extending the repayment terms to help struggling borrowers lower their payments.

But banks have made far fewer modifications than expected. So, the president said, the loan-modification program is being extended by a year -- it will expire at the end of 2013 -- and expanded to help more borrowers who didn't meet the income requirements before.

But most importantly, Fannie and Freddie will be given more incentives to begin reducing the principal on loans they own through loan modifications.

Fannie and Freddie have had a policy of not allowing principal reductions.

"I have no idea whether the legislation has a chance to pass," said Mike Orr, director of the Center for Real Estate Theory and Practice at Arizona State University's W.P. Carey School and publisher of the Cromford Report.

"However, I would say that helping underwater homeowners, who are still current on their payments, refinance into lower interest-rate loans is the best thing the government could do for the market."

by Catherine Reagor - Feb. 1, 2012 11:20 PM The Republic | azcentral.com

Obama unveils plan on housing

Mom who lost 3 kids in plane crash about to lose home, too

The news came little more than a month after her three young children and their father were killed in a Thanksgiving eve plane crash in the Superstition Mountains.

Arizona plane crash in Superstition Mountains

The ridge where it happened looms large in the view from Perry's lawn in Gold Canyon, a largely retirement-oriented community about 40 miles east of Phoenix.

"I have a reminder outside my door every day of how they passed away," Perry said.

Morgan, 9, Logan, 8, and Luke, 6, were flying to Safford from Mesa to spend the holiday with dad Shawn Perry. Two of his co-workers, Russel Hardy and Joseph Hardwick, also perished. There were no survivors.

"There are a lot of memories here, and I personally find that very comforting," Perry said Wednesday. "I look at pictures, and I visualize (the children) around the house. It's going to be hard to leave."

Like many Arizonans, Perry is saddled with negative equity in her home. And while she was a single mother for two years, divorce-attorney fees nearly wrung her dry, she said.

Perry learned the house would be auctioned while she was seeking a loan modification -- and the date was set for less than two weeks, according to Nicole Hamming, Perry's friend and real-estate agent.

Within 10 days, Hamming said, they managed to secure a short-sale contract, which is now pending. A second buyer is also lined up.

Perry remains in a tight spot, Hamming said, but "at this point, we have to try to help her go forward."

Friends worry she's not emotionally ready to pack up the children's things. Toys are in the yard, and plastic, brightly colored playsets still flank the fireplace. The children's laundry hasn't been moved.

All will need to be boxed up soon, but Perry can take her time in other ways.

Perry's fellow flight attendants at Delta Air Lines donated enough paid-leave time for her to take a year off, Hamming said.

And Ladies Day Fund, a New Orleans-based charity founded by active and retired Delta flight attendants, has raised more than $12,550 since December by matching donations up to 20 percent. This month, Ladies Day Fund will match donations by 10 percent.

Perry expressed her gratitude for the support and well wishes she's received from across the globe.

While the outpouring doesn't change her situation, she said, it's made her feel closer to the community and given her strength.

"I don't feel angry now," Perry said. "I feel a lot of things ... but I don't want to feel sorry for myself. (I want to) take all the negative energy and use it in a positive way."

How to help

Donate -- Ladies Day Fund, www.ladiesdayfund.com, will match up to 10 percent of donations for every check written to Karen Perry through Feb. 28. Mail donations to Ladies Day Fund Inc., 1000 Bourbon St. #370, New Orleans, LA 70116.

Bid -- Listeners to KSWG 96.3 FM Real Country can bid on a pair of tickets to the sold-out George Strait concert. The auction is from 6:30 to 8:55 a.m. today.

Listen and buy -- A portion of proceeds from iTunes sales of the song "Fly," written by Tina Vallejo in honor of Perry's children, will go to help Perry.

by Lindsey Collom - Feb. 1, 2012 10:13 PM The Republic | azcentral.com

Mom who lost 3 kids in plane crash about to lose home, too

EU blocks $10 billion Deutsche Boerse, NYSE merger

The European Commission, the EU’s executive body, said it was ruling against the merger because the combined exchange would have controlled more than 90 percent of the trading in European derivatives — complex but highly profitable financial products that allow investors to bet on changes in interest rates or the price of oil.

It said that the combined company’s dominance of that market would have made it almost impossible for competitors to offer rival trading systems.

“The merger between Deutsche Boerse and NYSE Euronext would have led to a near-monopoly in European financial derivatives worldwide,” the EU’s Competition Commissioner Joaquin Almunia said in a statement. “These markets are at the heart of the financial system and it is crucial for the whole European economy that they remain competitive.”

The Commission’s decision deals a blow to Deutsche Boerse AG and NYSE Euronext, which hoped combining their businesses would have allowed them to compete better with other large exchanges in the U.S. and Asia.

But it also underlines the profound transformation their businesses — and financial markets as a whole — have undergone over the past decade. Today, the value of outstanding derivatives contracts has surpassed by many times the value of traditional financial products like stocks and bonds.

Deutsche Boerse and NYSE Euronext both managed to build highly profitable businesses out of this trend and today own Europe’s biggest derivatives exchanges. A push from regulators across the globe to push more derivative trades onto exchanges to make the market more transparent has opened even bigger opportunities for established players.

To make the merger acceptable, the Commission wanted the companies to sell either Deutsche Boerse’s Eurex or NYSE Euronext’s Liffe — something they refused.

“This is a black day for Europe and its global competitiveness on financial markets,” Deutsche Boerse Chief Executive Reto Francioni said in a news conference in Frankfurt, Germany.

Francioni added that the decision will prevent the creation of a “globally competitive” European exchange group that would have helped strengthen the Commission’s push for transparent and stable financial markets.

NYSE said in a statement that the two companies are now discussing terminating the merger agreement.

“While we are disappointed and strongly disagree with the EU decision, which is based on a fundamentally different understanding of the derivatives market, it is now time to move on,” NYSE Euronext Chairman Jan-Michiel Hessels said.

The Commission’s decision did not come as a surprise as last month a competition case team recommended the merger should be blocked, based on the combined company’s dominance in the trading of some of the most popular and liquid European derivatives.

But the two exchanges argued that the vast majority of derivatives are traded directly between banks and other investors, or over-the-counter (OTC), rather than on exchanges, providing healthy competition in the overall market.

They also pointed to Chicago-based CME Group, which has a similar dominance over trading in key American derivatives.

But Almunia argued that neither the over-the-counter derivatives market nor CME Group could have been true competitors to a company owning both Eurex and Liffe.

He said derivatives based on U.S. indexes or interest rates traded on the CME were useless for investors trying to hedge against changes in their European equivalents. Over-the-counter trades, he argued, were riskier than exchange-based trades, eliminating then as an alternative to many companies.

Deutsche Boerse announced nearly a year ago that it was looking to buy NYSE Euronext for $10 billion. NYSE Euronext owns bourses in Paris, Lisbon, Brussels and Amsterdam, in addition to New York.

by Gabriele Steinhauser - Feb. 1, 2012 04:57 PM Associated Press

EU blocks $10 billion Deutsche Boerse, NYSE merger

FHFA Takes First Step in Its REO Pilot Initiative | Mortgage News | Daily National and State Headlines

The REO Initiative was developed in conjunction with the U.S. Department of the Treasury, the U.S. Department of Housing & Urban Development (HUD), the Federal Deposit Insurance Corporation (FDIC), the Federal Reserve, Fannie Mae and Freddie Mac. The Initiative was formulated by meetings with stakeholders and a review of more than 4,000 responses to a Request for Information (RFI) seeking input on options for selling single-family REO properties held by the government-sponsored enterprises (GSEs)—Fannie Mae, Freddie Mac—and the Federal Housing Administration (FHA).

“This is an important step toward increasing private investment in foreclosed properties to maximize value and stabilize communities,” said FHFA Acting Director Edward J. DeMarco. “I am grateful for the collaborative effort by the many stakeholders including investors, non-profit organizations, and state and local government officials, who have worked together on this Initiative.”

During the pilot phase, Fannie Mae will offer pools of various types of assets, including rental properties, vacant properties and non-performing loans, for sale with a focus on the hardest-hit areas. The first transaction will be announced in the near-term.

The pre-qualification will require those interested in receiving information regarding specific pilot transactions to meet certain minimum criteria including, but not limited to, (a) financial wherewithal to acquire the assets; (b) sufficient experience and knowledge in financial and business matters to analyze and bear the risks of the investment opportunity; and (c) agreement to keep certain information about the REO and related matters confidential.

Interested investors can register at FHFA’s REO Initiative page to pre-qualify. FHFA is also looking at ways to improve REO sales to homeowners and small investors, enhancing the existing retail sales strategy at the GSEs. Both companies sell the majority of their REO properties to owner-occupants at close-to-market value. The purpose of the pilot phase will be to examine investor interest in various types of assets, including the location, size and composition of pools of assets; the ways in which investors maximize the participation of experienced local firms and organizations that can provide the types of services and support needed to ensure community stabilization; the types of structures and/or financing that improve returns to the sellers as well as home values in impacted markets; and the process by which investors are qualified to and ultimately participate in the sales transactions.

by nationalmortgageprofessional.com Feb 1, 2012

FHFA Takes First Step in Its REO Pilot Initiative | Mortgage News | Daily National and State Headlines

Government Triples Payout to Servicers for Principal Reduction Under Revamp of HAMP | Mortgage News | Daily National and State Headlines

The Making Home Affordable Program deadline will be extended for an additional year, through Dec. 31, 2013. This date conforms to the extended deadline for HARP. The U.S. Department of the Treasury will also triple the incentives provided to investors who agree to reduce principal for borrowers by paying from .18 to .63 cents on the dollar, depending on the degree of change in the loan-to-value (LTV) ratio.

HAMP borrowers who have loans owned or guaranteed by the government-sponsored enterprises (GSEs)—Fannie Mae or Freddie Mac—do not currently benefit from principal reduction loan modifications. To encourage the GSEs to offer this assistance to underwater borrowers, Treasury has notified the GSEs’ regulator, the Federal Housing Finance Agency (FHFA), that it will pay principal reduction incentives to both Fannie Mae or Freddie Mac if they allow servicers to forgive principal in conjunction with a HAMP modification.

"Fannie Mae and Freddie Mac currently have 470,000 permanent HAMP modifications on their books, but also have active another 530,000 non-HAMP modifications since 2009, or roughly one million total," said FHFA Acting Director Edward J. DeMarco. "The GSEs have also completed one million nonmodification foreclosure prevention actions, ranging from forbearance plans to short sales, for

a total of some two million actions that have helped homeowners in trouble avoid foreclosure and,

in most cases, keep their home."

In response to the announcement of the HAMP expansion, FHFA has announced the following with regards to the GSEs:

►Both Fannie Mae and Freddie Mac will extend their use of HAMP Tier 1 as the first modification option through 2013 in line with the Treasury’s HAMP extension.

►Fannie Mae and Freddie Mac will continue in their respective roles as financial agents for Treasury in implementing the changes announced.

►The HAMP Tier 2 option is based on the GSEs’ standard modification that FHFA announced and the enterprises implemented last year under the Servicing Alignment Initiative, meaning Fannie Mae and Freddie Mac will not need to adopt further changes to be in alignment with HAMP Tier 2.

►FHFA has been asked to consider the newly available HAMP incentives for principal reduction. FHFA recently released analysis concluding that principal forgiveness did not provide benefits that were greater than principal forbearance as a loss mitigation tool.

“HOPE NOW is pleased that the Obama Administration has reviewed its existing HAMP program and decided that expanding it to reach more homeowners and extending it for another year is the appropriate course of action," said Faith Schwartz, executive director of HOPE NOW, a voluntary, private sector alliance of mortgage servicers, investors, mortgage insurers and non-profit counselors. "We have worked very closely with Making Home Affordable since its inception. HAMP has not only helped nearly a million distressed homeowners nationwide, it has established a standardized process for allowing mortgage servicers to determine the proper solution for each individual case, whether it be a HAMP modification, proprietary modification or short term solution."

HAMP has helped more than 900,000 U.S. homeowners permanently modify their mortgage loans, resulting in a median savings of more than $500 every month in most cases. Since December of 2009, 80 percent of proprietary modifications have included reduced principal and interest payments and 60 percent of proprietary modifications have had those payments reduced by 10 percent or more.

"This initiative shows that President Obama’s strong language on the foreclosure crisis and holding bankers accountable during his State of the Union speech is more than mere rhetoric," said Richard L. Trumka, president of the American Federation of Labor and Congress of Industrial Organizations (AFL-CIO). "The expansion of principal reduction alternatives to foreclosure complements the President’s new working group of state and federal officials who are investigating bank wrongdoing in mortgage-backed securities. Homeowners who have been harmed by fraudulent bank practices must receive real relief in the form of meaningful principal reduction on their mortgages."

by nationalmortgageprofessional.com Jan 27, 2012

Government Triples Payout to Servicers for Principal Reduction Under Revamp of HAMP | Mortgage News | Daily National and State Headlines

Real Estate News

Reuters: Business News

National Commercial Real Estate News From CoStar Group

Latest stock market news from Wall Street - CNNMoney.com

Archive

-

▼

2012

(392)

-

▼

February

(21)

- Building-permit complaints in Phoenix increased in...

- Report: Upbeat findings for Arizona housing market

- Arizona bills target home-affidavit law

- Investors have eye on McDowell Corridor - USATODAY...

- Rising sales point to a stronger year for housing

- Expert: Building jobs on rebound

- Paradise Valley residents get first glimpse of res...

- Builder Sentiment Up Again « Eye on Housing

- California Mortgage Applicants Tops in the Nation ...

- Arizona gets $1.6 billion in mortgage fraud settle...

- PennyMac posts $19.6 million in earnings, plans to...

- Real estate bidding wars

- Arizona housing experts guarded but hopeful

- Apartments are planned

- Foreclosures hit 4-year low in metro area

- Economist sees hope for Ariz. recovery

- Obama unveils plan on housing

- Mom who lost 3 kids in plane crash about to lose h...

- EU blocks $10 billion Deutsche Boerse, NYSE merger

- FHFA Takes First Step in Its REO Pilot Initiative ...

- Government Triples Payout to Servicers for Princip...

-

▼

February

(21)