The housing market is confusing and difficult to navigate for most these days. One month prices are up, the next they are down. The same with foreclosures. In one metro Phoenix neighborhood, there are more short sales than regular sales. In another area less than a mile away, homes are selling for the asking price.

As a real-estate reporter for The Arizona Republic since 1996, I have been watching the market closely for a while. I have owned more than one home in the region. My stomach churns with other homeowners' when prices fall, and I am elated when I see even the slightest positive signs in the housing market. But it all has to be put into perspective.

Starting today, I'll be answering real-estate questions from you, often with the help of experts, at least once a month.

Question: When will the (expanded refinancing) program be available to homeowners? How do you know you are eligible? Also, are the banks being given any incentives to help homeowners who qualify for the program? Right now, it is next to impossible to get anyone from my bank on the phone to talk about my options. -- Carl S.

Answer: Since Monday's announcement by the Obama administration about the expansion of the Home Affordable Refinancing Program, I have heard from dozens of readers who want to know the same thing: Are they eligible?

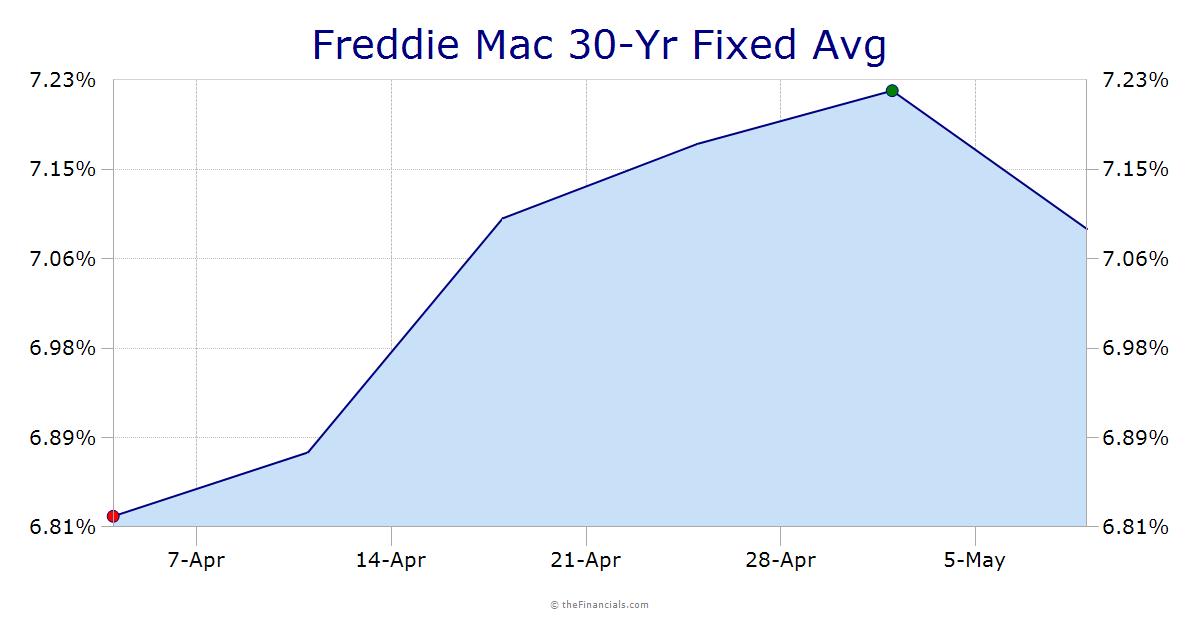

Homeowners must have a mortgage backed by government-owned Fannie Mae and Freddie Mac. To determine if your mortgage is backed by Fannie or Freddie, call your mortgage servicer or go to makinghomeaffordable.gov, where you can look it up.

Homeowners must be underwater and not have missed more than one payment in the past year. Now, there aren't supposed to be any limits on how much more a homeowner owes on a house compared with what it's worth. This is known as the loan-to-value ratio. Previously, HARP capped the LTV at 125 percent, which is of little help to homeowners in metro Phoenix.

The federal government won't release all details of the program until December. But HUD and Treasury officials said this week that they would cut fees and work on other ways to get lenders to participate quickly. I will continue to follow the program and track its success or failure.

Q: How will I know when new-home prices have hit bottom? I have been looking for a new house in the Gilbert/Chandler area, and it looks like homes now cost half what they did a few years ago. -- Michelle in Tempe

A: Homebuilders are competing with foreclosure homes. They are trying to build and sell houses for the lowest prices they can and still eke out a profit. Housing analysts say it's a great time to buy a new home. In most cases, you don't have to compete with investors paying cash because they are buying foreclosure homes.

Also, the number of new foreclosures is slowing. That means fewer inexpensive homes on the market, which will stabilize prices. The number of homes listed for sale is down, so prices could climb again next year, even in the new-home market.

If you have the cash for a 10 to 20 percent down payment, interest rates are still at new record lows, making it a great time to get a mortgage if you have decent credit. But don't buy unless you plan on holding onto the house for at least a few years, housing advocates warn. No one really knows when the housing market will recover.

by Catherine Reagor The Arizona Republic Oct. 28, 2011 05:12 PM

Reagor: Revised program targets underwater homeowners

Saturday, October 29, 2011

Economists warn housing prices will lose more ground

U.S. home prices were largely flat in August from a month earlier and down almost 4% from a year ago, with more declines ahead, economists say.

The Standard & Poor's Case-Shiller home price data, released Tuesday, showed non-seasonally adjusted prices dipping in 10 of 20 major metropolitan areas in August from July.

Yet there was a "modest glimmer of hope" in that year-over-year results in 16 of 20 cities were better than they had been in recent months, says David Blitzer, chairman of the S&P index committee.

Case-Shiller's 20-city index showed prices down 3.8% in August from a year ago, while the 10-city index posted a 3.5% decline. August prices were flat with July in the 20-city index when adjusted for seasonal factors and down 0.2% when not adjusted.

The market is battling high unemployment, rampant foreclosures in some areas, weak consumer confidence and tight lending standards.

Prices will fall another 5% to 10%, says IHS Global Insight economist Patrick Newport. They'll fall even more if the U.S. economy falls into recession, he says.

Consumers clearly are distraught. Consumer confidence plunged in October to its lowest level since March 2009, the Conference Board, a private research group, said Tuesday.

The tremendous volatility in equity markets, and the European debt issue, are driving concerns, IHS says.

In addition, consumers are concerned about business conditions, the job market and income prospects, says Lynn Franco, director of the Conference Board Consumer Research Center. That will be a drag on home prices, says Jed Kolko, economist for real estate website Trulia.

The latest housing price report from the Federal Housing Finance Agency, also released Tuesday, points to a weaker housing market than previously thought, says Paul Ashworth, economist for Capital Economics.

The FHFA index -- which measures sales prices of homes owned or guaranteed by Freddie Mac and Fannie Mae-- shows prices slipping 0.1% in August, for their first monthly decline since March.

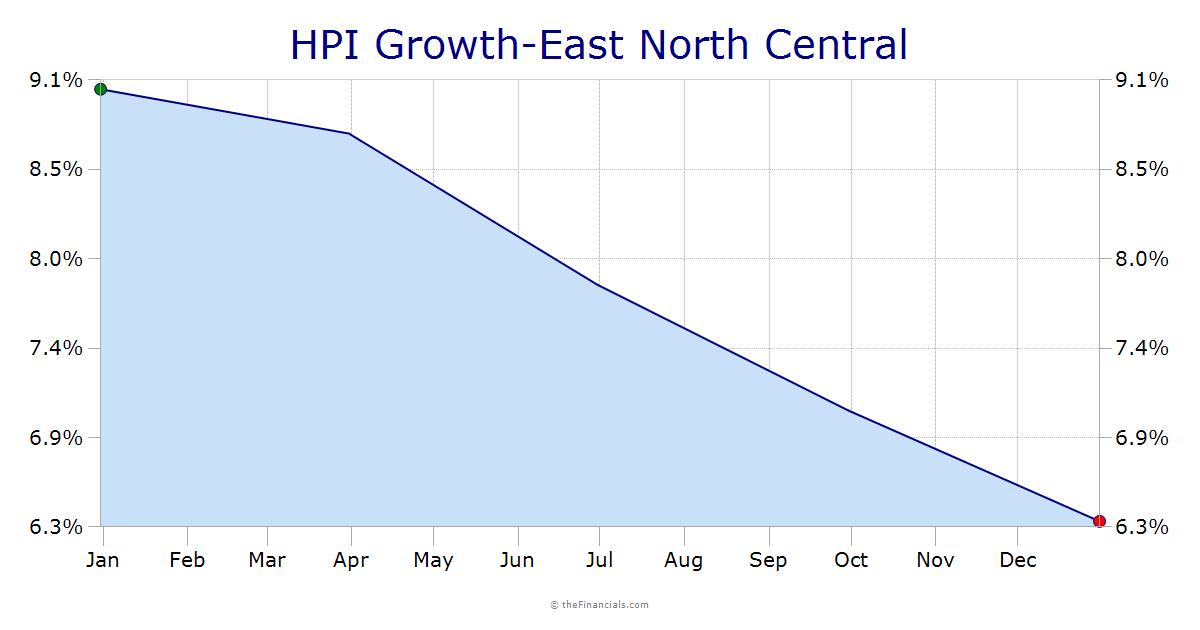

Some regions are performing better than others.

Chicago, Detroit and Minneapolis all posted monthly home price increases going back to May, the Case-Shiller data show.

The markets were some of the weakest, particularly Detroit. But as of August, home prices in Detroit were up 2.7% from a year earlier -- the most of any city measured by Case-Shiller.

Detroit is rising faster than others because it fell so far, Kolko says. But home prices in Washington, D.C., Chicago, Minneapolis and Boston were also up slightly in August from May -- even when adjusted for seasonal factors, Kolko says.

Those cities tend to have stronger economies, lower housing vacancy rates or both, he adds.

Year-over-year, only Washington, D.C., joined Detroit in posting higher prices. Prices were up 0.3% in Washington in August vs. a year ago, according to Case-Shiller.

by Julie Schmit USA Today Oct. 27, 2011 12:06 PM

Economists warn housing prices will lose more ground

The Standard & Poor's Case-Shiller home price data, released Tuesday, showed non-seasonally adjusted prices dipping in 10 of 20 major metropolitan areas in August from July.

Yet there was a "modest glimmer of hope" in that year-over-year results in 16 of 20 cities were better than they had been in recent months, says David Blitzer, chairman of the S&P index committee.

Case-Shiller's 20-city index showed prices down 3.8% in August from a year ago, while the 10-city index posted a 3.5% decline. August prices were flat with July in the 20-city index when adjusted for seasonal factors and down 0.2% when not adjusted.

The market is battling high unemployment, rampant foreclosures in some areas, weak consumer confidence and tight lending standards.

Prices will fall another 5% to 10%, says IHS Global Insight economist Patrick Newport. They'll fall even more if the U.S. economy falls into recession, he says.

Consumers clearly are distraught. Consumer confidence plunged in October to its lowest level since March 2009, the Conference Board, a private research group, said Tuesday.

The tremendous volatility in equity markets, and the European debt issue, are driving concerns, IHS says.

In addition, consumers are concerned about business conditions, the job market and income prospects, says Lynn Franco, director of the Conference Board Consumer Research Center. That will be a drag on home prices, says Jed Kolko, economist for real estate website Trulia.

The latest housing price report from the Federal Housing Finance Agency, also released Tuesday, points to a weaker housing market than previously thought, says Paul Ashworth, economist for Capital Economics.

The FHFA index -- which measures sales prices of homes owned or guaranteed by Freddie Mac and Fannie Mae-- shows prices slipping 0.1% in August, for their first monthly decline since March.

Some regions are performing better than others.

Chicago, Detroit and Minneapolis all posted monthly home price increases going back to May, the Case-Shiller data show.

The markets were some of the weakest, particularly Detroit. But as of August, home prices in Detroit were up 2.7% from a year earlier -- the most of any city measured by Case-Shiller.

Detroit is rising faster than others because it fell so far, Kolko says. But home prices in Washington, D.C., Chicago, Minneapolis and Boston were also up slightly in August from May -- even when adjusted for seasonal factors, Kolko says.

Those cities tend to have stronger economies, lower housing vacancy rates or both, he adds.

Year-over-year, only Washington, D.C., joined Detroit in posting higher prices. Prices were up 0.3% in Washington in August vs. a year ago, according to Case-Shiller.

by Julie Schmit USA Today Oct. 27, 2011 12:06 PM

Economists warn housing prices will lose more ground

Labels:

home prices

Pending home sales fell 4.6% in Sept.

WASHINGTON -- The number of Americans who signed contracts to buy homes fell for the third straight month in September after the spring-and-summer peak buying season failed to entice new buyers.

The National Association of Realtors says its index of sales agreements fell 4.6 percent last month to a reading of 84.5.

A reading of 100 is considered healthy. The last time the index reached that high was in April 2010, the final month that buyers could qualify for a federal tax credit that has since expired.

Contract signings are usually a reliable indicator of where the housing market is headed. There's typically a one- to two-month lag between a contract and a completed deal.

But the Realtors group said a growing number of buyers have canceled contracts.

by Derek Kravitz Associated Press Oct. 27, 2011 07:30 AM

Pending home sales fell 4.6% in Sept.

The National Association of Realtors says its index of sales agreements fell 4.6 percent last month to a reading of 84.5.

A reading of 100 is considered healthy. The last time the index reached that high was in April 2010, the final month that buyers could qualify for a federal tax credit that has since expired.

Contract signings are usually a reliable indicator of where the housing market is headed. There's typically a one- to two-month lag between a contract and a completed deal.

But the Realtors group said a growing number of buyers have canceled contracts.

by Derek Kravitz Associated Press Oct. 27, 2011 07:30 AM

Pending home sales fell 4.6% in Sept.

Labels:

home sales,

pending home sales

Scottsdale condo prices up nearly 5% as foreclosures fall

Here's a look at home and condo prices for Scottsdale in 2011. Click "Next" to view previous months.

by Peter Corbett The Arizona Republic Oct. 24, 2011 07:51 AM

by Peter Corbett The Arizona Republic Oct. 24, 2011 07:51 AM

Labels:

arizona,

condominiums,

condos,

home prices,

scottsdale

$1.6 billion Prasada project stays on track in Surprise

Surprise has a number of goals when it comes to Prasada, a mammoth commercial and residential center that will straddle Loop 303 in the decades ahead.

City officials want to see thousands of new jobs, new homebuyers and a healthy new stream of sales-tax revenue. City Council members were eager to revise a development agreement with Prasada developer Westcor recently, largely because it would help them reach the most important goal of all.

"The goal of this development agreement is to get it built," said Surprise Community Development Director Jeff Mihelich, who laid out the deal in a City Council meeting in September.

The terms of the agreement extend some building deadlines for Westcor, reduces to $200 million from $240 million the amount Surprise must reimburse Westcor for infrastructure, cuts some interest rates and gives the city flexibility in making those payments.

City officials said the wait and the financial incentives will be worth it when the $1.6 billion project is complete.

"At the end of the day, it would be the largest commercial development in the state of Arizona," Mihelich said. "It would have a profound and positive impact on Surprise for years to come."

Once built, the regional mall and surrounding power centers, auto mall and new neighborhoods are expected to pour $40 million a year into city accounts, while boosting the Dysart Unified School District's income by $16 million a year. Surprise would be able to lay claim to 18,500 new jobs, with 14,600 employees working on construction alone.

The day when the entire project is complete could be two decades in the future, since the timeline for the regional mall depends on the economy and growth in Surprise and the West Valley.

Garrett Newland, vice president of development at Westcor, said that work on Prasada never stopped. Much of it took place at ground level, where $50 million worth of roads, water and wastewater systems have been built.

"For those of us spending tens of millions of dollars, we are very committed," Newland said of the project. "We're in it for the long term."

Prasada's grand vision

Westcor executives first unveiled plans for Prasada in 2005, when housing was booming and Surprise could hardly keep up with growth.

Prasada would transform a 3,400-acre swath of farmland into a regional mall, surrounded by power centers, restaurants, theaters, an auto mall, commercial offices and a community of 7,200 houses, townhouses and condominiums. The project would straddle Loop 303, filling in both sides of the freeway between Waddell and Cactus roads. The commercial core would fill 800 acres and attract shoppers from miles around.

Fulton Homes and other builders would construct suburban and urban landscapes, complete with grassy open space and trails.

Prasada was to play off of the new lifestyle trend found in developments such as Phoenix's Kierland Commons, where residents could live, work shop and play without having to get into a car. Harkins Theatres and Dillard's were to anchor the project.

It would, as Mihelich phrased it six years later, "put Surprise on the map."

Facing economic strain

The economy pushed the whole project back by a number of years. Under the original plans, Prasada would have opened 2 million square feet of commercial space by the end of 2012. The revised agreement with the city pushes that deadline to 2017.

But elements are falling in place, even with the downturn.

Two of the 10 planned auto dealers have opened at 303 AutoShow at Prasada - Sands Chevrolet and Sands Kia. City officials are reviewing a site plan for a Coulter Nissan dealership.

A Fry's Marketplace is complete and a Walmart, now under construction, will open next year. Building permits have been issued for Target.

Since announcing plans for Prasada in 2005, Westcor executives have been careful to not set a timeline for the project. That hasn't changed.

Newland described development as a numbers game; the population and the income have to be in place before anyone breaks ground on a regional mall.

Westcor will not start drafting site plans for the Prasada mall until the company's new regional mall in Goodyear, Estrella Falls, has been open for at least a couple of years. That project was delayed in 2009 and now may open in 2014 or 2015.

Assuming growth continues, that's when Westcor would start planning the Prasada mall, a project that would take about two years to build.

Prasada would follow the same development pattern of some other regional Westcor malls: First the power centers open with big-box stores such as Walmart and Target. The auto mall draws in more shoppers and, when the population and income level hit a certain point, the larger stores can project enough sales to start building.

Department stores such as Dillard's, Macy's, J.C. Penney and even higher-end brands such as Nordstrom are all watching the West Valley, Newland said.

In the meantime, Walmart and Target will open and two or three other power centers will appear at Prasada.

"Income levels in Surprise are already very good," Newland said. "The bottom line is there will be a lot of development at Prasada the next 15 to 20 years."

Homes before retail

People may be able to buy their own piece of Prasada before the first retailer opens at the mall.

Suburban Land Reserve, the company that owns the residential portion of Prasada, hopes to begin building by 2013.

Carl Duke, the company's vice president of portfolio management, said that the market remains soft.

Despite the slowed economy, the company's plans have not changed much, Duke said, although they may not build all of the 7,200 homes originally envisioned for many years, if at all.

Plans call to start with single-family houses before the mall is built, since that is a selling point for homebuyers. More urban-style homes likely would be built later in the life of the project.

Duke said that company executives are optimistic, since Phoenix should be well-situated compared with other Southwest cities when interest rates rise.

"We are seeing a number of signs that are encouraging," he said. "Overall, we are very bullish on the Phoenix market. We think there is a huge opportunity for job growth, and the affordability of the area is critical."

by Lesley Wright The Arizona Republic Oct. 24, 2011 10:26 AM

$1.6 billion Prasada project stays on track in Surprise

City officials want to see thousands of new jobs, new homebuyers and a healthy new stream of sales-tax revenue. City Council members were eager to revise a development agreement with Prasada developer Westcor recently, largely because it would help them reach the most important goal of all.

"The goal of this development agreement is to get it built," said Surprise Community Development Director Jeff Mihelich, who laid out the deal in a City Council meeting in September.

The terms of the agreement extend some building deadlines for Westcor, reduces to $200 million from $240 million the amount Surprise must reimburse Westcor for infrastructure, cuts some interest rates and gives the city flexibility in making those payments.

City officials said the wait and the financial incentives will be worth it when the $1.6 billion project is complete.

"At the end of the day, it would be the largest commercial development in the state of Arizona," Mihelich said. "It would have a profound and positive impact on Surprise for years to come."

Once built, the regional mall and surrounding power centers, auto mall and new neighborhoods are expected to pour $40 million a year into city accounts, while boosting the Dysart Unified School District's income by $16 million a year. Surprise would be able to lay claim to 18,500 new jobs, with 14,600 employees working on construction alone.

The day when the entire project is complete could be two decades in the future, since the timeline for the regional mall depends on the economy and growth in Surprise and the West Valley.

Garrett Newland, vice president of development at Westcor, said that work on Prasada never stopped. Much of it took place at ground level, where $50 million worth of roads, water and wastewater systems have been built.

"For those of us spending tens of millions of dollars, we are very committed," Newland said of the project. "We're in it for the long term."

Prasada's grand vision

Westcor executives first unveiled plans for Prasada in 2005, when housing was booming and Surprise could hardly keep up with growth.

Prasada would transform a 3,400-acre swath of farmland into a regional mall, surrounded by power centers, restaurants, theaters, an auto mall, commercial offices and a community of 7,200 houses, townhouses and condominiums. The project would straddle Loop 303, filling in both sides of the freeway between Waddell and Cactus roads. The commercial core would fill 800 acres and attract shoppers from miles around.

Fulton Homes and other builders would construct suburban and urban landscapes, complete with grassy open space and trails.

Prasada was to play off of the new lifestyle trend found in developments such as Phoenix's Kierland Commons, where residents could live, work shop and play without having to get into a car. Harkins Theatres and Dillard's were to anchor the project.

It would, as Mihelich phrased it six years later, "put Surprise on the map."

Facing economic strain

The economy pushed the whole project back by a number of years. Under the original plans, Prasada would have opened 2 million square feet of commercial space by the end of 2012. The revised agreement with the city pushes that deadline to 2017.

But elements are falling in place, even with the downturn.

Two of the 10 planned auto dealers have opened at 303 AutoShow at Prasada - Sands Chevrolet and Sands Kia. City officials are reviewing a site plan for a Coulter Nissan dealership.

A Fry's Marketplace is complete and a Walmart, now under construction, will open next year. Building permits have been issued for Target.

Since announcing plans for Prasada in 2005, Westcor executives have been careful to not set a timeline for the project. That hasn't changed.

Newland described development as a numbers game; the population and the income have to be in place before anyone breaks ground on a regional mall.

Westcor will not start drafting site plans for the Prasada mall until the company's new regional mall in Goodyear, Estrella Falls, has been open for at least a couple of years. That project was delayed in 2009 and now may open in 2014 or 2015.

Assuming growth continues, that's when Westcor would start planning the Prasada mall, a project that would take about two years to build.

Prasada would follow the same development pattern of some other regional Westcor malls: First the power centers open with big-box stores such as Walmart and Target. The auto mall draws in more shoppers and, when the population and income level hit a certain point, the larger stores can project enough sales to start building.

Department stores such as Dillard's, Macy's, J.C. Penney and even higher-end brands such as Nordstrom are all watching the West Valley, Newland said.

In the meantime, Walmart and Target will open and two or three other power centers will appear at Prasada.

"Income levels in Surprise are already very good," Newland said. "The bottom line is there will be a lot of development at Prasada the next 15 to 20 years."

Homes before retail

People may be able to buy their own piece of Prasada before the first retailer opens at the mall.

Suburban Land Reserve, the company that owns the residential portion of Prasada, hopes to begin building by 2013.

Carl Duke, the company's vice president of portfolio management, said that the market remains soft.

Despite the slowed economy, the company's plans have not changed much, Duke said, although they may not build all of the 7,200 homes originally envisioned for many years, if at all.

Plans call to start with single-family houses before the mall is built, since that is a selling point for homebuyers. More urban-style homes likely would be built later in the life of the project.

Duke said that company executives are optimistic, since Phoenix should be well-situated compared with other Southwest cities when interest rates rise.

"We are seeing a number of signs that are encouraging," he said. "Overall, we are very bullish on the Phoenix market. We think there is a huge opportunity for job growth, and the affordability of the area is critical."

by Lesley Wright The Arizona Republic Oct. 24, 2011 10:26 AM

$1.6 billion Prasada project stays on track in Surprise

Labels:

arizona,

commercial real estate,

construction,

surprise

Judge approves Chapter 11 for Realty Executives

A U.S. Bankruptcy Court judge has approved Phoenix-based Realty Executives Inc.'s Chapter 11 reorganization plan, allowing the company to emerge from bankruptcy.

The two creditor objections filed against the company's reorganization plan were withdrawn, owner Richard Rector said Thursday after the brief courtroom hearing.

One of those objections, filed by former company president John Foltz and his wife, Marie, was withdrawn Thursday, clearing the way for approval of the reorganization plan, court documents show.

"The parties have reached an agreement to mediate the amount of the Foltzes claims," according to a document filed Thursday by the Foltzes' attorneys.

Rector and Foltz had been embroiled in an employment lawsuit related to Rector's removal of Foltz as president.

The residential-real-estate agency, which does business as Realty Executives Phoenix, in its lawsuit accused Foltz of theft and mismanagement, while Foltz had filed a counterclaim accusing the company of severing his employment contract under false and defamatory pretenses.

With the legal dispute behind it, the company's first order of business will be to recruit additional real-estate agents to make up for those lost to competitors during the bankruptcy proceedings, Rector said.

The agency ran into financial trouble in 2007 when the real-estate market crashed, in part because Realty Executives had grown to a large organization with 17 offices, 1,800 real-estate agent contractors and about 120 payroll employees.

After downsizing and cutting overhead costs, the company was returned to relatively good financial health except for several expensive lease agreements, Rector has said.

Of the roughly 15 leases Realty Executives held for various offices in the Valley, there were four in particular in which renegotiations with the property owners had broken down, making it necessary to file the bankruptcy petition.

A motion filed along with the bankruptcy petition allows Realty Executives to "reject," or walk away from, four of the 15 lease agreements.

Those leases included two Tucson offices, one in Peoria and another in north Scottsdale, which cost the company a combined $37,733 per month, according to court documents.

Both the franchise and its parent company, Realty Executives International, are based in Phoenix and owned by Rector.

Only the franchise was a debtor in the bankruptcy, with the parent company and its owner as two of its biggest creditors.

A list of the 20 largest creditors, filed with the company's Chapter 11 petition, includes Rector as the largest creditor, saying the company owes him about $1.25 million. Franchisor Realty Executives International is the third largest, with a claim of about $600,000.

Other creditors include Phoenix law firm Greenberg Traurig, owed about $838,000, and Johnson Bank in Scottsdale, which is owed $400,000.

Under the reorganization plan, the law firm and bank likely would be repaid in full.

All claims by current and former employees would be paid in full, including deposits owed to former agents.

Rector agreed to defer repayment of any debts owed to him and pay an additional $300,000 toward the repayment of other creditors.

Most of the remaining contractors, landlords and other unsecured creditors would receive an estimated three-fourths of the money owed to them, based on the company's projections.

The residential-real-estate agency filed for Chapter 11 reorganization on April 30.

"When you think about it, this was done rather quickly compared with some other recent bankruptcies," Rector said. "Now it's just a matter of executing the plan that's in place."

by J. Craig Anderson The Arizona Republic Oct. 28, 2011 12:00 AM

Judge approves Chapter 11 for Realty Executives

The two creditor objections filed against the company's reorganization plan were withdrawn, owner Richard Rector said Thursday after the brief courtroom hearing.

One of those objections, filed by former company president John Foltz and his wife, Marie, was withdrawn Thursday, clearing the way for approval of the reorganization plan, court documents show.

"The parties have reached an agreement to mediate the amount of the Foltzes claims," according to a document filed Thursday by the Foltzes' attorneys.

Rector and Foltz had been embroiled in an employment lawsuit related to Rector's removal of Foltz as president.

The residential-real-estate agency, which does business as Realty Executives Phoenix, in its lawsuit accused Foltz of theft and mismanagement, while Foltz had filed a counterclaim accusing the company of severing his employment contract under false and defamatory pretenses.

With the legal dispute behind it, the company's first order of business will be to recruit additional real-estate agents to make up for those lost to competitors during the bankruptcy proceedings, Rector said.

The agency ran into financial trouble in 2007 when the real-estate market crashed, in part because Realty Executives had grown to a large organization with 17 offices, 1,800 real-estate agent contractors and about 120 payroll employees.

After downsizing and cutting overhead costs, the company was returned to relatively good financial health except for several expensive lease agreements, Rector has said.

Of the roughly 15 leases Realty Executives held for various offices in the Valley, there were four in particular in which renegotiations with the property owners had broken down, making it necessary to file the bankruptcy petition.

A motion filed along with the bankruptcy petition allows Realty Executives to "reject," or walk away from, four of the 15 lease agreements.

Those leases included two Tucson offices, one in Peoria and another in north Scottsdale, which cost the company a combined $37,733 per month, according to court documents.

Both the franchise and its parent company, Realty Executives International, are based in Phoenix and owned by Rector.

Only the franchise was a debtor in the bankruptcy, with the parent company and its owner as two of its biggest creditors.

A list of the 20 largest creditors, filed with the company's Chapter 11 petition, includes Rector as the largest creditor, saying the company owes him about $1.25 million. Franchisor Realty Executives International is the third largest, with a claim of about $600,000.

Other creditors include Phoenix law firm Greenberg Traurig, owed about $838,000, and Johnson Bank in Scottsdale, which is owed $400,000.

Under the reorganization plan, the law firm and bank likely would be repaid in full.

All claims by current and former employees would be paid in full, including deposits owed to former agents.

Rector agreed to defer repayment of any debts owed to him and pay an additional $300,000 toward the repayment of other creditors.

Most of the remaining contractors, landlords and other unsecured creditors would receive an estimated three-fourths of the money owed to them, based on the company's projections.

The residential-real-estate agency filed for Chapter 11 reorganization on April 30.

"When you think about it, this was done rather quickly compared with some other recent bankruptcies," Rector said. "Now it's just a matter of executing the plan that's in place."

by J. Craig Anderson The Arizona Republic Oct. 28, 2011 12:00 AM

Judge approves Chapter 11 for Realty Executives

Labels:

bankruptcy,

realty executives

Economy picked up over summer

The U.S. economy grew at its fastest clip in a year during late summer as consumers and businesses shrugged off fears of a new recession, according to government data released Thursday that helped drive the stock market to its best day since August.

Investors were also cheered by overnight news that European leaders have reached an agreement on how to address their continent's debt crisis, and the Standard & Poor's 500 stock index ended the day up 3.4 percent. European markets were up even more sharply, with the German Dax index up 5.3 percent.

The agreement in Europe still has many details to be filled in, and the 2.5 percent pace of U.S. economic expansion in the third quarter isn't enough to bring unemployment down quickly even if it is sustained. But on both sides of the Atlantic, the news on Thursday offered a sense of relief: Maybe the world isn't falling apart, after all.

"The Europeans told us they're doing what they can do to take the immediate fear of financial collapse off the table, and the GDP numbers tell us that the U.S. economy did not collapse in the third quarter," said Jerry Webman, chief economist at OppenheimerFunds. "Together, they are a kind of sigh of relief."

Over the summer, uncertainty over Europe's future and a downgrade of U.S. debt helped drive a period of confidence-rattling volatility on global financial markets. But now that the broadest measure of economic activity for that period is in, it appears that U.S. consumers and businesses took the events in stride.

Gross domestic product rose at a 2.5 percent annual pace in the July-through-September quarter, the Commerce Department said, considerably better than the 1.3 percent gain in the second quarter and the 0.9 percent rate of growth for the first half of 2011.

If there is to be a dip back into recession, as some analysts have feared, it appears it did not start in the third quarter.

But GDP was not strong enough to represent a "catch-up" effect that could bring the unemployment rate down substantially over time. Rather, 2.5 percent is somewhere around the treading-water rate of U.S. economic growth - the approximate rate of economic expansion that would be expected, given an ever-increasing labor force and rising worker productivity, but not enough to put many of the 14 million unemployed Americans back to work.

In another sign that the economy is not falling into recession, the number of new people filing claims for unemployment insurance benefits edged down last week, to 402,000 from a revised 404,000 the previous week.

Growth was bolstered during the quarter by a rebound in some of the factors that had held the economy back in the first half of the year. Automobile-supply chains that had been disrupted by the Japanese earthquake in the spring reopened, and oil prices moderated after spiking early in the year.

The details of the new report on GDP, which aims to capture the value of goods and services produced within U.S. borders during the quarter, were generally more favorable than expected. Spending by American consumers rose at a 2.4 percent annual rate, better than analysts had forecast, suggesting that even as their confidence has been walloped, Americans continued going to stores.

But the ailing job market and stagnant incomes could weigh on consumer spending in the months ahead, and few analysts expect households to drive rapid growth any time soon.

"The acceleration in consumer spending was driven by a drop in the saving rate, not by stronger income growth," Nigel Gault, chief U.S. economist at IHS Global Insight, said in a report.

Business investment was a source of particular strength in the third quarter, as it has been for most of the past two years. Spending on equipment and software rose at a rate of 17.4 percent, and spending on structures such as office buildings and factories rose at rate of 13.3 percent.

A major question for the future will be whether the onset of a new wave of volatility and uncertainty in financial markets worldwide leads businesses to become more cautious in their capital-spending plans in the final months of the year. At least through late summer, they were in expansion mode.

In Europe, leaders announced a 50 percent reduction in Greece's loan repayments to private lenders, a $1.4 trillion rescue fund to keep credit flowing to other troubled nations and a bank-recapitalization program designed to boost reserves by the middle of next year.

But behind the rhetoric, many details remain to be worked out. Banks must agree to the latest bailout for Greece, which still would leave its gross debt at 120 percent of its economy by 2020, down from 160 percent. The rescue-fund firewall relies on leveraging the European Financial Stability Facility rather than new government contributions. And European banks still could remain short of capital for the next eight months, threatening the flow of credit to consumers.

The effects of Europe's ills have damaged U.S. interests, from multinational companies to major exporters. Individual investors have plenty of reason for concern, as the enthusiasm from earlier agreements has given way to pessimism and stock-market dives.

by Neil Irwin Washington Post Oct. 28, 2011 12:00 AM

Economy picked up over summer

Investors were also cheered by overnight news that European leaders have reached an agreement on how to address their continent's debt crisis, and the Standard & Poor's 500 stock index ended the day up 3.4 percent. European markets were up even more sharply, with the German Dax index up 5.3 percent.

The agreement in Europe still has many details to be filled in, and the 2.5 percent pace of U.S. economic expansion in the third quarter isn't enough to bring unemployment down quickly even if it is sustained. But on both sides of the Atlantic, the news on Thursday offered a sense of relief: Maybe the world isn't falling apart, after all.

"The Europeans told us they're doing what they can do to take the immediate fear of financial collapse off the table, and the GDP numbers tell us that the U.S. economy did not collapse in the third quarter," said Jerry Webman, chief economist at OppenheimerFunds. "Together, they are a kind of sigh of relief."

Over the summer, uncertainty over Europe's future and a downgrade of U.S. debt helped drive a period of confidence-rattling volatility on global financial markets. But now that the broadest measure of economic activity for that period is in, it appears that U.S. consumers and businesses took the events in stride.

Gross domestic product rose at a 2.5 percent annual pace in the July-through-September quarter, the Commerce Department said, considerably better than the 1.3 percent gain in the second quarter and the 0.9 percent rate of growth for the first half of 2011.

If there is to be a dip back into recession, as some analysts have feared, it appears it did not start in the third quarter.

But GDP was not strong enough to represent a "catch-up" effect that could bring the unemployment rate down substantially over time. Rather, 2.5 percent is somewhere around the treading-water rate of U.S. economic growth - the approximate rate of economic expansion that would be expected, given an ever-increasing labor force and rising worker productivity, but not enough to put many of the 14 million unemployed Americans back to work.

In another sign that the economy is not falling into recession, the number of new people filing claims for unemployment insurance benefits edged down last week, to 402,000 from a revised 404,000 the previous week.

Growth was bolstered during the quarter by a rebound in some of the factors that had held the economy back in the first half of the year. Automobile-supply chains that had been disrupted by the Japanese earthquake in the spring reopened, and oil prices moderated after spiking early in the year.

The details of the new report on GDP, which aims to capture the value of goods and services produced within U.S. borders during the quarter, were generally more favorable than expected. Spending by American consumers rose at a 2.4 percent annual rate, better than analysts had forecast, suggesting that even as their confidence has been walloped, Americans continued going to stores.

But the ailing job market and stagnant incomes could weigh on consumer spending in the months ahead, and few analysts expect households to drive rapid growth any time soon.

"The acceleration in consumer spending was driven by a drop in the saving rate, not by stronger income growth," Nigel Gault, chief U.S. economist at IHS Global Insight, said in a report.

Business investment was a source of particular strength in the third quarter, as it has been for most of the past two years. Spending on equipment and software rose at a rate of 17.4 percent, and spending on structures such as office buildings and factories rose at rate of 13.3 percent.

A major question for the future will be whether the onset of a new wave of volatility and uncertainty in financial markets worldwide leads businesses to become more cautious in their capital-spending plans in the final months of the year. At least through late summer, they were in expansion mode.

In Europe, leaders announced a 50 percent reduction in Greece's loan repayments to private lenders, a $1.4 trillion rescue fund to keep credit flowing to other troubled nations and a bank-recapitalization program designed to boost reserves by the middle of next year.

But behind the rhetoric, many details remain to be worked out. Banks must agree to the latest bailout for Greece, which still would leave its gross debt at 120 percent of its economy by 2020, down from 160 percent. The rescue-fund firewall relies on leveraging the European Financial Stability Facility rather than new government contributions. And European banks still could remain short of capital for the next eight months, threatening the flow of credit to consumers.

The effects of Europe's ills have damaged U.S. interests, from multinational companies to major exporters. Individual investors have plenty of reason for concern, as the enthusiasm from earlier agreements has given way to pessimism and stock-market dives.

by Neil Irwin Washington Post Oct. 28, 2011 12:00 AM

Economy picked up over summer

Labels:

economy

Thursday, October 27, 2011

Scottsdale approves 2nd plan for apartments near airpark

The Scottsdale City Council this week approved a second plan to build apartments in the Scottsdale Airpark but postponed consideration of a third proposal until after the Federal Aviation Administration weighs in on allowing residences close to Scottsdale Airport.

By a 6-1 vote, the council Tuesday approved a non-major, General Plan amendment to the Greater Airpark Character Area Plan. The change creates a mixed-use residential designation that allows apartments on a 32-acre site along Scottsdale Road south of Paradise Lane. The site currently houses CrackerJax Family Fun and Sports Park.

Mayor Lane asks appointee to resign over complaint to FAA

Scottsdale council OKs first plan for apartments near airport

Councilman Bob Littlefield was the only no vote. "This is about protecting one of Scottsdale's biggest assets, the airport," he said.

Residents in the airpark will complain about aircraft noise, prompting political pressure to restrict flight times, therefore driving business away to other Valley airports, Littlefield said.

The Herberger family, which owns the property, and Woodbine Southwest, which developed the nearby Kierland Commons on the Phoenix side of Scottsdale Road, want to develop a similar mixed-use project on the CrackerJax site.

"This is a fine project and will bring great value to the airport and the airpark," Mayor Jim Lane said.

Mike Withey, an attorney representing the Herberger family, said his client will be returning to the council with a rezoning request and site plan in the future, so the council will have a second chance to vote on the project.

Multifamily residential will be just one component of the project and it hasn't been determined how many units the project will include, he said.

"Kierland Commons only has 84 units," he said.

Withey said Kierland residents have not complained about noise from the airport.

Also, the proposal is in full compliance with all city and FAA land-use requirements, he said.

Airport Advisory Commissioner Stephen Ziomek told the council the CrackerJax property is in the path of helicopters flying below 500 feet.

"I would not want a helicopter coming over my head at 500 feet," he said.

Helicopters currently fly right past Kierland and there has never been concern from residents, Withey said, adding the helicopter route likely will be altered once the project is completed.

Vice Mayor Linda Milhaven said the acreage is outside the 55-decibel, day-to-night average noise level contour surrounding the airport, and that 55 decibels is the equivalent of a "quiet office."

Gary Mascaro, the airport's aviation director, said 55 decibels is an average, and that the actual noise level may be higher or lower based on a single event.

Last week, the council voted 6-1 to approve rezoning and other changes that will allow development of the Residences at Zocallo Place, a four-building, 240-unit apartment complex near the northwestern corner of Greenway-Hayden Loop and 73rd Street. Littlefield was the only no vote.

A third proposal for a 605-unit complex south of Hayden Road and west of Northsight Boulevard will be considered by the council at its Tuesday meeting. Sunrise Luxury Living, a multifamily residential developer, wants to develop a complex on the site, which was vacated by an auto dealership more than two years ago.

An issue in all three cases has been whether allowing residential in the airpark, which surrounds the airport, will constitute a violation of land-use policy approved by the council and the FAA, and therefore jeopardize existing and future FAA grants to the airport.

The FAA has stipulated that land use in the immediate vicinity of the airport should be restricted to "activities and purposes compatible with normal airport operations, including landing and takeoff of aircraft."

Mascaro said the FAA will be responding to Airport Advisory Commissioner John Washington's complaint about all three proposals for residential in the airpark, and the response will be reported to the council. Lane has asked for Washington's resignation for filing the complaint, saying it has "given rise to a serious concern as to (Washington's) motivation with respect to the city and the airport."

Earlier this month, the Airport Advisory Commission rejected all three proposals. The city's Planning Commission recommended approval of all three.

by Edward Gately The Arizona Republic Oct. 26, 2011 01:50 PM

Scottsdale approves 2nd plan for apartments near airpark

By a 6-1 vote, the council Tuesday approved a non-major, General Plan amendment to the Greater Airpark Character Area Plan. The change creates a mixed-use residential designation that allows apartments on a 32-acre site along Scottsdale Road south of Paradise Lane. The site currently houses CrackerJax Family Fun and Sports Park.

Mayor Lane asks appointee to resign over complaint to FAA

Scottsdale council OKs first plan for apartments near airport

Councilman Bob Littlefield was the only no vote. "This is about protecting one of Scottsdale's biggest assets, the airport," he said.

Residents in the airpark will complain about aircraft noise, prompting political pressure to restrict flight times, therefore driving business away to other Valley airports, Littlefield said.

The Herberger family, which owns the property, and Woodbine Southwest, which developed the nearby Kierland Commons on the Phoenix side of Scottsdale Road, want to develop a similar mixed-use project on the CrackerJax site.

"This is a fine project and will bring great value to the airport and the airpark," Mayor Jim Lane said.

Mike Withey, an attorney representing the Herberger family, said his client will be returning to the council with a rezoning request and site plan in the future, so the council will have a second chance to vote on the project.

Multifamily residential will be just one component of the project and it hasn't been determined how many units the project will include, he said.

"Kierland Commons only has 84 units," he said.

Withey said Kierland residents have not complained about noise from the airport.

Also, the proposal is in full compliance with all city and FAA land-use requirements, he said.

Airport Advisory Commissioner Stephen Ziomek told the council the CrackerJax property is in the path of helicopters flying below 500 feet.

"I would not want a helicopter coming over my head at 500 feet," he said.

Helicopters currently fly right past Kierland and there has never been concern from residents, Withey said, adding the helicopter route likely will be altered once the project is completed.

Vice Mayor Linda Milhaven said the acreage is outside the 55-decibel, day-to-night average noise level contour surrounding the airport, and that 55 decibels is the equivalent of a "quiet office."

Gary Mascaro, the airport's aviation director, said 55 decibels is an average, and that the actual noise level may be higher or lower based on a single event.

Last week, the council voted 6-1 to approve rezoning and other changes that will allow development of the Residences at Zocallo Place, a four-building, 240-unit apartment complex near the northwestern corner of Greenway-Hayden Loop and 73rd Street. Littlefield was the only no vote.

A third proposal for a 605-unit complex south of Hayden Road and west of Northsight Boulevard will be considered by the council at its Tuesday meeting. Sunrise Luxury Living, a multifamily residential developer, wants to develop a complex on the site, which was vacated by an auto dealership more than two years ago.

An issue in all three cases has been whether allowing residential in the airpark, which surrounds the airport, will constitute a violation of land-use policy approved by the council and the FAA, and therefore jeopardize existing and future FAA grants to the airport.

The FAA has stipulated that land use in the immediate vicinity of the airport should be restricted to "activities and purposes compatible with normal airport operations, including landing and takeoff of aircraft."

Mascaro said the FAA will be responding to Airport Advisory Commissioner John Washington's complaint about all three proposals for residential in the airpark, and the response will be reported to the council. Lane has asked for Washington's resignation for filing the complaint, saying it has "given rise to a serious concern as to (Washington's) motivation with respect to the city and the airport."

Earlier this month, the Airport Advisory Commission rejected all three proposals. The city's Planning Commission recommended approval of all three.

by Edward Gately The Arizona Republic Oct. 26, 2011 01:50 PM

Scottsdale approves 2nd plan for apartments near airpark

Labels:

apartments,

arizona,

commercial real estate,

multi-family,

scottsdale

New-home sales up 5.7%, builders slash prices

WASHINGTON -- Sales of new homes rose in September after four straight monthly declines, largely because builders cut their prices.

The Commerce Department says sales rose 5.7 percent last month to a seasonally adjusted annual rate of 313,000 homes. Still, that's less than half the 700,000 economists say must be sold to sustain a healthy housing market.

The median sales price of a new home fell 3.1 percent to $204,400 -- the lowest since October 2010. The number of new homes on the market was unchanged at 163,000, a record low.

Sales of new homes fell for four straight months before September and hit a six-month low in August. This year could be the worst year for sales since the government began keeping records a half century ago.

by Derek Kravitz Associated Press Oct. 26, 2011 07:57 AM

New-home sales up 5.7%, builders slash prices

The Commerce Department says sales rose 5.7 percent last month to a seasonally adjusted annual rate of 313,000 homes. Still, that's less than half the 700,000 economists say must be sold to sustain a healthy housing market.

The median sales price of a new home fell 3.1 percent to $204,400 -- the lowest since October 2010. The number of new homes on the market was unchanged at 163,000, a record low.

Sales of new homes fell for four straight months before September and hit a six-month low in August. This year could be the worst year for sales since the government began keeping records a half century ago.

by Derek Kravitz Associated Press Oct. 26, 2011 07:57 AM

New-home sales up 5.7%, builders slash prices

Labels:

housing,

new home sales

Sarkozy Turns to Hu for China Aid as Europe Expands Rescue Fund

Oct. 27 (Bloomberg) -- French President Nicolas Sarkozy said he plans to call Chinese President Hu Jintao today to discuss China contributing to Europe's efforts to resolve the region's debt crisis.

The European Financial Stability Facility will be worth $1.4 trillion after European leaders agreed to leverage existing guarantees by as much as five times, Sarkozy estimated when speaking to reporters at a briefing in Brussels at 4 a.m. local time after the end of a summit of European leaders. Chinese support for the effort would be welcomed, Sarkozy said. The presidents will speak about noon Brussels time, he said.

Chinese Premier Wen Jiabao has signaled willingness to aid the European Union as financial turmoil within the region threatens to crush export demand in China's biggest market. The expansion of the rescue fund and a deal for bondholders to take 50 percent losses on Greek debt may help Sarkozy and German Chancellor Angela Merkel to convince the world that Europe is getting to grips with the crisis.

"China will need time to evaluate this plan very carefully," said Shen Jianguang, a Hong Kong-based economist for Mizuho Securities Asia Ltd. "What worries China is that there is so much disagreement among European policy makers. It doesn't want to be seen spending money on a plan that even Europeans don't want to support."

Sarkozy and Hu's conversation comes a day before a planned visit to Beijing by Klaus Regling, chief executive officer of the EFSF, to court investors. China has the world's largest foreign currency reserves at more than $3.2 trillion.

Sovereign Bonds

The EFSF, established last year to sell bonds to finance loans for distressed euro nations, has since also gained the authority to buy sovereign bonds on the secondary and primary markets, offer credit lines to governments and recapitalize banks as the Greece-triggered debt troubles have spread. The EFSF said Regling's visit to China this week is linked to the fund's original debt-issuance role.

"It is a normal round of discussion with important buyers of EFSF bonds," Christof Roche, spokesman for the Luxembourg- based facility, said by e-mail yesterday. He declined to comment further when contacted by Bloomberg News by telephone. Agence France-Presse reported that Regling will travel on to Tokyo, citing a European Union official in Asia.

China may be willing to respond to a European request to help them fund a package to solve the euro region's debt crisis, AFP said, citing unidentified government officials familiar with the situation.

Chinese Reserves

A press official at the People's Bank of China said he wasn't aware of the issue and asked for faxed questions, which weren't immediately answered. The Ministry of Foreign Affairs and the State Administration of Foreign Exchange, which manages China's foreign-exchange reserves, didn't immediately respond to faxed questions.

Calls to the press office of China Investment Corp., the nation's $300 billion sovereign wealth fund, weren't immediately answered.

Europe is facing international calls to end a debt crisis that President Barack Obama has said "is scaring the world" and U.S. Treasury Secretary Timothy F. Geithner has described as a "catastrophic risk." With a Group of 20 meeting looming on Nov. 3-4, euro-area government heads gathered in Brussels yesterday for the 14th time to tackle troubles that began in Greece two years ago, then engulfed Ireland and Portugal and now threaten Spain and Italy.

Premier Wen said last month that while China was willing to help, that developed nations also needed to put "their own houses in order."

European Responsibility

In Canberra today, Australian Treasurer Wayne Swan echoed that sentiment. "We think it's appropriate that the international community look at what resources the International Monetary Fund has available to it," Swan told reporters. "But in the first instance, any bailout fund in Europe is a responsibility of the Europeans."

Bank of Korea Governor Kim Choong Soo said today the nation hasn't been approached to and hasn't considered joining the effort. Indonesian Vice Finance Minister Mahendra Siregar said the nation hasn't been asked to aid in Europe's effort.

The question of leveraging the AAA rated EFSF has arisen because of the political hurdles in countries such as Germany, the biggest European economy, to increasing the national guarantees that back the fund.

Aid Package

As part of its original role, the EFSF is providing 17.7 billion euros under Ireland's aid package of 67.5 billion euros and 26 billion euros under Portugal's rescue of 78 billion euros. So far, the EFSF has sold two five-year bonds and one 10-year security, all in the first half of this year. The Japanese government bought more than a fifth of the inaugural issue in January.

On Oct. 13, the EFSF announced changes to its bond-sale program for the two countries in the second half of 2011. Instead of selling four "benchmark" bonds in the period, as outlined in mid-May, the fund will sell one security for Ireland valued at 3 billion euros and delay issues planned for Portugal until "early 2012."

The EFSF may have to finance more than 70 billion euros of a planned second aid package for Greece. The initial Greek rescue of 110 billion euros in May 2010 was composed of loans directly from euro-area governments and the IMF.

by Jonathan Stearns and Helene Fouquet Bloomberg News Oct 27, 2011

Read more: http://www.sfgate.com/cgi-bin/article.cgi?f=/g/a/2011/10/26/bloomberg_articlesLTPGNJ0YHQ0X.DTL#ixzz1bzpDPC4m

Sarkozy Turns to Hu for China Aid as Europe Expands Rescue Fund

The European Financial Stability Facility will be worth $1.4 trillion after European leaders agreed to leverage existing guarantees by as much as five times, Sarkozy estimated when speaking to reporters at a briefing in Brussels at 4 a.m. local time after the end of a summit of European leaders. Chinese support for the effort would be welcomed, Sarkozy said. The presidents will speak about noon Brussels time, he said.

Chinese Premier Wen Jiabao has signaled willingness to aid the European Union as financial turmoil within the region threatens to crush export demand in China's biggest market. The expansion of the rescue fund and a deal for bondholders to take 50 percent losses on Greek debt may help Sarkozy and German Chancellor Angela Merkel to convince the world that Europe is getting to grips with the crisis.

"China will need time to evaluate this plan very carefully," said Shen Jianguang, a Hong Kong-based economist for Mizuho Securities Asia Ltd. "What worries China is that there is so much disagreement among European policy makers. It doesn't want to be seen spending money on a plan that even Europeans don't want to support."

Sarkozy and Hu's conversation comes a day before a planned visit to Beijing by Klaus Regling, chief executive officer of the EFSF, to court investors. China has the world's largest foreign currency reserves at more than $3.2 trillion.

Sovereign Bonds

The EFSF, established last year to sell bonds to finance loans for distressed euro nations, has since also gained the authority to buy sovereign bonds on the secondary and primary markets, offer credit lines to governments and recapitalize banks as the Greece-triggered debt troubles have spread. The EFSF said Regling's visit to China this week is linked to the fund's original debt-issuance role.

"It is a normal round of discussion with important buyers of EFSF bonds," Christof Roche, spokesman for the Luxembourg- based facility, said by e-mail yesterday. He declined to comment further when contacted by Bloomberg News by telephone. Agence France-Presse reported that Regling will travel on to Tokyo, citing a European Union official in Asia.

China may be willing to respond to a European request to help them fund a package to solve the euro region's debt crisis, AFP said, citing unidentified government officials familiar with the situation.

Chinese Reserves

A press official at the People's Bank of China said he wasn't aware of the issue and asked for faxed questions, which weren't immediately answered. The Ministry of Foreign Affairs and the State Administration of Foreign Exchange, which manages China's foreign-exchange reserves, didn't immediately respond to faxed questions.

Calls to the press office of China Investment Corp., the nation's $300 billion sovereign wealth fund, weren't immediately answered.

Europe is facing international calls to end a debt crisis that President Barack Obama has said "is scaring the world" and U.S. Treasury Secretary Timothy F. Geithner has described as a "catastrophic risk." With a Group of 20 meeting looming on Nov. 3-4, euro-area government heads gathered in Brussels yesterday for the 14th time to tackle troubles that began in Greece two years ago, then engulfed Ireland and Portugal and now threaten Spain and Italy.

Premier Wen said last month that while China was willing to help, that developed nations also needed to put "their own houses in order."

European Responsibility

In Canberra today, Australian Treasurer Wayne Swan echoed that sentiment. "We think it's appropriate that the international community look at what resources the International Monetary Fund has available to it," Swan told reporters. "But in the first instance, any bailout fund in Europe is a responsibility of the Europeans."

Bank of Korea Governor Kim Choong Soo said today the nation hasn't been approached to and hasn't considered joining the effort. Indonesian Vice Finance Minister Mahendra Siregar said the nation hasn't been asked to aid in Europe's effort.

The question of leveraging the AAA rated EFSF has arisen because of the political hurdles in countries such as Germany, the biggest European economy, to increasing the national guarantees that back the fund.

Aid Package

As part of its original role, the EFSF is providing 17.7 billion euros under Ireland's aid package of 67.5 billion euros and 26 billion euros under Portugal's rescue of 78 billion euros. So far, the EFSF has sold two five-year bonds and one 10-year security, all in the first half of this year. The Japanese government bought more than a fifth of the inaugural issue in January.

On Oct. 13, the EFSF announced changes to its bond-sale program for the two countries in the second half of 2011. Instead of selling four "benchmark" bonds in the period, as outlined in mid-May, the fund will sell one security for Ireland valued at 3 billion euros and delay issues planned for Portugal until "early 2012."

The EFSF may have to finance more than 70 billion euros of a planned second aid package for Greece. The initial Greek rescue of 110 billion euros in May 2010 was composed of loans directly from euro-area governments and the IMF.

by Jonathan Stearns and Helene Fouquet Bloomberg News Oct 27, 2011

Read more: http://www.sfgate.com/cgi-bin/article.cgi?f=/g/a/2011/10/26/bloomberg_articlesLTPGNJ0YHQ0X.DTL#ixzz1bzpDPC4m

Sarkozy Turns to Hu for China Aid as Europe Expands Rescue Fund

Labels:

central banks,

china,

economy,

europe

Greece to get 100 bil euros in more rescue loans

BRUSSELS, Belgium - European leaders agreed this morning on a crucial plan to reduce Greece's debt and provide it with more rescue loans so that the faltering country can eventually dig out from under its debt burden.

After a marathon summit, EU President Herman Van Rompuy said that the deal will reduce Greece's debt to 120 percent of its GDP in 2020. Under current conditions, it would have grown to 180 percent.

That will require banks to take on 50 percent losses on their Greek bond holdings - a hard-fought deal that negotiators will now have to sell to individual bondholders.

Van Rompuy also said the eurozone and International Monetary Fund - which have both been propping the country up with loans since May 2010 - will give the country an additional $140 billion. That's slightly less than the amount agreed upon in July, presumably because the banks will now pick up more of the slack.

"These are exceptional measures for exceptional times. Europe must never find itself in this situation again," European Commission President Jose Manuel Barroso said after the meetings.

The question of how to reduce Greece's debt load had proved the sticking point in European leaders' efforts to come up with a grand plan to solve its debt crisis.

But it was just one of three prongs necessary to restore confidence in Europe's ability to pay its debts and prevent the 2-year-old crisis from pushing the continent and much of the developed world back into recession.

The first details of such a plan emerged hours earlier, when European Union leaders announced they would force the continent's biggest banks to raise $148 billion by June - partially to ensure they could weather the expected losses on Greek debt.

Van Rompuy also announced that the eurozone would boost the firepower of their bailout fund to about $1.4 trillion to protect larger economies, such as Italy's and Spain's, from the market turmoil that has pushed three countries to need bailouts.

"We have reached an agreement which I believe lets us give a credible and ambitious and overall response to the Greek crisis," French President Nicolas Sarkozy told reporters as the meeting broke this morning. "Because of the complexity of the issues at stake, it took us a full night. But the results will be a source of huge relief worldwide."

Efforts to increase the clout of the bailout fund got a boost earlier in the day when German Chancellor Angela Merkel won a strong endorsement from German lawmakers for her plan to reinforce the fund.

Italian Prime Minister Silvio Berlusconi, meantime, came to Brussels with plans to change his country's pension system and take other steps to balance the budget. Other European leaders had pressed him to accelerate those steps to help build confidence that his nation can manage its large levels of public debt.

Because the plan to shore up the banks applies to European economies both inside and outside the euro area, the initiative was the subject of deliberations by the full EU.

Along with increasing bank capital, the plan calls for a new effort by governments to ensure that banks have the funds they need to operate.

European banks rely heavily on short-term loans, and the vulnerability of that funding played a role in the recent collapse of the French-Belgian Dexia bank.

Concerns about the European economy have caused many investors, including U.S.-based money-market funds, to pull out of European banks. This development has raised banks' operating costs and generated fear that Dexia would be just the first in a series of casualties.

The new plan asks the European Central Bank, the European Investment Bank and other agencies to "urgently explore" a guarantee system so that banks could wean themselves from short-term loans, which often must be renewed weekly or even daily.

Under the plan, banks would have to set aside capital equal to 9 percent of their assets. That represents a significant increase from the 5 percent level used as a standard by the European Banking Authority, when it recently analyzed whether the region's financial firms could weather a new economic downturn.

One concern about increasing relative capital levels is that banks could reach the 9 percent threshold by decreasing their total assets, in other words reducing how much money they loan to businesses, consumers and governments. This pullback could stymie economic growth at a time when it is already slowing in much of Europe.

To head off this prospect, the bank capital plan calls for heightened oversight by regulators to ensure that banks don't achieve the new targets by selling off assets or restricting new loans.

by Associated Press Oct. 27, 2011 12:00 AM

Greece to get 100 bil euros in more rescue loans

After a marathon summit, EU President Herman Van Rompuy said that the deal will reduce Greece's debt to 120 percent of its GDP in 2020. Under current conditions, it would have grown to 180 percent.

That will require banks to take on 50 percent losses on their Greek bond holdings - a hard-fought deal that negotiators will now have to sell to individual bondholders.

Van Rompuy also said the eurozone and International Monetary Fund - which have both been propping the country up with loans since May 2010 - will give the country an additional $140 billion. That's slightly less than the amount agreed upon in July, presumably because the banks will now pick up more of the slack.

"These are exceptional measures for exceptional times. Europe must never find itself in this situation again," European Commission President Jose Manuel Barroso said after the meetings.

The question of how to reduce Greece's debt load had proved the sticking point in European leaders' efforts to come up with a grand plan to solve its debt crisis.

But it was just one of three prongs necessary to restore confidence in Europe's ability to pay its debts and prevent the 2-year-old crisis from pushing the continent and much of the developed world back into recession.

The first details of such a plan emerged hours earlier, when European Union leaders announced they would force the continent's biggest banks to raise $148 billion by June - partially to ensure they could weather the expected losses on Greek debt.

Van Rompuy also announced that the eurozone would boost the firepower of their bailout fund to about $1.4 trillion to protect larger economies, such as Italy's and Spain's, from the market turmoil that has pushed three countries to need bailouts.

"We have reached an agreement which I believe lets us give a credible and ambitious and overall response to the Greek crisis," French President Nicolas Sarkozy told reporters as the meeting broke this morning. "Because of the complexity of the issues at stake, it took us a full night. But the results will be a source of huge relief worldwide."

Efforts to increase the clout of the bailout fund got a boost earlier in the day when German Chancellor Angela Merkel won a strong endorsement from German lawmakers for her plan to reinforce the fund.

Italian Prime Minister Silvio Berlusconi, meantime, came to Brussels with plans to change his country's pension system and take other steps to balance the budget. Other European leaders had pressed him to accelerate those steps to help build confidence that his nation can manage its large levels of public debt.

Because the plan to shore up the banks applies to European economies both inside and outside the euro area, the initiative was the subject of deliberations by the full EU.

Along with increasing bank capital, the plan calls for a new effort by governments to ensure that banks have the funds they need to operate.

European banks rely heavily on short-term loans, and the vulnerability of that funding played a role in the recent collapse of the French-Belgian Dexia bank.

Concerns about the European economy have caused many investors, including U.S.-based money-market funds, to pull out of European banks. This development has raised banks' operating costs and generated fear that Dexia would be just the first in a series of casualties.

The new plan asks the European Central Bank, the European Investment Bank and other agencies to "urgently explore" a guarantee system so that banks could wean themselves from short-term loans, which often must be renewed weekly or even daily.

Under the plan, banks would have to set aside capital equal to 9 percent of their assets. That represents a significant increase from the 5 percent level used as a standard by the European Banking Authority, when it recently analyzed whether the region's financial firms could weather a new economic downturn.

One concern about increasing relative capital levels is that banks could reach the 9 percent threshold by decreasing their total assets, in other words reducing how much money they loan to businesses, consumers and governments. This pullback could stymie economic growth at a time when it is already slowing in much of Europe.

To head off this prospect, the bank capital plan calls for heightened oversight by regulators to ensure that banks don't achieve the new targets by selling off assets or restricting new loans.

by Associated Press Oct. 27, 2011 12:00 AM

Greece to get 100 bil euros in more rescue loans

Labels:

central banks,

economy,

europe

Wednesday, October 26, 2011

Home prices up in half of major US cities

WASHINGTON — Home prices rose in August in half of major U.S. cities measured by a private survey, a sign that prices are stabilizing in some hard-hit portions of the country.

The Standard & Poor’s/Case-Shiller index showed Tuesday that prices increased in August from July in 10 of the 20 cities tracked. That marked the fifth straight month that at least half of the cities in the survey showed gains.

The biggest price increases were in Washington, Chicago and Detroit. The greatest declines were in Atlanta and Los Angeles.

Over the past 12 months, prices have fallen in all but two cities — Detroit and Washington.

Analysts warn that prices are certain to fall again once banks resume millions of foreclosures that have been delayed because of a yearlong government investigation into mortgage lending practices.

The index, which covers half of all U.S. homes, measures prices compared with those in January 2000 and creates a three-month moving average. The August data are the latest available.

Home prices have stabilized in coastal cities over the past six months, helped by a rush of spring buyers and investors. But this year, home prices in many cities, including Cleveland, Detroit, Las Vegas, Phoenix and Tampa, have reached their lowest points since the housing bust more than four years ago.

Sales of previously occupied home sales are on pace to match last year’s dismal figures — the worst in 13 years. Sales of new homes fell to a six-month low in August and this year could be the worst since the government began keeping records a half century ago.

Housing is a key reason why the economy continues to struggle more than two years after the recession officially ended. Foreclosures and short sales — when a lender accepts less for a home than what is owed on a mortgage — makes up about 30 percent of all home sales last month, up from about 10 percent in past years. The large number of unsold homes and foreclosures are sending prices lower and hurting sales.

by Derek Kravitz Associated Press Oct. 25, 2011 06:32 AM

Home prices up in half of major US cities

The Standard & Poor’s/Case-Shiller index showed Tuesday that prices increased in August from July in 10 of the 20 cities tracked. That marked the fifth straight month that at least half of the cities in the survey showed gains.

The biggest price increases were in Washington, Chicago and Detroit. The greatest declines were in Atlanta and Los Angeles.

Over the past 12 months, prices have fallen in all but two cities — Detroit and Washington.

Analysts warn that prices are certain to fall again once banks resume millions of foreclosures that have been delayed because of a yearlong government investigation into mortgage lending practices.

The index, which covers half of all U.S. homes, measures prices compared with those in January 2000 and creates a three-month moving average. The August data are the latest available.

Home prices have stabilized in coastal cities over the past six months, helped by a rush of spring buyers and investors. But this year, home prices in many cities, including Cleveland, Detroit, Las Vegas, Phoenix and Tampa, have reached their lowest points since the housing bust more than four years ago.

Sales of previously occupied home sales are on pace to match last year’s dismal figures — the worst in 13 years. Sales of new homes fell to a six-month low in August and this year could be the worst since the government began keeping records a half century ago.

Housing is a key reason why the economy continues to struggle more than two years after the recession officially ended. Foreclosures and short sales — when a lender accepts less for a home than what is owed on a mortgage — makes up about 30 percent of all home sales last month, up from about 10 percent in past years. The large number of unsold homes and foreclosures are sending prices lower and hurting sales.

by Derek Kravitz Associated Press Oct. 25, 2011 06:32 AM

Home prices up in half of major US cities

Labels:

home prices,

housing

Tuesday, October 25, 2011

Banks score higher in satisfaction survey

Despite criticism of banks over rising fees, tight-lending policies and more, the industry generally received an improved score in a new satisfaction survey.

Researcher J.D. Power and Associates found that small-business customers gave banks an average score of 717 on a 1,000-point scale, up from 711 in 2010. Results were based on responses from nearly 7,000 decision makers at small companies -- those with annual sales from $100,000 to $10 million.