Tuesday, August 24, 2010

PIMCO's Gross Sees Government Backing of Mortgages Undesirable but Necessary « HousingWire

In his monthly investment outlook, Gross said 95% of existing mortgages written over the past 12 months were government guaranteed because the private market contracted so much, reiterating what he said last week at the Treasury Department’s housing-finance summit in Washington.

Gross' answer to the housing collapse recognizes "the necessity, not the desirability, of using government involvement," including rolling FNMA, FHLMC, and other housing agencies into one giant agency and guaranteeing a majority of existing and future originations" Gross said.

Gross said the private/public nature of Fannie Mae and Freddie Mac ultimately led to their demise because that structure “incentivized executives and stockholders to go for broke with the implicit understanding that Uncle Sam would be there as a backstop should anything go wrong.”

Gross believes origination points and private insurance fee would instantly disappear, if the housing market continues to be government dominated. In his proposal for what to do with the GSEs, he claims taxpayers would be protected through tight regulation, adequate down payments, and an insurance fund bolstered by a fee of 50 to 75 basis points attached to all mortgages.

"If you eliminated the private incentive and provided a tighter regulatory watchdog, we would have no more ‘liar loans’ or ‘no docs’ and a much sounder foundation for future homeowners and investors," Gross said. "The private market, to my mind, had really lost its claim as the most efficient and judicious arbiter in this particular case. Markets and private incentives without proper guardrails were as threatening to a sound economy in the 21st century as too much regulation and government ownership proved to be in the 1970s."

by JASON PHILYAW HousingWire August 24, 2010

PIMCO's Gross Sees Government Backing of Mortgages Undesirable but Necessary « HousingWire

Sunday, August 22, 2010

Market Recap - Week Ending August 20, 2010

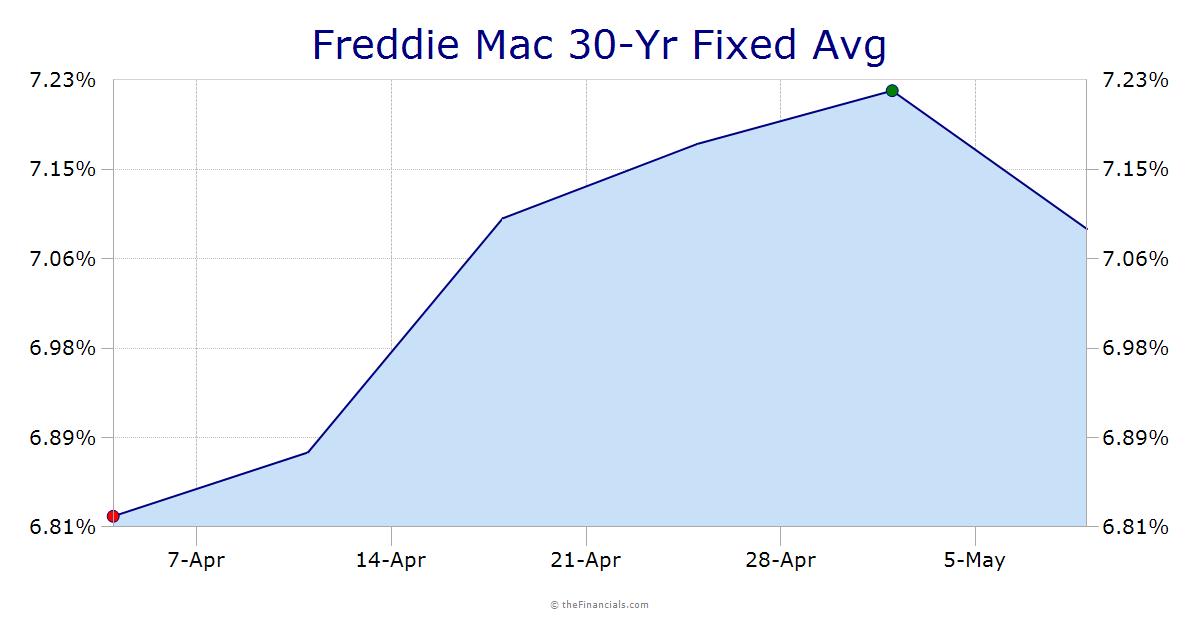

As the economic recovery has lost steam recently, investors are closely watching for signs that growth will slow even more. The economic data released during the week was generally weaker than expected. In a sign that the labor market is not improving, Weekly Jobless Claims rose to 500K, the highest level since November 2009. After a series of positive readings, the Philly Fed manufacturing index surprisingly fell to -7.7. Readings below zero indicate a contraction in the sector. Slower economic growth typically leads to less inflationary pressure, which is positive for mortgage rates.

On Tuesday, a conference was held to discuss the future of Fannie Mae and Freddie Mac, and participants offered a wide range of ideas. While no clear consensus was reached, a few hints emerged about what to expect. Treasury Secretary Geithner suggested that the government should retain a role in providing guarantees for mortgages, but that taxpayers should be exposed to less risk. The Obama administration has announced that it will produce a proposal to address these issues by January 2011. In almost any scenario, changes will be phased in very slowly over a period of many years to avoid disruptions to the housing market.

Next week's economic data will begin with housing market reports. Existing Home Sales will be released on Tuesday. New Home Sales will come out on Wednesday. Durable Orders, an important indicator of economic growth, will also be released on Wednesday. Revisions to second quarter Gross Domestic Product (GDP) will come out on Friday, along with Consumer Sentiment. There will be Treasury auctions on Tuesday, Wednesday, and Thursday.

Market Recap - Week Ending August 20, 2010

Inside the 'Glass Pavilion' - Yahoo! Real Estate

Known for his modern designs, Los Angeles- based architect Steve Hermann finished his latest project in Montecito, Calif., about four months ago.

|

Mr. Hermann considers the home, called the Glass Pavilion, his “opus.”

When he builds in the Hollywood Hills or Beverly Hills, Mr. Herman says he is usually restricted to a small lot.

This lot measures about three-and-a-half acres and gave him the space he needed to create a home featuring walls of glass.

|

"Here I have complete privacy," Mr. Herman says.

"It allows you to be one with nature inside the house."

The 13,875-square-foot home features five bedrooms, five-and-a-half bathrooms, a kitchen with a wine room and an art gallery that displays the architect’s vintage car collection.

|

Mr. Hermann, who has a passion for mid-century modern furnishings, also designed some of the home's furniture, including the benches in the hallway.

He originally built the home for himself, but while the six-year project was underway, he says, his plans changed.

Among those changes, he notes, was the birth of his daughter, now 10 months old.

|

Mr. Hermann says he will likely rent another home for awhile before embarking on another project for himself.

The home is now listed for $35 million, and the furnishings are negotiable. Suzanne Perkins of Sotheby's International Realty has the listing.

Click here to see more photos of the "Glass Pavilion"

Inside the 'Glass Pavilion' - Yahoo! Real Estate

Friday, August 20, 2010

Valley mortgage delinquencies drop

For the second straight quarter, Phoenix-area mortgage delinquencies dipped in the April to June period, reported TransUnion.

As of midyear, 12.3 percent of Valley homeowners were 60 days or more late on payments, down from 12.71 percent in the first quarter and a cyclical peak late last year of 13.16 percent.

Delinquencies also have eased nationally, with 6.67 percent of borrowers two months or more past due in the second quarter, down from 6.77 percent in the first quarter and 6.89 percent late last year.

"We do think we're seeing a trend of improvement," said FJ Guarrera, a vice president in TransUnion's financial-services group.

Some of the most cash-strapped borrowers already have been forced out of their homes, but those who remain are doing a better job saving money, spending less and managing payments, he said.

The TransUnion mortgage study, based on a sampling of thousands of credit reports, coincides with a couple of other promising local statistics.

For example, Valley bankruptcy filings have declined for the past four months.

Also, Arizona's jobless rate has stabilized in the 9.5 percent to 9.6 percent range this year after climbing sharply over the past 2 1/2 years.

Home values and employment are two of the biggest factors influencing mortgage delinquencies, Guarrera said.

Still, the Valley's mortgage-delinquency ratio ranks as the 22nd highest of more than 360 metro areas examined.

by Russ Wiles The Arizona Republic Aug. 20, 2010 12:00 AM

Valley mortgage delinquencies drop

Thursday, August 19, 2010

Low mortgage rates out of reach for most Arizonans

The lowest available rate for a conventional, 30-year fixed-rate mortgage in Arizona was less than 4 percent on Wednesday, according to online lender exchange LendingTree.com.

Also on Wednesday, the Mortgage Bankers Association reported that the national average rate for a 30-year fixed loan was 4.6 percent, and the latest available data on Federal Housing Administration loans indicates an annual rate just above 5.2 percent.

In all cases, today's mortgage rates are the lowest in years, offering a huge financial incentive to buy a home or refinance an existing mortgage.

The only challenge is meeting lenders' underwriting standards.

It's a challenge most Arizona consumers are not able to meet, said Paul Klimke, president-elect of the Arizona Association of Mortgage Professionals.

Klimke said that underwriting standards aren't any tougher today than they were 15 years ago but that the financial climate has changed dramatically.

"The tough economy has pushed people's financial history and financial stability to the point where they don't qualify," said Klimke, who is also branch manager at AmeriFirst Financial Inc. in Mesa.

For an FHA loan, the easiest mortgage loan for which to qualify, a buyer must have enough cash for a down payment of 3.5 percent of the home's purchase price.

The minimum down payment for a conventional loan, the kind guaranteed by government-sponsored guarantors Fannie Mae and Freddie Mac, is at least 5 percent.

The vast majority of today's loan applications are for FHA loans, said Tina L. Rose, branch manager of Allied Home Mortgage in Phoenix.

While the FHA does not technically have a minimum credit-score requirement, she said, most lenders will not underwrite an FHA loan unless the borrower's credit score is at least 620.

"You still have to satisfy the lender," said Rose, who is also vice president of the Arizona Association of Mortgage Professionals.

To get loan terms akin to the 4 percent rate touted by LendingTree.com, Klimke said, the borrower most likely would need a credit score of at least 720 and would have to put 20 percent down on the home purchase.

Other general requirements for all mortgage loans include having enough money left in the bank to cover mortgage payments for two months, no credit-card payments more than 30 days late within the past two years, and no home foreclosure, deed in lieu of foreclosure or short sale within the past three years, Klimke said.

While such requirements existed on paper even throughout the housing boom, Klimke said lenders have stopped ignoring them and are now allowing no exceptions.

"Banks are holding (applicants) to the letter of that standard," he said.

by J. Craig Anderson - Aug. 19, 2010 12:00 AM

Low mortgage rates out of reach for most Arizonans

22 cities in danger of a double-dip recession - Aug. 17, 2010

NEW YORK (CNNMoney.com) -- The chance of a national double-dip recession is hotly debated amid an increasing number of signs that the economic recovery is losing pace, but the risk is particularly troublesome on a local level.

NEW YORK (CNNMoney.com) -- The chance of a national double-dip recession is hotly debated amid an increasing number of signs that the economic recovery is losing pace, but the risk is particularly troublesome on a local level.A new report from Moody's Economy.com singled out 22 cities that are at risk of slipping back into a recession in as early as three months. To come to this conclusion, the economists considered dwindling progress in employment, housing starts, home prices and industrial production. (See the map above for the full list.)

The at-risk cities are spread across the country, though more than half of the cities are in the South, and five are concentrated in the Midwest.

"With chances of a national double-dip recession now estimated at about one in four, several metro areas will probably experience their own downturns in the first half of 2011," said economist Andrew Gledhill, author of the report.

Private sector hiring has been tapering off in recent months compared to the start of the year, triggering Moody's to boost its forecast for a national double-dip from a 20% chance to 25% chance.

What's a double dip? No one really knows.

In the 22 identified metro areas, Gledhill said private sector hiring is particularly sluggish, increasing the chances of a slowdown.

Without a substantial pick-up in hiring, Gledhill said the number of cities in danger of a double-dip recession could grow, possibly reaching the triple-digits.

"There was a time when all 384 metro areas were in a recession. We probably won't get to that point again, but given the growing risk of another national recession, we're on the lookout for more metro areas that will be weakening substantially on several levels over the next six months to a year," Gledhill said.

He added that a handful of metro areas, particularly those that are industrial economies, are also suffering from a recent falloff in manufacturing.

By Hibah Yousuf CNNMoney.com August 18, 2010: 10:39 AM ET

22 cities in danger of a double-dip recession - Aug. 17, 2010

Wednesday, August 18, 2010

Refi Boom Could Bust Smaller Banks - CNBC

To summarize, refinance applications are way up, up 17 percent, while purchase applications are on life support, down 3.4 percent from the previous week and down nearly 39 percent from a year ago. Refis now make up a full 81.4 percent of all mortgage applications, up from 78.1 percent the previous week, and at their highest level since January of 2009.

With home prices way down and mortgage interest rates hovering near record lows, you would think more buyers would get off the fence and sign a contract, but continued weak consumer sentiment is hold them back. You would also think that the bright side to all this is that all this refinancing is putting more money in the average, struggling American's pocket.

But then I read this note from FBR's Bob Ramsey, who believes the rate on the 30-year fixed could go as low as 4 percent, with the following implications:

If rates continue to fall, a refi boom could swamp banks and thrifts with cash flows with no obvious place to invest. With newly issued agency MBS yielding approximately 3.5%, banks and thrifts face considerable reinvestment risk.

Thrifts, he says, are better positioned to handle the risk than regional banks, because, "better efficiency provides a significant buffer to weaker revenues."

The less efficient regionals, he says, are most at risk and adds:

Further, if rates remain low for an extended period, we would expect an increase in bank M&A activity as challenging prospects convince some to sell, and others choose to consolidate and grow earnings by cutting duplicative costs.

I had thought that most borrowers who could had already refinanced by now, but he says that, for some unknown reason, is not the case. "We believe approximately half of conforming borrowers have both the economic incentive and equity to refinance."

It seems that in today's housing finance market, for every upside, there is a downside.

By: Diana Olick CNBC Real Estate August 18, 2010

Refi Boom Could Bust Smaller Banks - CNBC

Loan Officer Survey Offers No Surprises. Credit Standards Still Tight

Loosening of lending requirements was most pronounced in the area of commercial and industrial (C&I) loans. Residential lending was only modestly improved, with nearly as many banks reporting they had tightened credit as had loosened it.

A total of 55 banks, 29 of them defined as large, the remainder as "other" responded to questions about residential lending. 48 banks or 87.3 percent said that their credit standards for prime residential mortgages had remained basically unchanged over the previous three months. Five banks, all of them large, said their standards had eased somewhat while a total of four - two large and two other - reported somewhat tightened credit.

When questioned about standards for non-traditional mortgages, that is interest only, option ARM, and Alt-A products, 33 banks responded that they did not do such lending. Of the remaining 22 banks, one large bank reported an easing of credit while two banks said that lending standards had tightened. Too few responding banks did subprime lending to permit characterization of the responses. As most housing professionals are aware, non-agency lending is essentially frozen and the GSEs and Ginnie Mae are the primary source of mortgage funding.

Nearly 4 percent of lenders, all smaller banks, reported that the recent demand for mortgages was substantially stronger while 34.5 percent of all banks said demand was moderately stronger. Approximately 30 percent of banks reported a moderately or substantially weaker demand. The lenders reporting weaker demand were primarily larger banks. The increase in demand was moderately stronger for non-traditional loans in 22 percent of banks, moderately weaker in 18 percent. Substantially weaker demand for these loans was reported by only one large bank.

Of the 56 banks reporting that they had written revolving home equity loans in the previous three months, 92.9 percent said their lending standards were basically unchanged. Three large banks and one other reported a slight easing of standards during that period. Demand for the loans was said to be about the same by 73 percent of the banks with the remainder almost evenly divided between those that reported a moderately or substantially stronger demand and those that reported demand was moderately or substantially weaker.

Respondents reported having eased standards and most terms on C&I loans to firms of all sizes but this was the first Senior Loan Officer Survey since late 2006 that showed an easing of C&I credit to small firms. There was also a significant fraction of banks that reported easing pricing on these loans to businesses of all sizes and the banks pointed to increased competition in the market for those loans as an important factor in those changes.

The net percentage of banks that reported a willingness to make consumer installment loans also increased as well as reports of an easing of standards for consumer loans other than credit cards. Terms of those loans remained roughly unchanged. While a small percentage of large banks reported an increase in demand for consumer loans, it was offset by a slightly larger percentage of other banks that reported a decreased demand.

A few banks reported that they had eased standards for credit cards but a small net fraction indicated that they had tightened both terms and conditions and a small net fraction reported reducing credit lines for existing customers.

by Jann Swanson Mortgage News Daily August 18, 2010

Loan Officer Survey Offers No Surprises. Credit Standards Still Tight

USDA Rural Housing Program: Where's the Funding?

While this put the program back in business on paper, lenders were understandably reluctant to write Section 502 loans without a USDA guarantee firmly in place. Without this guarantee, buyback responsibility for early payment defaults on those loans would fall solely on the shoulders of the lender. In the current climate, that is a huge risk that few lenders are willing to take. All of these machinations came at the very time many home buyers, especially first time buyers, were scrambling to take advantage of the homebuyers' tax credit before it expired on April 30.

Finally, on July 29 Congress passed HR 4899 to reestablish the program as one that would no longer be subject to the annual whims of Federal funding but self-sustaining through a 3.5 percent guarantee fee paid by the borrower. The fee, while substantial, could be financed into the loan. That legislation also included $679 million in funds to enable USDA to waive those fees for low-income borrowers.

All good right?

No. Three weeks have passed, the Congress did their job and appropriated unlimited funding for the USDA Rural Housing Program, yet all loans under Section 502 must still carry the "subject to availability" caveat. WHERE'S THE MONEY? WHAT'S THE HOLD UP?

Consequently, many lenders continue to hold back from writing Section 502 loans, and potential homebuyers are watching the clock tick toward the September 30 deadline for finalizing their home purchases before the tax credit disappears for good. In addition, the $659 million has not been released into the system for low income borrowers, and John Rodgers, President of Prime Mortgage Lending in Apex, North Carolina thinks he knows why the whole system has ground to a halt.

First a little background on the way the program is structured...

There are actually two Rural Housing Programs. The first is a direct program administered by USDA and intended for low income homebuyers. The second program is a loan guarantee program that operates like FHA or VA, with loans originated by private lenders like Prime Mortgage Lending. These loans are primarily used to help individuals purchase homes in rural areas and can be used to build, repair, renovate, or relocate a home. The loans require no down payment and while they are primarily intended to help low-income individuals. There are geographical income limits.

The guarantee program is very popular, particularly now with so many other avenues of funding closed to homebuyers, and is usually oversubscribed. The direct program is not nearly as sought after; borrowers, given their druthers, appear to prefer to deal with private lenders rather than work through the inevitable bureaucracy of the direct lending program. Unfortunately, USDA has a quota for its direct lending program; a quote which has not yet been met.

Rodgers said that lenders expected the conditional status of guarantees would be removed shortly after the legislation was passed and that the newly appropriated funds would also quickly be available. In the past, he said, it has taken only about ten days to update the software and get the system operating when major changes have been made. However, with the USDA quota as yet unmet, he feels the Department is under pressure to put more borrowers through that program. If the $689 million is released, Rodgers said, the Secretary will probably have to allocate it to both the direct and the guarantee programs which will give the guarantee program, with its greater efficiencies, a competitive edge that USDA may not be able to match.

With most federal programs, funds unspent at the end of the year are returned to the Treasury, something program administrators hate to do. Unspent funds in one fiscal year also mean that it is harder to justify the same or greater levels of funding for the following year. There are also always politics involved; Congress who voted for a program want to see results rather than a program that falls short of its goals.

Whether Rodger's theory is right, USDA needs to get the Rural Housing Program back up and running immediately. Home financing is in tight enough supply already and with the end the fiscal year only 43 days away, a lot of homebuyers may see their hopes of owning a home expire along with the tax credits.

by Jann Swanson Mortgage News Daily August 17, 2010

USDA Rural Housing Program: Where's the Funding?

Factories aid bumpy recovery, housing still weak - Yahoo! News

Auto plants stayed open when they normally close for summer renovations and businesses replaced worn-out equipment. That helped boost factory output 1.1 percent — the biggest increase since August 2009.

Overall output at the nation's factories, mines and utilities rose 1.0 percent last month, the Federal Reserve reported. That followed a decline of 0.1 percent in June, the first drop in more than a year.

Construction of new homes and apartments rose 1.7 percent last month, the Commerce Department said. But the gains were driven by a 32.6 percent surge in apartment and condominium construction, a small fraction of the market.

Single-family home construction, which represented nearly 80 percent of the market, fell 4.2 percent. And requests for building permits, considered a good sign of future activity, slid 3.1 percent.

Separately, the Labor Department said wholesale prices rose last month on higher costs of food, cars and light trucks. Excluding volatile food and energy costs, so-called "core" producer prices rose 0.3 percent in July, the ninth straight increase. Core prices have risen 1.5 percent in the past year, a sign that inflation remains tame.

The recovery has weakened in recent months. Consumers are spending less and saving more. Businesses are hiring fewer workers. The unemployment rate for July was 9.5 percent and economists expect that to stay at that level for the rest of the year.

Investors appeared to be pleased with the latest economic data. All major stock indexes rose and the Dow Jones Industrial average jumped more than 170 points in afternoon trading.

Manufacturing has been the strongest sector since the recession ended, growing in 11 of the past 12 months.

Joshua Shapiro, chief U.S. economist at MFR Inc. in New York, cautioned that the numbers for June and July appeared more volatile because of "statistical quirks" such as the unexpected auto production.

"Things are nowhere near as bad as they appeared in June and nowhere near as good as the headline number in July would indicate," Shapiro said. He said averaging the two months would present a more accurate picture of manufacturing.

Growing demand for new cars and trucks prompted some automakers to keep factories open in July. Traditionally, auto companies close operations in the summer and use the time to refurbish assembly lines.

General Motors, the largest U.S. automaker, opted to forgo its two-week shutdown at nine of its 11 assembly plants in order to make 56,000 additional vehicles in high demand. The facilities include GM's Hamtrack, Mich. facility that is making the plug-in electric Chevrolet Volt that will go on sale later this year.

GM reported a $1.3 billion second-quarter profit and could file for an initial public offering as soon as this week.

A rebound in housing is considered critical for a sustained economic recovery. But builders continue to struggle with weak demand for new homes caused by high unemployment and a glut of foreclosed homes on the market.

Builders say consumers remain worried about the weak economic recovery and the sluggish jobs market. Among those who are buying, many are opting for deeply discounted foreclosed properties.

The July increase in housing construction pushed total activity to a seasonally adjusted annual rate of 546,000 units. Building activity in June was weaker than first reported. It fell 8.7 percent to an annual rate of 537,000 units, the slowest pace since October of last year.

"The bad news is that activity is likely to remain depressed for several years," said Paul Ashworth, senior U.S. economist at Capital Economics. "The good news, however, is that housing is so depressed it is hard to see activity falling much further from such a severely depressed level."

Housing construction got a boost earlier in the year when the government offered buyers up to $8,000 in federal tax credits. But after the incentives expired at the end of April, sales and construction activity slumped.

Construction of apartments and condominiums jumped to an annual rate of 114,000 units. The bigger single-family sector fell to an annual rate of 432,000 units.

The drop in building permits left applications for new construction at a seasonally adjusted annual rate of 565,000, the slowest pace since May 2009.

Construction activity surged 30.5 percent in the Northeast and was up 10.7 percent in the Midwest. However, construction fell 6.3 percent in the South and was flat in the West.

In advance of the report on housing starts, the National Association of Home Builders reported Monday that its monthly index of builder sentiment dropped to 13 in August. That was the lowest reading in 17 months. Readings below 50 indicate negative sentiment about the housing market. The last time builders' index was above 50 was in April 2006.

By MARTIN CRUTSINGER and DANIEL WAGNER, AP Economics Writers – Tue Aug 17, 2:31 pm ET

Factories aid bumpy recovery, housing still weak - Yahoo! News

Pimco's Gross' Bold Plan - CNBC.com

Pimco's Gross' Bold Plan - CNBC.com

Summit on Fannie Mae, Freddie Mac eyes reform

Tuesday's summit, in the Treasury Department's ornate Cash Room, was a starting point for a debate that will unfold in months ahead and carry consequences for all Americans.

How this debate is decided could affect everything from the supply of affordable rental housing to tax deductions for mortgage interest to whether Americans pay significantly more to be homeowners.

The process that began Tuesday also is likely to spell the end, at least in their current form, of mortgage-finance titans Fannie Mae and Freddie Mac, which have been in government conservatorship since September 2008. The mortgage leviathans, which were seized by the government after huge losses from subprime mortgages, have cost U.S. taxpayers nearly $150 billion.

Treasury Secretary Timothy Geithner put down some wide markers Tuesday on what he envisions for mortgage finance.

"We will not support returning Fannie and Freddie to the role they played before conservatorship, where they fought to take market share from private competitors while enjoying the privilege of government support," he said in introductory remarks. "We will not support a return to the system where private gains are subsidized by taxpayer losses."

Fannie Mae was created in 1938 to boost homeownership after the Great Depression. Freddie Mac was created in 1970 to provide more competition. The two congressionally chartered private entities buy mortgages originated by lenders and pool them into bonds backed by U.S. mortgages. For decades, this has freed banks and other mortgage lenders from having to retain the loans on their books and allowed them to keep lending to homebuyers.

The administration hasn't said what it will propose to Congress by January. The summit was intended to gather ideas and reaction from those involved in mortgage finance. Those present Tuesday ranged from bankers who underwrite loans to financiers who buy mortgage bonds to consumer advocates who want more affordable rental housing.

The summit began with a bang when Bill Gross, the managing director of PIMCO, the world's largest bond fund, proposed that the Obama administration order Fannie Mae and Freddie Mac to refinance all outstanding mortgages that they back or guarantee into today's historically low interest rates.

Doing so, he reasoned, would free up a significant amount of income for millions of Americans, who then could boost the economy by spending that additional disposable income.

Known as a maverick in financial circles, Gross also declared dead the private sector's secondary market for mortgages, where they're pooled together and sold to investors as bonds. The Obama administration should recognize this, he said, and explicitly guarantee all pools of new mortgages going forward.

Getting the government out of mortgage lending, Gross and others warned, may mean mortgage rates 3 or 4 percentage points higher than they are today.

by Kevin G. Hall McClatchy Newspapers Aug. 18, 2010 12:00 AM

Summit on Fannie Mae, Freddie Mac eyes reform

Bond king Gross says nationalize Fannie and Freddie - NYPOST.com

There's only one way to fix the badly dilapidated housing market, and that's to fully nationalize mortgage giants Fannie Mae and Freddie Mac.

There's only one way to fix the badly dilapidated housing market, and that's to fully nationalize mortgage giants Fannie Mae and Freddie Mac.That's the advice from bond king Bill Gross, who was among the executives asked to attend a Capitol Hill summit yesterday to hash out the fate of Fannie and Freddie, which were taken over by the government during the financial crisis.

Gross, who runs the world's largest bond fund, Pacific Investment Management Co. (Pimco), said keeping Fannie and Freddie as wards of the state may be the only permanent means of propping up the $11 trillion housing market.

"The only way to bring housing back and to create liquid, financeable mortgage finance going forward would be to provide a government guarantee," Gross said yesterday at the daylong summit.

Gross' comments at the summit were at odds with the views expressed by Treasury Secretary Tim Geithner, who said that Uncle Sam can't go back to the faulty model that left Fannie and Freddie choking on toxic mortgages two years ago, requiring a $150 billion taxpayer-funded rescue.

"The government's footprint in the housing market needs to be smaller than it is today," said Geithner, who co-hosted the summit. "We will not support returning Fannie and Freddie to the role they played before [the government took them over]." As it stands now, Fannie and Freddie, which are 80-percent owned by Uncle Sam, back about 80 percent of all US mortgages. One fear is that buyers of mortgage-backed securities won't purchase more mortgages if the government doesn't provide a guarantee.

Given that Fannie and Freddie guarantee such a massive chunk of the home mortgage market, Gross has recommended that the Obama administration push the two institutions to refinance millions of mortgages -- a move he says would inject as much as $60 billion into the collective wallets of homeowners and boost housing values by as much as 10 percent.

Gross' support for fully nationalizing the mortgage companies isn't novel. Some believe the Newport Beach, Calif.-based money manager's advice is in support of his firm, Pimco, which holds huge positions in mortgage debt.

"Nationalizing Fannie and Freddie may be a great trade for Pimco, but I think nationalizing the whole mortgage system is not a realistic option," said Jon Trugman, founder of New York-based hedge fund Pendulum Capital.

Yesterday, government officials and financial executives bandied about a raft of options for the beleaguered mortgage giants, including offering temporary guarantees on mortgage debt until the economy stabilizes.

Dismantling the entities in place of one gigantic mortgage co-op in which other mortgage lenders would own shares was also floated.

However, Geithner didn't appear to outline any specific game plan yesterday for dealing with Fannie and Freddie. Retooling the mortgage entities has been a nagging issue for the Obama administration and a problem that could cost taxpayers as much as $1 trillion, according to estimates.

"Here we are after passing the financial reform bill and we still can't have an honest conversation about [Fannie and Freddie]," said Christopher Whalen, managing director for Institutional Risk Analytics.

By MARK DeCAMBRE New York Post August 18, 2010

Bond king Gross says nationalize Fannie and Freddie - NYPOST.com

Tuesday, August 17, 2010

Banks Ease Small Business Lending Standards : NPR

In its new survey of bank lending practices, the Fed found that the loosening of loan standards was occurring primarily at the country's largest domestic banks.

Banks had been reporting relaxed credit standards for big corporations. But the new survey marked the first indication that credit was beginning to ease for smaller companies.

That could be welcome news for small businesses. Many have complained since the recession hit that they were having more trouble borrowing money to keep operating.

The Fed said it was the first time it had found relaxed lending standards being imposed on small businesses since late 2006. The Fed defined small firms as those with annual sales of less than $50 million.

The Fed's latest quarterly report on lending was based on responses received to a survey done in late July. It found that the most improvement came in loan areas where banks were facing competition to offer credit.

The survey found that the easing of standards was concentrated at large domestic banks. Most banks were still reporting lackluster demand for credit.

In addition to easier terms for business loans, many large banks also reported having eased standards on various types of consumer loans.

Some large banks reported that they had loosened standards for prime mortgage loans. The banks also reported an increased willingness to make consumer installment loans. A smaller proportion of banks reported that they had eased lending standards on both credit card and other types of consumer loans.

The Fed held a conference on the problem of tight credit to small businesses last month. Federal Reserve Chairman Ben Bernanke noted a serious gap between large corporations who are building up cash and reporting strong earnings and the thousands of small businesses who are struggling to get credit.

Bernanke said banking regulators were applying pressure to get more credit flowing to small businesses, who hire more than half of American workers.

"Making credit accessible to sound small businesses is crucial to our economic recovery," Bernanke had said at the July 12 conference.

More Credit Card Payments On Time

On-time payments have been on an upward trend over the last several months for many major card issuers.

Discover Financial Services, Capital One Financial Corp., JPMorgan Chase & Co. and Bank of America Corp. on Monday all reported declines in July charge-off rates — those unpaid balances they have given up on collecting.

Capital One's improvement led the group, with its net U.S. card charge-offs falling to 8.1 percent of total balances in July from 9.3 percent in June.

Card companies typically write off loans after they're 180 days past due, the point at which it's assumed the balances won't be collected.

by The Associated Press August 16, 2010

Banks Ease Small Business Lending Standards : NPR

Homebuilder confidence sinks for 3rd month

The National Association of Home Builders said its monthly index of builders' sentiment about the housing market fell to 13, the lowest reading since March 2009. The index is adjusted for seasonal factors.

Readings below 50 indicate negative sentiment about the market. The last time the index was above 50 was in April 2006.

Fewer people are buying new homes, even though prices have stabilized in the past year and those who have good credit can qualify for the lowest mortgage rates in decades. The market is struggling because jobs are scarce and credit is tight. And many analysts predict home prices are likely to drop again in the fall.

"Buyers just aren't stepping up to the plate," wrote Mike Larson, real-estate analyst with Weiss Research. "Unless and until the job market improves, we are simply not going to get any traction in the housing market."

Another key reading of housing activity will come today when the Commerce Department releases its report on home construction in July. Construction plunged in June to the lowest level since October. The survey suggests the market will be sluggish the rest of the year.

The building industry has sharply scaled back construction after the housing-market bubble burst. The number of new homes up for sale in June fell 1.4 percent from a month earlier to 210,000, the lowest level in nearly 42 years.

by Alan Zibel - Aug. 17, 2010 12:00 AM

Homebuilder confidence sinks for 3rd month

Monday, August 16, 2010

Fed Publishes Wave of Rules for Mortgage Origination Transparency « HousingWire

The Fed released final rules restricting an originator from receiving compensation based on the interest rate or other loan terms of the mortgage. The new rules apply to mortgage brokers and the companies that employ them, as well as loan officers employed by depository institutions and other lenders.

Some originators — like brokers — have been the object of public criticism for allegedly steering borrowers into loans with interest rates higher than the rate required by lenders, in order to receive higher yield-spread premiums.

"This will prevent loan originators from increasing their own compensation by raising the consumers' loan costs, such as by increasing the interest rate or points," the Fed said. "Loan originators can continue to receive compensation that is based on a percentage of the loan amount, which is a common practice."

The final rule also prohibits originators from receiving compensation directly from consumers while also receiving compensation from the lender or another third party.

"In consumer testing, the board found that consumers generally are not aware of the payments lenders make to loan originators and how those payments can affect the consumer's total loan cost," the Fed said. "The new rule seeks to ensure that consumers who agree to pay the originator directly do not also pay the originator indirectly through a higher interest rate, thereby paying more in total compensation than they realize."

The Fed also announced final rules to implement an amendment to the Truth in Lending Act that requires consumers be given notice within 30 days of the sale or transfer of their mortgage loan.

Additionally, the Fed issued an interim rule that revises disclosure requirements for closed-end mortgage loans under Regulation Z — or Truth in Lending regulations. Under the interim rule, lenders must include a payment summary table outlining the initial interest rate together with the corresponding monthly payment.

Lenders must also include the maximum interest rate and payment that can occur during the first five years of an adjustable-rate mortgage, as well as a "worst case" example showing the minimum rate and payment possible over the life of the loan. Lenders complying with the interim rule must also disclose the fact that consumers may not be able to avoid payment increases through refinancing.

Along with the final and interim rules, the Fed proposed consumer protections and disclosures on mortgage transactions. As the second phase of the Fed's review and update of mortgage rules, the proposal would affect Reg Z.

The proposal would improve disclosures that consumers receive for reverse mortgages and impose rules for accurate product representation in reverse mortgage advertising. It would also prohibit certain unfair practices in the sale of financial products related to reverse mortgages.

The Fed's proposal would improve disclosures of borrowers' rights to rescind certain mortgage transactions and clarify the responsibilities of the creditor if a consumer exercises the right. Additionally, it would ensure consumers receive new disclosures when the parties agree to modify the key terms of an existing closed-end mortgage loan.

The Fed also proposed a rule to revise the escrow account requirements for higher-priced first-lien jumbo mortgage loans. The rule would implement a provision of the Dodd-Frank Act and increase the annual percentage rate (APR) threshold used to determine whether a mortgage lender is required to establish an escrow account for property taxes and insurance for first-lien jumbos.

The rule would implement the Dodd-Frank provision to increase the APR threshold to 2.5 percentage points — from the current 1.5 percentage points.

by Diana Golobay HousingWire August 16, 2010

Fed Publishes Wave of Rules for Mortgage Origination Transparency « HousingWire

Sunday, August 15, 2010

Market Recap - Week Ending August 13, 2010

As expected, the Fed made no change to the fed funds rate and left the "extended period" language in place. The Fed also downgraded its economic outlook, saying that the pace of the recovery is likely to be "more modest in the near term than had been anticipated." In light of this, the Fed has implemented a new policy to purchase additional securities to replace maturing securities from its portfolio, instead of letting its balance sheet shrink. This action will provide a small amount of monetary stimulus to the economy. Even though the Fed will purchase Treasuries rather than mortgage-backed securities (MBS), higher Fed demand for bonds in general supports low mortgage rates.

This month's most closely watched inflation report showed that inflation is not a concern right now. In fact, some Fed officials and investors are worried that inflation will fall too low. The July Consumer Price Index (CPI) rose 0.3% from June, and increased at a 1.2% annual rate. Core CPI, which excludes food and energy, rose at a slim 0.9% annual rate. The Fed is believed to be most comfortable when core inflation is rising at a rate between 1.5% and 2.0% per year. Low inflation is favorable for mortgage rates.

Next week, the Empire State manufacturing index will be released on Monday. Tuesday will be the big day with Housing Starts, Industrial Production, and PPI. Industrial Production is an important indicator of economic growth. The Producer Price Index (PPI) focuses on the increase in prices of "intermediate" goods used by companies to produce finished products. Leading Indicators and the Philly Fed manufacturing index will be released on Thursday.

http://www.xinnix.com/viewemail/weekinreview.asp

Websites are troves of information on Social Security benefits

• AARP

www.aarp.org/money/social-security.

Features Social Security basics.

• The Social Security Network

socsec.org.

Contains news and views on a variety of topics.

• Today's Seniors

www.todaysseniors.com/pages/social _security_benefits.html.

Explores different retirement-age levels.

• U.S. Social Security Administration

www.ssa.gov.

Federal gateway to Social Security.

• NOLO

www.nolo.com/legal-encyclopedia/personal-finance-retirement

Select "Social Security" link.

McClatchy-Tribune News Service Aug. 15, 2010 12:00 AM

Websites are troves of information on Social Security benefits

FDIC-seized properties to be auctioned at live event, online

The FDIC, which regulates banks and insures deposits up to $250,000, has shut down dozens of banks during the past year, including eight in Arizona, according to its website, fdic.gov.

One of the federal regulatory group's responsibilities is to auction off the assets of those failed institutions.

Dallas-based auctioneer Hudson & Marshall is scheduled to conduct a live auction starting at 7 p.m. Tuesday at the JW Marriott Desert Ridge Resort and Spa, 5350 E. Marriott Drive, in the Desert Ridge area.

The event is just one scheduled stop on an eight-city tour across Arizona, Nevada, California, Utah and Washington state, according to the auctioneer.

Hudson & Marshall principal Dave Webb said the nearly 200 properties for sale include primarily high-end homes, former investor-owned homes and some vacant land.

"This auction offers property for every type of buyer, from investors to those looking for homes to live in," Webb said, adding that list prices for the various properties ranged from $5,000 to $1.5 million before falling into FDIC hands.

In addition to the live events, Hudson & Marshall has set up a website, AuctionFDIC.com, where many of the homes and other properties already are open for online bidding.

Prospective buyers must bring with them either $2,500 or 5 percent of the purchase price, whichever amount is greater, either in cash or a certified check.

by J. Craig Anderson The Arizona Republic Aug. 14, 2010 10:09 PM

FDIC-seized properties to be auctioned at live event, online

$150 mil of aid still available

South Carolina Gov. Mark Sanford, an outspoken critic, is one of them.

Arizona is one of 12 states that have not taken any of the additional unemployment aid. Thirty-nine others have received or are poised to receive at least some funding. The deadline to participate is August 2011.

The money would help modernize Arizona's unemployment-insurance system and it would make more people eligible for payments - up to 24,000 people each year for the next seven years. The assistance primarily would help low-wage earners, part-time workers and people who work sporadic or seasonal jobs.

To get the funds, the Legislature must loosen unemployment-eligibility requirements. Earlier this year, lawmakers declined to consider a bill to make the changes.

Brewer and the business community are worried that the changes could hurt future job creation, Governor's Office spokesman Paul Senseman said.

Each state has different financial issues, so it's unfair to compare Arizona to other states that took the money, he said. Brewer is waiting for the Legislature to act but is undecided if she will sign the law if it passes.

"What she has said," Senseman said, "is that she is considering the various circumstances behind it."

Advocates, who want Arizona to take the money, say modernizing Arizona's unemployment criteria won't trigger a tax increase on employers.

"It's an excellent deal, and that's why all these states have done it," said Maurice Emsellem policy co-director for the National Employment Law Project.

by Jahna Berry The Arizona Republic Aug. 15, 2010 12:00 AM

$150 mil of aid still available

Arizona real estate: Phoenix home prices down

Home prices in metro Phoenix are falling again, and new data about upcoming sales suggest that they are likely to keep falling over the next few months, bringing concerns of a housing-market "double dip" closer to reality.

Home prices had fallen to a median $119,900 back in April 2009, marking the low point of the region's housing crash. Recent months showed small but steady increases, keeping the price above $130,000.

But in July, the median sales price of a metropolitan Phoenix house fell more than 2 percent, according to the real-estate research firm Information Market. It was the first time the area's median has fallen below $130,000 this year, and the second month in a row that home prices fell.

Pending home-sales data provided to The Arizona Republic show the downward trend continuing.

Thousands of Phoenix-area homes are in escrow. If those deals close at the sales prices listed in their contracts, the region's overall home-sales price will tumble nearly as far as April 2009's low point.

If home prices drop below that mark, most analysts will consider it a double dip. With prices below their previous low point, a housing recovery will be even further away.

July is traditionally a slow month for the Phoenix-area housing market. But there is little data to contradict what pending home sales indicate about where prices are headed.

Instead, several other factors also point to a continuing decline.

The region's recession-battered job market is still weak, meaning few new buyers.

The number of foreclosed homes, which often end up being resold at bargain prices, continues to rise.

And most people who were considering buying anytime soon have likely already bought, getting in on a federal tax credit for homebuyers before it expired in June.

Also concerning to some in the industry is Arizona's crackdown on illegal immigration, which has spurred some people to leave the state.

New residents, who help fuel home buying in metro Phoenix, are no longer moving to the area like they were before the real-estate crash and recession.

"The market is much weaker now than it was a few months ago, with demand down severely almost everywhere," said Mike Orr, who publishes a daily online analysis of Phoenix-area housing called The Cromford Report. "I am currently expecting the average square-foot sales price to fall about 1 percent a month during the next two months. It's anybody's guess after that. It could get quite ugly."

He tracks average square-foot prices because they are less skewed by a few high or low prices. The current average is $87 a square foot, down from $91 a month ago.

Declining prices

The search for a recovery in metro Phoenix's housing market began in April of last year.

Prices had shot up more than 50 percent during the boom of 2004-06, then collapsed amid a mortgage crisis and a local, national and international economic crash.

April 2009 brought the bottom. With the median sales price at $119,900, home values were the lowest they had been since January 2000, according to Information Market. Since then, home prices showed what appeared to be a small, slow recovery. Prices dipped occasionally but never for two months in a row.

Last month changed that. The 2 percent decline was the largest this year.

The Arizona Regional Multiple Listing Service, the home-sales database set up for the state's real-estate industry, now tracks home prices in pending sales agreements.

The index shows metro Phoenix's median home price falling from $128,000 in July to $125,000 this month to $120,000 in September. A slight recovery is expected for October, to $123,000.

The index tracks future home prices by analyzing signed purchase agreements scheduled to close in a given month. The actual median prices for those months may turn out to be slightly higher. The predictions typically run slightly lower than actual sales prices because of last-minute changes to purchase agreements that drive up the final selling prices.

Since most home sales close within three months of a buyer signing a contract, the listing service can track prices and sales from its real-estate-agent members as far out as three months.

"Even with historically low mortgage rates, people in Phoenix just aren't that excited about buying a house now," said Mike Metz, managing director of Scottsdale-based Sun State Home Loans. "More inventory and fewer buyers equals lower prices."

Falling demand

A declining number of home sales indicates that there are fewer homebuyers in the market.

Valley home sales neared record-high levels during the past 18 months as buyers snapped up inexpensive foreclosure homes and houses discounted for short sales. But last month, sales of existing homes dropped 24 percent from June's robust pace. New-home sales in July fell to 534, half their pace in June.

"We have been predicting this kind of contraction as the tax credit expires," said Phoenix home-building analyst RL Brown.

Market watchers say there were fewer first-time buyers last month because of the June 30 expiration of the federal homebuyer tax credit. People who would have purchased later this year or next year rushed to buy to receive the $6,500 to $8,000 credit and are now out of the market.

Investors continue to buy Valley homes, particularly from lenders who have recently foreclosed on them. In July, investors were behind more than 21 percent of all home sales, up from 17 percent the month before, reports Information Market.

"If you aren't selling an inexpensive home, it can be tough to sell in this market," said Jay Butler, director of realty studies at Arizona State University.

Interest rates are near record lows, but it's more difficult to obtain a mortgage now. Also, potential buyers who own homes and can't sell them are stuck until home prices climb.

Rising supply

As demand from homebuyers dropped, the inventory of homes for sale in metro Phoenix climbed. Too many homes for sale and too few buyers will continue to drive down home prices.

There are 43,000 homes listed for sale in the region, up from 41,500 in June and 37,000 a year ago but still well below the record 55,000 homes listed in early 2008, when prices began to plummet.

Still, sales prices are falling, and many of the houses for sale now are lower-priced: one-fourth are foreclosure homes or houses discounted for short sales.

Pre-foreclosures rose 34 percent in July. If many of those homes are foreclosed on and go up for resale, the median price could drop further.

Part of metro Phoenix's home-price plunge can be attributed to foreclosure homes that lenders sold at bargain prices in late 2008 and early 2009.

"So many homeowners and investors are underwater with their homes that foreclosures will continue to lead market pricing," said Deila Mangold, a broker with Scottsdale-based Ideal Homes Realty.

There also is concern that Arizona's new immigration law will cause more legal and illegal residents to leave the state and that many may leave behind homes that will end up in foreclosure.

"Demand for housing is directly related to population," said Ruff, the Information Market analyst. "If there's an exodus due to SB 1070, expect home prices and sales volume to drop dramatically."

Despite the housing market's current setback, many analysts still expect a return to a normal market of steady annual growth by 2015.

For now, market watchers are tracking home sales and foreclosures to determine if prices will drop as far as expected in September and whether they climb again in October as the Arizona Regional Multiple Listing index predicts.

"It's just that there are now far fewer buyers and far more sellers than at this time last year," Orr said. "It's too early to say whether the current setback will be mild, moderate or severe, but there are no encouraging signs in the data from August so far."

by Catherine Reagor The Arizona Republic Aug. 15, 2010 12:00 AM

Arizona real estate: Phoenix home prices down

Making it nice and legal

The Squire, Sanders and Dempsey firm and the firm of Ballard, Spahr, Andrews and Ingersoll as well as Jennings Strouss & Salmon have moved in already. Gust Rosenfeld and Polsinelli Shughart will relocate this fall.

Leaders of the firms say that they were enticed to move to the downtown complex's tower because they got competitive leases, new space and a foothold in an up-and-coming neighborhood.

Jennings Strouss is metro Phoenix's seventh-largest law firm in terms of the number of lawyers, according to Who's Who in Business, Republic Media's 2010 ranking of local firms, and Gust Rosenfeld is tied for No. 10. Law firms will fill up about half of the office space in the 600,000-square-foot office building.

"Having so many firms occupy the office tower is important to us because it affirms the prominence and stature of the building and the project," said Jeff Moloznik of RED Development LLC.

While Ballard Spahr and Polsinelli Shughart are moving from midtown to downtown, the other firms came to CityScape from other downtown buildings, Jennings Strouss and Gust Rosenfeld both had leases at Collier Center, 201 E. Washington St. Squire, Sanders moved from Renaissance Square at 40 N. Central Ave.

The law firms are the latest additions to the $900 million hub of offices, shops and restaurants. CityScape's 27-story office building at First and Washington streets has been open since April, but the rest of the project will open gradually over several months. Some parts, including a boutique hotel, are projected to open late next year.

The sprawling three-block development is bordered by First Avenue and Second, Washington and Jefferson streets. A grand opening is planned for the fall.

"Cityscape will be - is - a really nice project," said Marty Harper, managing partner of Polsinelli Shughart's Phoenix office. The firm will move about 115 employees into 69,000 square feet of office space. The firm is now in midtown Phoenix at 3636 N. Central Ave.

"The amenities down there, the extra restaurants, the sporting facilities, some of our people are interested in using light rail to get to and from there they live," Harper said. "It's been the whole package that's been most attractive."

Law firms interviewed for this story would not disclose lease terms, but many central Phoenix office tenants have benefited from a renter's market.

At the same time that downsized businesses freed up office space, new office buildings were looking for tenants. That stiff competition for renters forced many landlords, such as CityScape, to sweeten their lease offers with relatively low rates, tenant-improvement deals and other goodies.

Ballard Spahr moved its 40 workers to CityScape from 3300 N. Central Ave. Road.

"They were aggressive in their total package that they offer to tenants," said Stephen Savage, Ballard Spahr's Phoenix managing partner.

The CityScape lease for 35,000 square feet was less expensive than the proposal from another building the firm considered in the tony 24th Street and Camelback Road neighborhood.

Like most real-estate deals, location was key, the firm's representatives said.

CityScape is on the light-rail line as well as near the Suns arena and the D-Backs stadium.

CityScape also plans to include several eateries affiliated with Valley restaurateurs. That includes Bob Lynn, owner of the La Grande Orange restaurant group, who plans to open LGO Public House.

The project also is within blocks of county and federal courthouses. Plus, Arizona State University may move its Tempe-based law school to downtown Phoenix.

"The ASU campus down there adds a tremendous amount," said Harper of Polsinelli Shughart, adding that many of the firm's lawyers hail from ASU or University of Arizona. "We hire quite heavily from both of the law schools, so having it close would be really good. We have the relationship there."

There was also a sprinkle of politics in the negotiations. Some firms, including Polsinelli Shughart, had meetings with Mayor Phil Gordon, who wanted to sway firms either to relocate downtown or to stay in the city.

by Jahna Berry The Arizona Republic Aug. 14, 2010 12:00 AM

Making it nice and legal

Golf Club Scottsdale wants to build suites

That would allow the 6-year-old private golf club to sell lodging memberships to out-of-town players who could stay in the suites, said Cathy Kulzer, vice president of development for WFP Cordillera LLC.

Her company would develop the lodging.

"The idea is to revitalize the club with a lodging component," she said, adding that Golf Club Scottsdale would remain private.

Private golf clubs have been hurt by the recession and have responded with strategies to attract new members and keep existing players.

Earlier this year, Golf Club Scottsdale sold about half of its 350 memberships at a cost of $110,000 plus monthly fees. It opened in 2004 at 122nd Street and Dynamite Boulevard.

Lodging members would be able to stay on a space-available basis in any of the club's one-, two- or three-bedroom units, Kulzer said.

The lodging units would be mostly single-story buildings but there might be a two-story building that would be similar to the clubhouse, she said.

The designs have not been completed.

Construction could start next year and be completed by 2013, Kulzer said.

Public meetings to explain the plans to neighbors are tentatively planned for next month but no dates have been set, she said.

In a separate project, developer Lyle Anderson is planning an eco-resort on his property west of Golf Club Scottsdale.

Both projects will be reviewed by the Scottsdale Planning Commission and City Council.

The resort and Golf Club Scottsdale border the McDowell Sonoran Preserve in an area that was burned in the 1995 Rio Fire that blackened close to 23,000 acres.

by Peter Corbett The Arizona Republic Aug. 13, 2010 11:05 AM

Golf Club Scottsdale wants to build suites

Scottsdale puts halt to planned luxury apartment complex

The commission voted for a continuance to postpone consideration of the Scottsdale Riverwalk proposal until a special meeting at 5 p.m. Sept. 1 in the City Hall Kiva. Commissioner Jay Petkunas did not participate in the discussion and vote because of a conflict of interest, while Commissioner Jay Ottman was absent from the meeting.

Commission Chairman MIchael D'Andrea said the proposal as it now stands is "just not enough" and introduces "stacked, vertical living in a community that has never seen it." He said he can't support it until Gray Development Group, the developer on the project, answers more questions.

"I want to support your project," he said. "Hopefully you can get with all of the stakeholders ... and come back with something that will blow our doors off."

The project, which would occupy a 4.3-acre site originally planned for phase two of the Safari Drive condominiums, has been scaled back, with the maximum height now 125 feet instead of 148 feet, and the apartment unit count now 957 instead of 1,196.

Also, it now features a tiered-floor design, three courtyards, a public plaza at the south entrance along Scottsdale Road, and is set back farther from the road.

However, none of the changes impressed the barrage of opponents Gray faced during the crowded meeting.

Randy Grant of G&G Consulting is representing property owners on the south, east and north sides of the site, and said the history of the project is "nothing short of a land speed record" and that not enough time has been spent addressing the community's concerns.

"It's simply too much for this site to accommodate," he said.

Robert Shull, an attorney representing the adjacent property owner, Safari Drive Marketing, said the project still resembles an "aircraft carrier parked on Scottsdale Road" and that the open spaces more closely resemble "three air shafts."

by Edward Gately The Arizona Republic Aug. 12, 2010 09:07 AM

Scottsdale puts halt to planned luxury apartment complex

Recovery in Europe hinges on consumers

Growth in the 16 countries that share the euro was just 0.2 percent in the first quarter, and analysts say the recovery can only really take root if consumers in France, Germany and elsewhere forget their fears of unemployment and more turmoil - and open their pocketbooks.

Second-quarter data to be released today are widely expected to show a modest acceleration, thanks to strong export-led growth in Europe's economic engine Germany. The figures will show eurozone growth rebounded to 0.8 percent quarter-on-quarter in the April to June period, estimates Jonathan Loynes, chief European economist at Capital Economics.

While the second quarter is expected to be strong, forecasts dwindle for the second part of the year. Can consumers help Europe continue its modest bounceback from the recession and a government debt crisis that saw Greece saved from bankruptcy by an international bailout in May?

Indicators are giving uncertain readings of consumer willingness to spend, leaving the recovery on a knife edge.

Overall retail spending in the eurozone was flat in June after rising slightly in May, according to EU statistics office Eurostat. France was among the worst performers, falling 1.3 percent compared to the previous month. This can partly be blamed on a shift of France's traditional summer sales period to July from June.

French shoppers' penchant for spending freely on the country's fine foods and fashions has long been the motor of economic growth in France, much more so than in neighboring Germany, where global trade and exports power the economy.

Jean-Claude Amer, shopping at the BHV department store in central Paris, is ready to do his part.

"Spending money is what I do," said Amer as he walked out of the store into the trendy Marais neighborhood.

The 63-year-old retiree said the crisis has not put a crimp in his spending ways. "Not at all. I love to buy tech gadgets. I just bought some home electronics," Amer said.

Spending in large retail chains, such as Carrefour, Casino or Monoprix, has risen in the first half of the year according to an upcoming report by retail consulting firm Symphony IRI.

"Shoppers have what we call 'frugal fatigue,' " said Jacques Dupre, an analyst at Symphony IRI and the report's author. After months of cutting back and substituting generic or lower priced products, shoppers are starting to fill their carts with more expensive options once again.

The researcher forecasts growth of between 1 and 1.5 percent in retail spending at supermarket chains in the second half, after 1.2 percent in the first six months of this year.

"But people are very reactive to shocks - if in October there are new rounds of layoffs or higher unemployment, it could quickly go much lower," Dupre said. "So the recovery is real but relatively fragile."

Another BHV shopper, Oliver Penin, says the economy will have to improve without any extra help from him.

"I'm not changing my habits one iota," Penin said. The 55-year-old engineer had just picked up a few small plumbing supplies to fix his sink. "Crisis or no crisis, I spend my money the same way."

by Greg Keller Associated Press Aug. 13, 2010 12:00 AM

Recovery in Europe hinges on consumers

Valley bankruptcies continue decline

The 2,585 filings last month were down from 2,656 in June and a recent peak of 3,063 in March, according to the U.S. Bankruptcy Court in Phoenix.

Valley bankruptcies remain at elevated levels and still are on pace to exceed last year's 25,104 filings.

But the year-over-year comparisons have been improving, with the July 2010 total up just 11 percent from July 2009. By contrast, the March numbers were 59 percent higher compared with March 2009.

The recent easing could prove to be a summer lull. Diane L. Drain, a Phoenix bankruptcy attorney, said she expects the tally to rise in coming months, citing a spike in local foreclosures over the past few weeks. Foreclosures often are a precursor to more bankruptcies, she said.

Although unemployment is a catalyst that persuades some debtors to file for bankruptcy protection, Drain pointed to lower housing values as the main factor.

"Real estate is the biggest reason people are calling and asking for help," she said.

Some calls are from homeowners who have been using credit cards to help pay their mortgages and finally have decided they no longer can afford the home, Drain said.

"They're often at a point where all the other debt has piled up because they have struggled to service the real-estate debt, so they decide to let the house go," she said.

Other callers include people who want to keep their properties but desire a court-supervised debt-repayment plan under Chapter 13 of the Bankruptcy Code.

Joe Volin, a bankruptcy attorney in Tempe, also cites housing problems as a primary motivator.

"If a person's only problem is a first mortgage on a house, he or she rarely will need to file for bankruptcy in Arizona," he said, citing consumer protection given by the state's anti-deficiency statutes.

But in many serious cases, debtors have taken out other loans on the property, maxed out their credit cards and amassed additional IOUs, he said.

Chapter 7 filings, which provide a fresh financial start after a debtor's non-exempt assets are used to pay creditors, accounted for four in five Valley bankruptcies last month. Chapter 13 debt-restructuring plans accounted for most of the rest.

The 3,526 filings for all of Arizona were down from 3,585 in June and a recent peak of 4,135 in March. Statewide filings last month were up 11 percent from July 2009.

National bankruptcies also have been rising but at a slower pace. U.S. consumer filings in July were up 9 percent from June and 9 percent from July 2009, the American Bankruptcy Institute reported.

by Russ Wiles The Arizona Republic Aug. 13, 2010 12:00 AM

Valley bankruptcies continue decline

How To Boost Social Security Benefits - IBD - Investors.com

Congress is still dithering while Social Security runs out of gas.

Congress is still dithering while Social Security runs out of gas.The newly released trustees' report says the old-age program's tank will be bone-dry by 2037.

That's no better, no worse than last year's projection.

With nothing in the trust fund, trustees say benefits then would have to be paid solely by tax revenues. So bennies would have to shrink to 78% of what's promised.

Perhaps Congress will restore Social Security's financial health before that happens.

Meanwhile, what if you retire and want to start drawing benefits? You can take steps to boost the size of your monthly check.

• Delay your start. The most basic strategy is to postpone tapping into the program.

You can start collecting at age 62. But if you wait until your full eligibility age, your benefits will be higher.

Depending on your age, waiting until you reach full eligibility age — which the program calls normal retirement age, or NRA — can expand your monthly check by up to 30%.

NRA is 66 for anyone born in 1943 through 1954. It's 67 for anyone born in 1960 or later.

The table nearby shows NRA for people born between 1954 and 1960.

Aside from resulting in a smaller check, starting benefits early also exposes you to an earnings cap penalty.

Basically, for every $2 you earn in excess of a certain threshold — which is $14,160 in 2010 — you lose $1 in benefits.

• Reward for extra delay. If you wait until after your NRA, your starting benefits are even higher.

This is due to the delayed retirement credit. It can be worth up to 8% a year, until age 70, depending on when you were born.

Anyone born in 1943 or later gets the 8% annual premium. If you were born in 1933-34, it's worth only 5.5% extra a year.

Suppose you were born in 1944. Your NRA would be 66. Let's say your monthly check would be $1,000, given your earnings history.

If you wait until age 70 to start benefits, your check will be 32% bigger. That's 8% times four years. Your monthly support would be $1,320.

The additional benefit you gain by waiting until 70 vs. 62 is striking. The extra monthly benefit is typically 75% higher, says Alicia Munnell, director of the Center for Retirement Research at Boston College.

"Almost everyone benefits by delaying the start of benefits," she said.

By PAUL KATZEFF, INVESTOR'S BUSINESS DAILY August 13, 2010

How To Boost Social Security Benefits - IBD - Investors.com

Existing-home sales fell in July from year earlier

Sales of existing single-family, detached homes in Maricopa County fell to 5,080 in July, down from 7,300 in July 2009, according to the report by Jay Butler, Arizona State University associate professor of real estate.

Butler attributed the backward slide to "anemic" improvements in the economy and job market, low consumer confidence and strict mortgage-lending standards.

The median home-resale price in July was $137,500, an increase from the July 2009 median sale price of $135,500, but down compared with this June's median price of $143,000, the report said.

One reason for the slow sales and stagnant prices is that so-called move-up buyers - existing-home owners who stimulate sales of higher-priced homes as they accrue equity, sell their homes and "move up" to more expensive properties - are staying put.

"People who might normally be looking for a move-up home may be satisfied to stay in their current house, given the economy," Butler said.

Foreclosure activity rose just slightly from June to July in terms of raw numbers, Butler said. There were 3,865 single-family-home foreclosures in July, up from 3,835 foreclosures in June, according to the report.

Still, Butler said that, when taken as a percentage of all existing-home transactions, the jump in foreclosure activity was more drastic, going from 36 percent in June to 43 percent in July.

"This is the second month in a row with a percentage increase in foreclosures," he said. "Before that, we were seeing declines."

by J. Craig Anderson The Arizona Republic Aug. 11, 2010 05:08 PM

Existing-home sales fell in July from year earlier

New Arizona law helps shield buyers from mortgage abuses

Backed by mortgage brokers and real-estate regulators, the law quietly went into affect on July 1.

The law, passed in 2008, creates state oversight for people who take loan applications, gives consumers an avenue for reporting misconduct and establishes a fund to help repay borrowers who lose money because of unethical or illegal acts by their loan officers.

The law faces hurdles, as cash-strapped Arizona struggles to process thousands of new applications.

Still, advocates call it a success. Many of the risky - and sometimes illegal - home loans that helped lead to record foreclosures in Arizona might not have been made if the more than 10,000 unlicensed loan officers working then had been subject to more oversight.

During the housing boom, borrowers were sometimes misled about what their real payments would be or other terms of their loans, and some loans were given to people who never should have qualified. In some cases, officers were untrained or had little experience; others were unscrupulous and intentionally made bad loans so they could be paid a commission.

Either way, consumers had little recourse once they realized they had been wronged. The new law is aimed at changing that.

Now, in Arizona, any person who handles a loan application or takes a borrower's financial information will be fingerprinted and subject to a background check. Officials at the Arizona Department of Financial Institutions can reject applicants with a record of misconduct.

Applicants also have to pass a test to prove their understanding of federal law, mortgage standards and ethics.

So far, 4,336 people have applied to be loan originators in Arizona and 2,413 licenses have been issued, according to the department. About 1,000 of the applications are on hold because not all the necessary information was provided or the state agencies found problems with them. The rest are still being processed.

"Loan-officer licensing is long overdue in Arizona," said Felecia Rotellini, who for five years served as superintendent of the Department of Financial Institutions, the state agency regulating the mortgage industry. She is running for Arizona attorney general.

"A lot of bad loans wouldn't have been made if we had it before," Rotellini said. "It gives me peace of mind for consumers to know we have licensing now."

In Arizona, the housing boom and crash were partly fueled by loan officers, how they operated and how they were paid.

Mortgage brokers, who run firms that connect borrowers with the best loans, have long been regulated by the Department of Financial Institutions.

Brokers employ loan officers, who work directly with borrowers, collecting their Social Security numbers and financial information to determine whether they qualify for a loan. Loan officers usually recommend types of mortgages and lenders.

These officers, sometimes called originators, weren't subject to state scrutiny. They worked under the licenses of their brokers, much the way an apprentice would work for a licensed contractor. Previously, that oversight was considered sufficient.

Flood of loan officers

But, in recent years, thousands of loan officers began working to handle the flood of new and refinanced loans triggered by the housing boom.

Those new loan officers often got little scrutiny. Some simply operated on their own, writing up loans and selling them to lenders and Wall Street firms without working for a broker at all - technically illegal but difficult to track. Many others worked for big national lenders like Countrywide and weren't subject to state oversight.